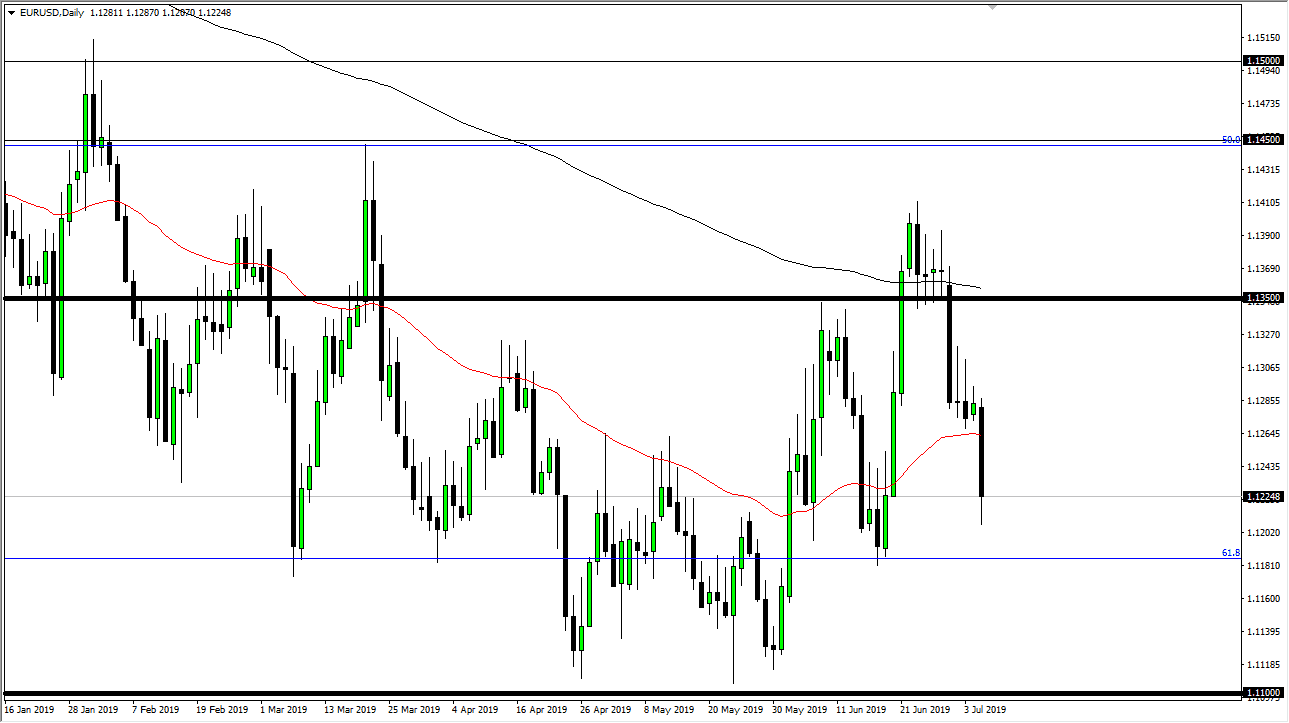

The Euro fell significantly during the trading session on Friday, slicing through the 50 day EMA which is a very negative sign. At this point, the fact that we have broken down through that area is a very negative sign. That being the case, the extremely bearish candle suggests that we could be trying to test major support underneath at the 1.12 level. Keep in mind that a lot of this was precedented on the idea of the jobs number being much higher than anticipated. If that is the case, then it’s very likely that this market is trying to get ahead of the Federal Reserve changing its tune when it comes to interest rate cuts.

However, Jerome Powell stated later in the day that the Federal Reserve was still going to do whatever it took to keep the market afloat, which of course means interest rate cuts. Ultimately, this is a market that looks as if it is trying to carve a bigger bottom, perhaps some type of “rounded bottom.” We still haven’t made a “lower low”, so we are still technically in an uptrend although we did get a hell of a challenge to it during the trading session.

If we can wipe out the negative candle from the Friday session, that would be a very bullish sign. At that point, it’s very likely that the market could go to the 200 day EMA above. The 1.1350 level above would be a target, that has a lot of noise just above it. That being said, if we did break down below the most recent low which is near the 1.1180 handle, that would wipe out the idea of this market bottoming in the short term.

The real definitive action will be the next couple of days as we could either get a break down or a breakout. As we get that answer, it should become a much more clear picture as to where we are going. I think this pair is one of the most difficult once the trade in the Forex world anyway, because quite frankly all it does is chop. Longer-term though, it tends to trend for long periods of time, so you almost have to look at this as an investment and less a trade. We have a couple of levels to watch as per usual, but not a lot more than that.