This week's EUR/USD pair was calm and in a limited range as expected within the 30-point range and limits only as the economic calendar is free of any significant and influential data. The pair is stable around 1.1265 at the time of writing ahead of the release of an economic data package from the Eurozone and the United States. The pair is still waiting for stronger catalysts to complete the bullish correction to break out of its bearish channel environment, which is still firmly in place. The Euro did not take advantage of the recent US dollar losses as the US central bank confirmed the near-term opportunity to cut US interest rates, as the Euro faces a strong economic slowdown in the Eurozone with continuing global trade. On the other hand, the European Central Bank will support easing of monetary policy to counter this slowdown, which could lead to a reduction in the interest rate to the negative region. The continuation of the global trade war has a negative impact on the Eurozone economy more than the United States economy.

In his testimony before Senate and US congressional committees, Jerome Powell stressed on the near-term date for cutting US interest rates more than previously expected. Therefore, outlooks that the bank is likely to cut interest rates when it meets later this month, are higher. Powell's most highlighted comments were: "Doubts about trade tensions and concerns about the strength of the global economy, still affect the US economic outlook." The US central bank's signs strongly contributed to the US stock indexes' record highs.

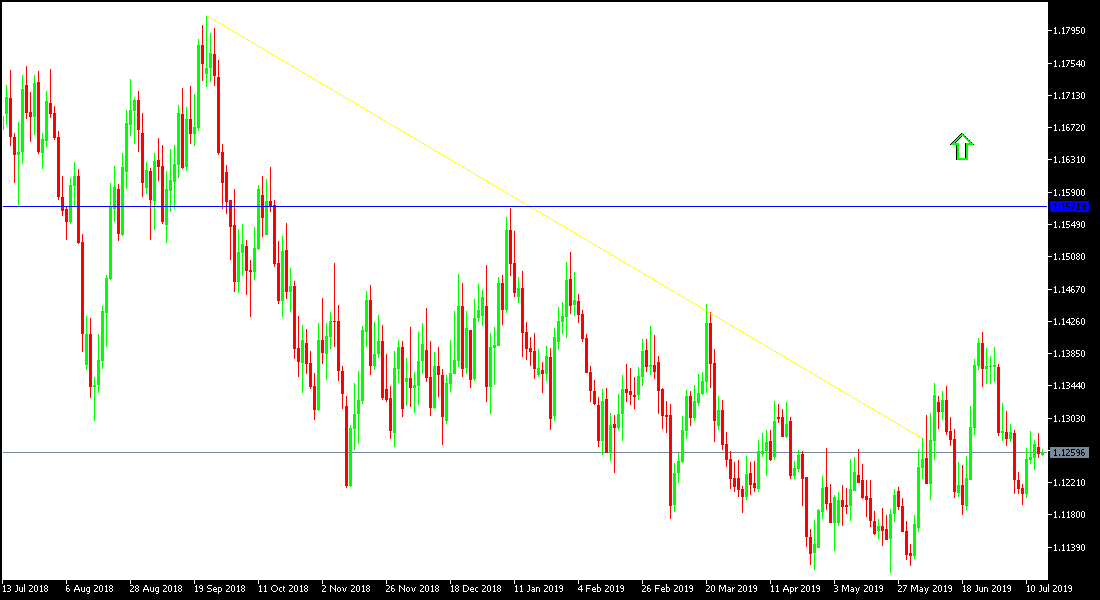

Technically: EUR / USD's general trend is still strongly bearish and will strengthen this move if it moves towards the 1.1200 psychological support, which will increase pressure to move towards stronger support levels at 1.1170, 1.1060 and 1.0980 respectively, as concerns over the future of the Eurozone continues. On the bullish correction side, the attempts for a higher bounce mayr may target resistance levels at 1.1285, 1.1355 and 1.1445, respectively. In general, there were no serious signals for a strong upward correction soon.

On the economic data front: The economic calendar today will focus first on the release of the German ZEW Economic Sentiment Index and the Eurozone trade balance. And from the United States of America, there will be announcement of retail sales figures, industrial production and statements by Federal Reserve Chair Powell.