Since the beginning of this week’s trading, the EUR / USD pair has been in a bearish correction as the US dollar gained enough support after the announcement of a truce to stop imposing more tariffs between the US and China, after the positive results from the Trump and Xi summit on the sidelines of the G20 summit in Japan. The pair dropped to the 1.1274 support level at yesterday's session and settled around 1.1288 at the time of writing, ahead of the announcement of important US data.

We have mentioned in the previous technical analysis that the bullish correction for the pair is still weak and is expected to decline again if the Euro does not find stronger catalysts. That is as expectations of a rate cut to the negative region by the European Central Bank (ECB) amid growing weakness in economic data from the Eurozone.

Markets are constantly questioning Trump's policy and the fears still lingering over its trade file with China, as they have often been negotiating and eventually new tariffs were imposed. US economic growth figures have not changed as expected, but economists expect the US economy to start slowing from the next announcement with Trump's stimulus plans evaporating.

The continuation of the global trade war means that the Eurozone economy is slowing increasingly and the Euro may lose its recent gains and more.

Both the European Central Bank and the Federal Reserve have confirmed readiness to cut interest rates to cope with the economic slowdown. The recent US economic data confirm the US economic slowdown and therefore market expectations are that the US interest rate could be reduced as soon as possible.

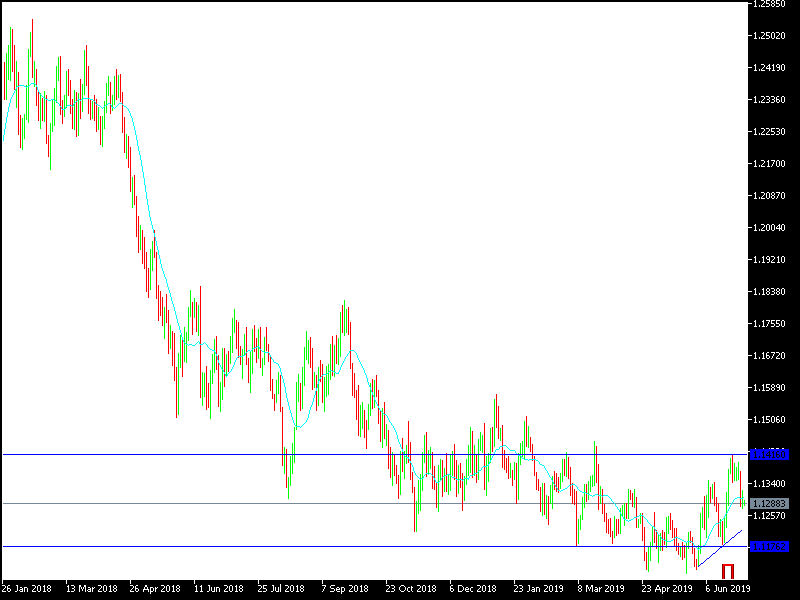

On the daily chart below, it is clear that the pair lacks the sufficient and strong momentum for the upward correction. The European Central Bank (ECB) is in a cautious position, keeping the interest rates unchanged as expected, and ruling out a chance to raise interest rates later this year.

The bearish stability supports investors' question of the most appropriate timing for buying: this will depend on the return of confidence in the Euro and optimism about the imminent resolution of the US-China trade dispute, which increases the pressure on the Eurozone economy, which depends on manufacturing and exports. Technical indicators are still confirming oversold areas and the pair is ready for an upward correction.

Technically: We had expected and recommended in the previous analysis for a long time to sell the pair from every ascending level. Turning to the EUR / USD bullish trend needs a move towards the resistance levels 1.1355, 1.1440 and 1.1515 to confirm the upward correction strength. On the bearish side, the nearest support levels are currently 1.1240 and 1.1180 respectively, which are levels confirming the renewed strength of the bearish trend.

On the economic data front, the pair will watch for the Eurozone Service sector PMI. From the U.S, there will be an announcement of ADP Non-Farm Employment Change forecast, unemployment claims, trade balance and ISM services PMI.