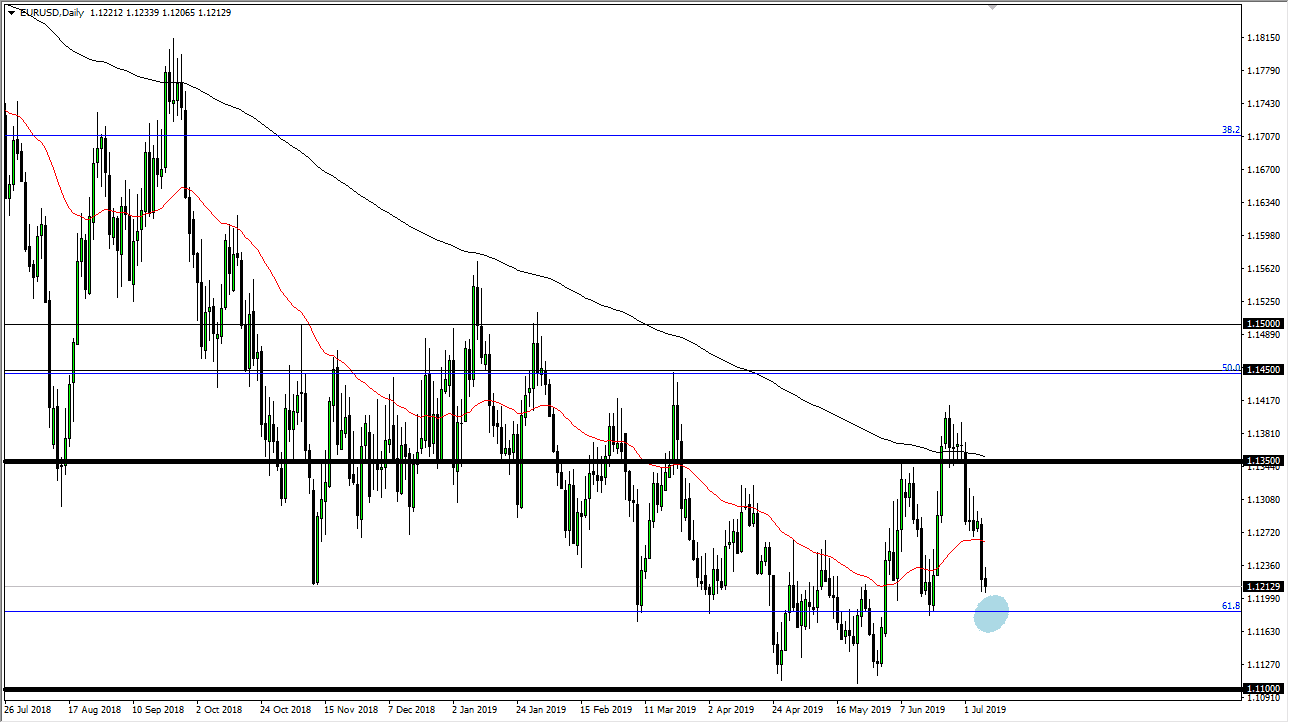

The Euro initially tried to rally during the day on Monday, but then broke down towards the 1.2 level underneath. There is a significant amount of support just below as shown by the blue circle, which also coincides nicely with the 61.8% Fibonacci retracement level from a longer-term move. If this area doesn’t hold though, we could go down to the 1.11 level underneath which shows signs of massive support as well. If we were to break down below this blue circle, that’s going to put the idea of an uptrend in serious trouble.

Alternately, if we were to turn around and break above the candle stick for the trading session on Monday, that is a positive sign and then I think we go looking towards 1.1275 level which is the top of the candle stick from the Friday session that was so negative. Clearing that area, we then could go looking towards the 1.1350 level. That’s an area where the 200 day EMA crosses.

Keep in mind that the Federal Reserve is ready to cut interest rates in July, so is very likely that it will continue to work against the greenback. However, we have a lot of problems in the European Union, not the least of which is the problems with Deutsche Bank. Overall, the ECB is likely to keep monetary policy extraordinarily loose for an extended amount of time, so that does put some negativity in the Euro.

On a move higher, this is going to be more of a grind than anything else, because we are starting to perhaps form a rounded bottom pattern, but that takes a significant momentum and effort. Overall, the Euro is essentially the “anti-dollar”, so at this point it’s going to come down to what we are focusing on. If it’s all about the Federal Reserve, then this pair goes higher, otherwise we will probably continue to get a lot of back and forth choppiness as per usual in this market. This market is very difficult in these times, as there are still multiple reasons for this market to move in either direction. With Jerome Powell testifying in front of Congress this week, that will probably cause some volatility here, so keep that in mind and recognize that it could be crucial as to where the US dollar goes next. The looser the central bank sounds, the higher this pair will go. However, if they disappoint we could test the bottom again.