Looking at the EUR/USD pair, it’s very likely that we will see a lot of action during the trading session on Wednesday, as the statement and rate decision will move these markets quite drastically as it will move the US dollar in general.

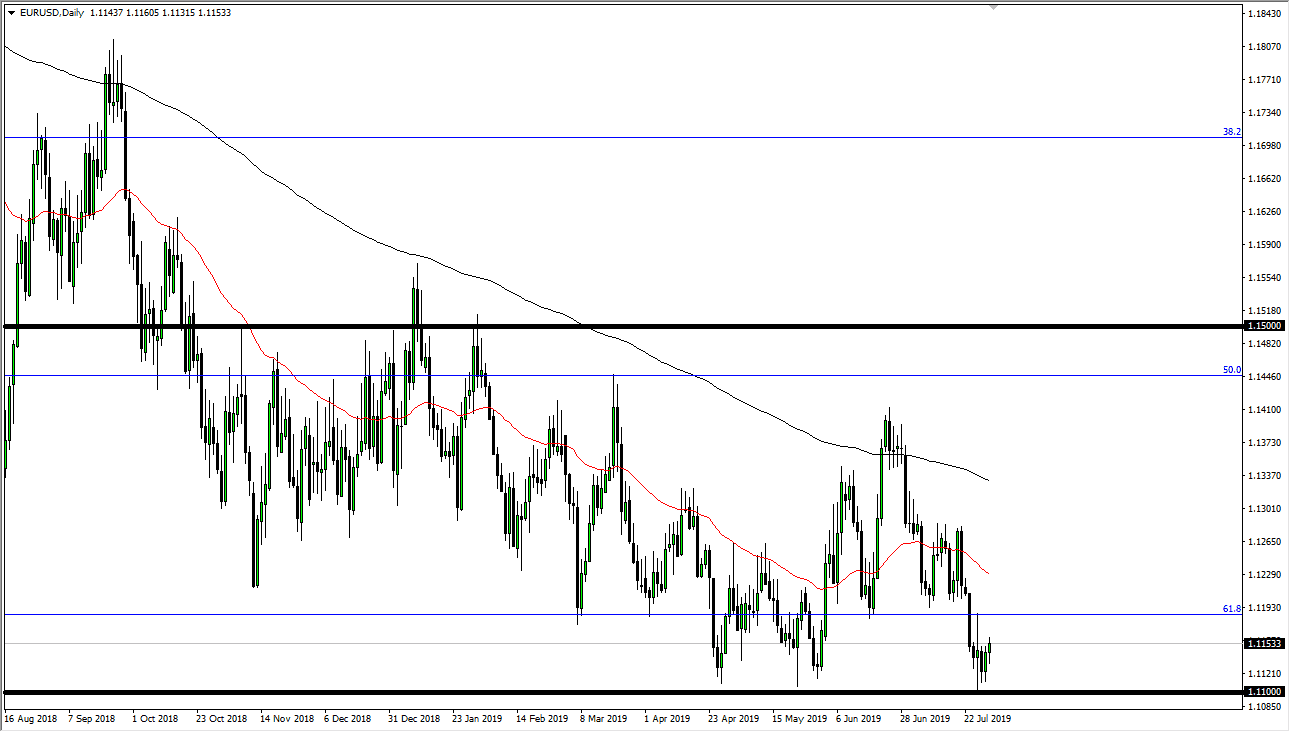

The Euro continues to be a beat down currency, but at this point it’ll come down to whether or not the Federal Reserve is going to come in and jump all over the US dollar and the idea of dovish and is to liquefy the markets. In the short term, we have been bouncing around between the 1.11 level underneath, and the 1.12 level above. In other words, we have been stuck in the same range, and therefore it appears that the market is simply waiting for some reason to move. Wednesday afternoon should provide that reason and perhaps even a bit more clarity.

Ultimately, the markets will look towards how the Federal Reserve makes its statement, and whether or not it’s going to continue to be very loose with its monetary policy. I believe that it will be, so it’s very likely that the market will rally after that. There is obvious resistance at the 1.12 handle though, and it’s at that point I think even more money flows into this market, perhaps trying to reach towards the 1.13 level after that.

However, there’s always the possibility that the Federal Reserve disappoints, and if it does that will more than likely send the US dollar higher. If we break down below the 1.11 handle, it’s likely that the market reaches down towards the 1.10 level after that. That being said, the 1.11 level has been massive support more than once, so I do favor the upside but I think that this is going to be a lot of choppiness and of course uncertainty. You need to be a very short term trader at this point, but if we do break above the 1.12 handle, then I think we will start to really pick up a bit of momentum.

Between now and the Federal Reserve interest rate statement, it's very likely that the market will simply flounder back and forth so it’s really difficult to imagine putting a lot of money to work. That being said, I think we are setting up for more of an upside move than down.