The Euro has rallied a bit during the trading session on Thursday in what would have been very thin trading during the Independence Day holiday in America. Because of this, New York was essentially closed, so at this point I think we have been simply treading water over the last couple of days in anticipation of the holiday, and then on Friday the jobs figure. That being said, there are a lot of things going on in this general vicinity that could come into play.

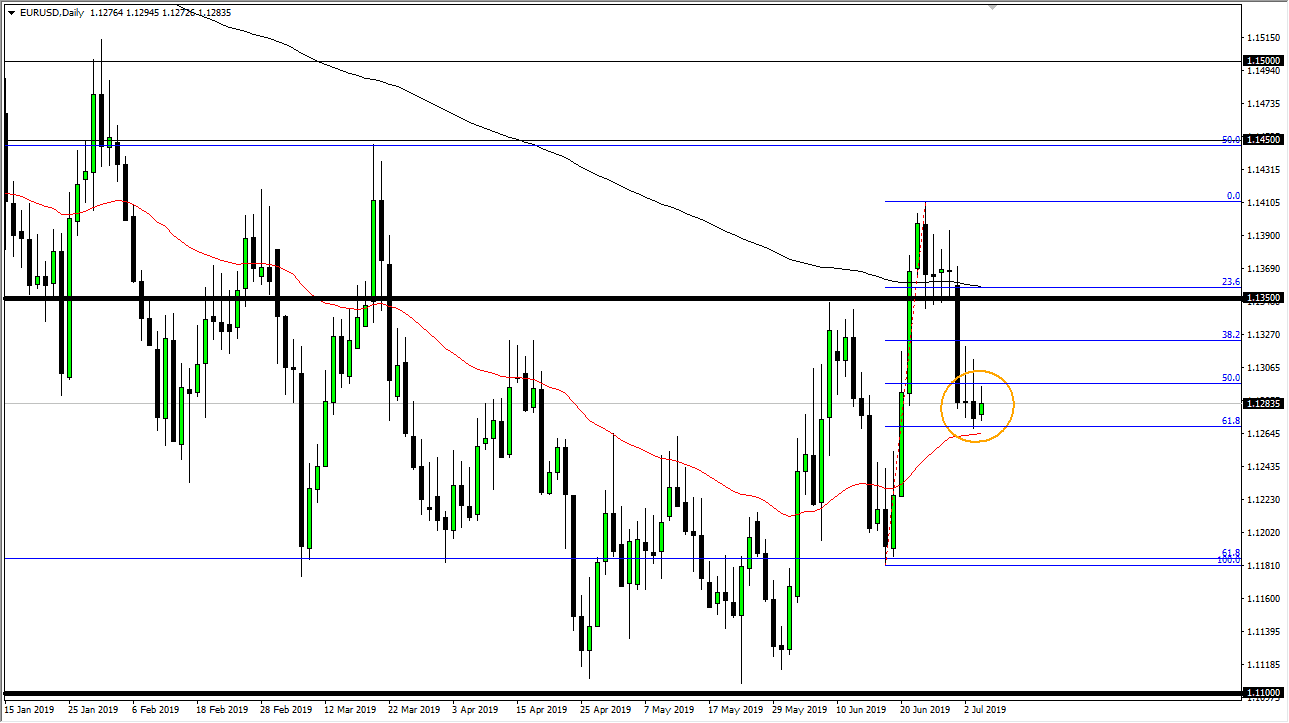

The 50 day EMA is just below, pictured in red on the chart. You’ll notice that I have an ellipse drawn here because there have been three inverted hammers in a row print it now. That’s obviously a very bearish sign, but that doesn’t necessarily mean that we are going to break down, although it certainly shows negativity. The question here is whether or not we can turn around and break above those candlesticks. If we can, that would be an extraordinarily bullish sign, reaching towards the 1.1350 level, possibly even the 1.14 level after that.

Beyond that there is the 61.8% Fibonacci retracement level that is offering support, right along with the previously mentioned 50 day EMA, and it makes for a nice set up for buyers if we can get the right catalyst during the trading session on Friday. The jobs number could very well make that happen. In fact, when this announcement comes out, we could be a situation where we go higher regardless. Let me explain.

If the jobs number is incredibly weak, that puts more pressure on the Federal Reserve to cut interest rates, which of course is negative for the US dollar. However, if the jobs number is strong, we may have a short-term pullback but then traders will start to think about the Federal Reserve cutting interest rates later this month, which is priced in at roughly a 100% chance. In other words, I do think that we turn around given enough time. That being said, if we do close below the 50 day EMA, it probably sends this market down to the 1.12 level, which has been supportive in the past. Overall though, I think we are trying to build up the necessary momentum to turn around and shoot higher. Breaking above those candlesticks would of course be a sign of increased momentum and a potential rounded bottom be informed yet again.