Employers in the United States sharply intensified their employment during June, adding 224,000 new jobs, underscoring the strength of the US economy after more than a decade of steady growth. The US government's jobs report on Friday could delay a Fed Board decision late this month on cutting interest rates to help boost the economy. Most investors expected a US interest rate cut in July and possibly one or two cuts by the US central bank later this year. This scenario may be less likely now after strong job numbers.

Immediately after the announcement of these important data, the EUR / USD pair moved sharply lower to the support level at 1.1207 before settling around 1.1232 at the time of writing. At the beginning of this week's important trading, the US dollar is carefully watching for the contents of M.o.M from the last Federal Reserve meeting, and the testimony of Governor Jerome Powell in front of the US Congress and Senate, and US inflation data will complete the full picture of the future US interest rate cut or not.

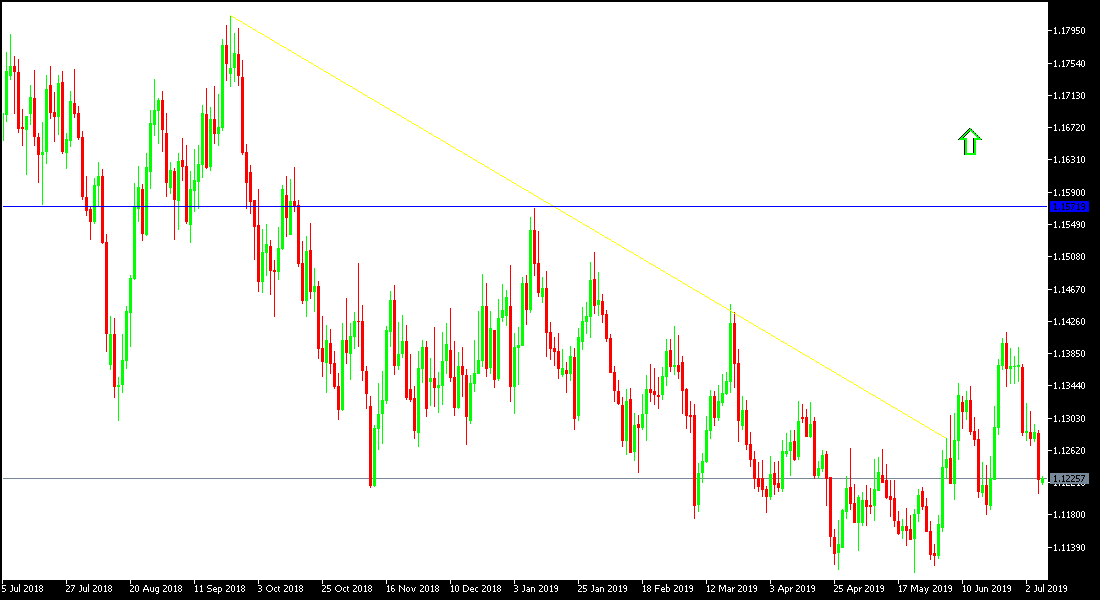

After director of the International Monetary Fund (IMF), Lagarde, has been named the successor to Mario Draghi, whose term expires in October, the euro has not reacted much to the announcement. Lagarde has not announced any plans to boost the faltering European economy. The overall trend for this pair as shown on the chart below is still bearish.

Markets are constantly questioning Trump's policy and the fears still lingering over its trade file with China, as they have often been negotiating and eventually new tariffs were imposed. The continuation of the global trade war means that the Eurozone economy is slowing increasingly and the Euro may lose its recent gains and more.

Technically: as expected, the strength of the bearish trend for the EUR/USD is now confirmed by testing the psychological support at 1.1200. Focus is now going to be on the support levels at 1.1170, 1.1060 and 1.0980 respectively in case the current situation continues. The bullish correction attempts might target resistance levels at 1.1285, 1.1355 and 1.1445 as initial stops. Generally speaking, there were no signs of strong bullish correction on the way.

On the economic data front, the pair will carefully watch for the German Trade Balance and Manufacturing production data. From the Eurozone, there will be the announcement of investment confident data. There is no important American data today.