The Euro rallied quite stringently during the trading session on Wednesday, reaching much higher after the opening statement by Jerome Powell at the Humphrey Hawkins testimony in front of the United States Congress. It seems to reiterate the idea that the Federal Reserve is getting ready to cut interest rates, which of course works against the value of the US dollar in general.

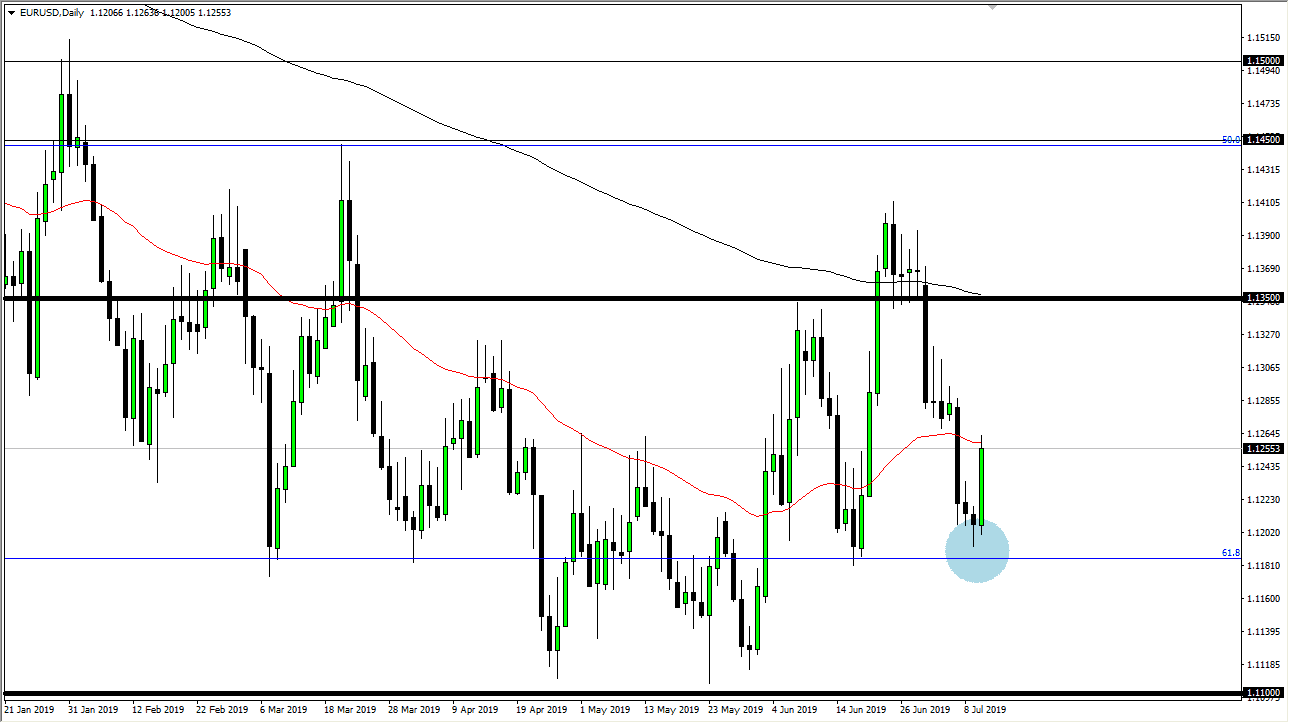

The 61.8% Fibonacci retracement level underneath is support, and therefore it makes a lot of sense that we continue to see buyers underneath. You can see I have a blue circle drawn where you should see plenty of buyers. We ended up forming a hammer during the previous session which of course is a bullish sign, and then on top of that the inverted hammer was broken above from the Monday session as well. With that in mind, it makes sense that we have broken through a lot of resistance, and now I think the market is free to continue to go higher although there are a few hurdles here and there.

The 50 day EMA, pictured in red on the chart is basically the only thing stopping the Euro at the moment. However, the 1.13 level above is an area of choppiness and has been important more than a couple of times. If we can break above the stars from last week, then the market is free to go to the 1.1350 level above. The 200 day EMA which is pictured in black is above, and therefore I think it’s only a matter of time before the sellers come back in and keep this market lower.

Overall though, it looks like we are trying to form a longer-term bottoming pattern, and then go much higher. I think we will get the occasional pullback that can offer value the people are willing to take advantage of in the face of the Federal Reserve being such a dovish central bank. Beyond that, keep in mind that the US dollar has been overvalued for some time, because we have seen other central banks be dovish for so much longer. The US dollar has a little bit of “catching up” to do for the “race to the bottom” that so many central bankers are involved in. This is going to be choppy, but it certainly looks as if we are going to find buyers given enough time. I have no interest in selling this pair, at least not until we would break down below the 1.11 level underneath.