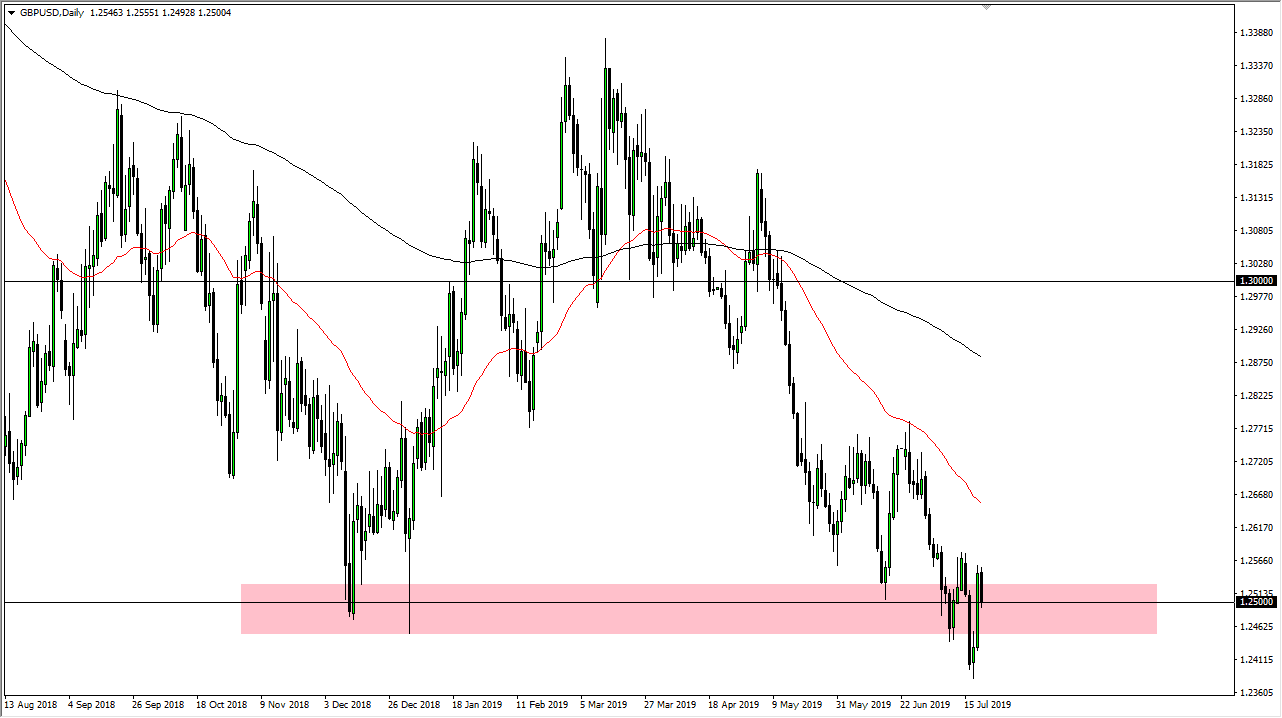

The British pound pulled back a bit during the trading session on Friday to reach towards the psychologically and structurally important 1.25 level. At this point, it looks as if the week is going to close right at this handle, so I think we are at a bit of an inflection point right now. Ultimately, if we break down from here, I think that the market probably reaches towards the 1.24 handle. Ultimately, if we were to break above the 1.2570 level, we could then go to the 50 day EMA. After that, we could go to the 1.2750 level.

All of that being said, I do not want to buy the British pound because there are far too many headlines risks out there. Granted, I recognize that the Federal Reserve is trying everything it can do to kill off the US dollar, but ultimately this is a market that will continue to fall due to the Brexit noise. The Brexit noise continues to be a major issue. There are a lot of headlines out there just waiting to happen, and that should continue to send this market lower.

This market continues to show a lot of bearish pressure, and I think that as we worry about whether or not the British can get some type of deal, the reality is that the uncertainty is killing the British pound. This being the case, the US dollar softening doesn’t seem to be correcting this move as much as it could. We have formed a bit of a sawtooth pattern, which of course shows a lot of indecision but we are continuing to form “lower highs” and “lower lows.” Ultimately, I do think that we continue to drift lower.

Rallies at this point should be sold if there are signs of exhaustion, and therefore I think that it’s only a matter of time before we can start selling again. At this point, I believe that it’s very likely that we continue to see a lot of confusion and trouble, but you should not be looking to buy this market anyway, because it’s essentially “catching a falling knife.” If you are looking to short the US dollar, do it against other currencies that are much more strong than the British pound right now. Expect volatility but I would still expect a lot of negativity.