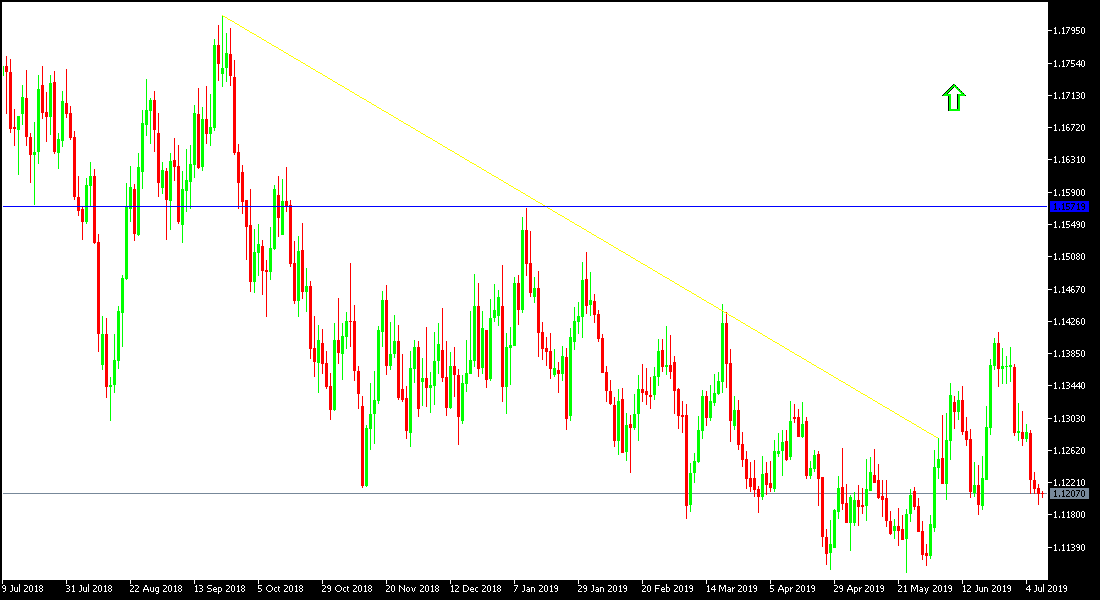

The FX market will watch today, and cautiously, any new signals from the US Federal Reserve about the future of its monetary policy. US job numbers for June have led markets to rule out that the bank will cut the US interest rates at its meeting this month. There will be testimony from Federal Reserve Chair Jerome Powell in front of the US Congress to clarify the state of the economy and the bank's plans to maintain its growth. After that, we will have an appointment with the announcement of the minutes of the last meeting of the bank. Prior to that, the EUR/USD pair is moving around the 1.1200 psychological support. The general trend of the pair is still bearish and although technical indicators reaching oversold levels, weakness in the EUR will continue to move within its bearish channel.

The latest US jobs report, albeit its mixed results, still underscore the strength of the US economy after more than 10 years of steady growth. Before announcing the report, most investors expected a US interest rate cut in July and possibly one or two cuts by the US central bank later this year. This scenario may be less likely now after recent job numbers.

Lagarde, was officially nominated for the post of governor of the European Central Bank (ECB), replacing Mario Draghi, whose term expires in October. The euro has not reacted much to the announcement, as Lagarde has not announced any plans to boost the faltering European economy. On the side of Trump’s trade wars, narkets are constantly questioning Trump's policy and the fears still lingering over its trade file with China, as they have often been negotiating and eventually new tariffs were imposed. The continuation of the global trade war means that the Eurozone economy is slowing increasingly and the Euro may lose more.

Technically: as expected, the strength of the bearish trend for the EUR/USD is gaining strength by testing the psychological support at 1.1200. The support levels will be 1.1170, 1.1060 and 1.0980 respectively in case the current situation continues. The bullish correction attempts might target resistance levels at 1.1285, 1.1355 and 1.1445 as initial stops. Generally speaking, there were no signs of strong bullish correction on the way.

On the economic data front, the pair will react strongly to the testimony of the Fed’s chair and the content of the bank’s last meeting. There is no important European data today.