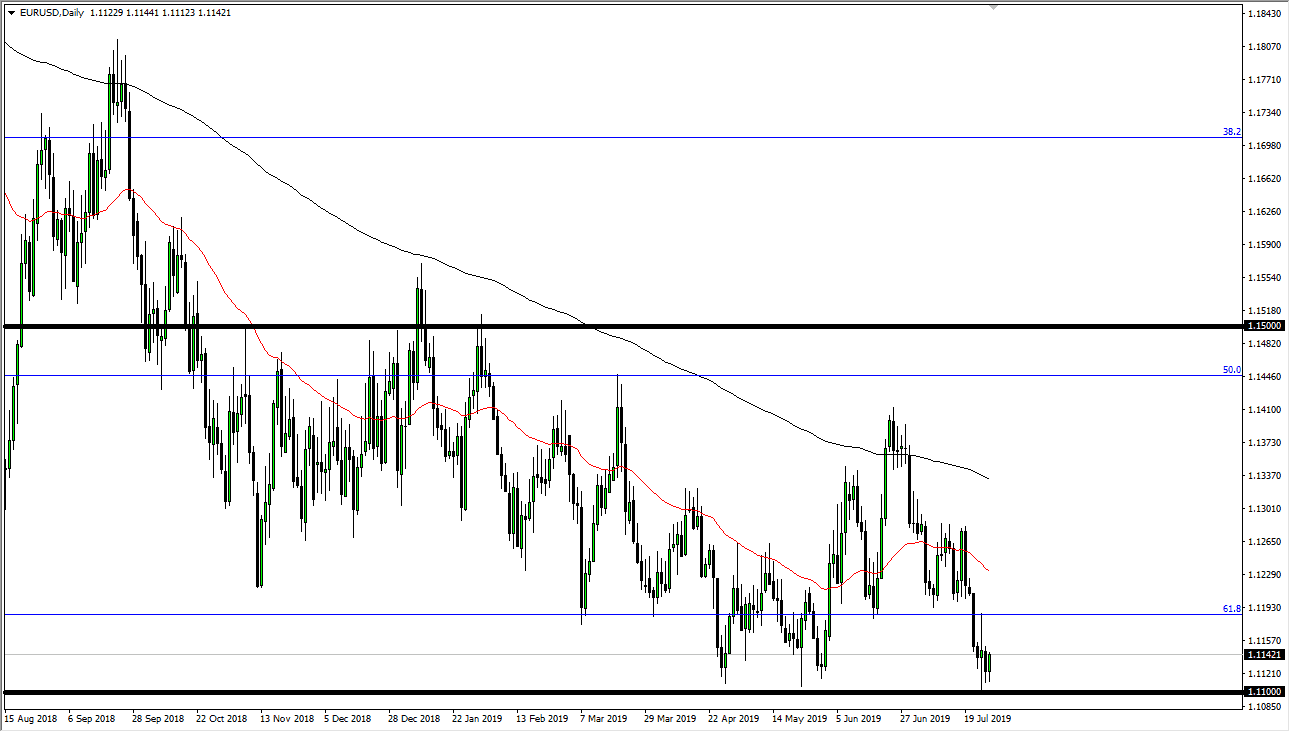

The Euro did very little during the trading session on Monday, as we continue to simply dance around just above the 1.11 handle. I suspect that the Euro won’t do much between now and the announcement, as we simply don’t have any catalyst. People will be waiting to see what the Federal Reserve is going to do next, more importantly not only whether or not there is a cut, (which of course there should be) but whether it is 25 bps or 50 bps. My suspicion is that the 25 bps cut is what we are going to see, but the real question is going to be whether or not the Federal Reserve is going to continue to cut rates going forward.

The Federal Reserve is very likely to look forward with dovish tones, and it’s likely that we will see the US dollar loses a little bit of its luster if the Federal Reserve is going to suggest even more cuts down the road. The 1.11 level underneath has been massive support previously, and therefore it’s likely that the buyers should be interested in the market near that area. That being said, I am a buyer of short-term pullbacks, at the first signs of a bounce between now and the Wednesday afternoon session in America.

To the upside, I believe that the 1.12 level should be massive resistance, so I think that would be the first hurdle to overcome. This is a market that if we can continue to stay in this 100 point range, it’s likely that we will eventually build up the necessary momentum to finally break out. That being said, if we were to break down below the 1.11 level, then it could reach down towards the 1.10 level after that.

Ultimately though, I think what we are looking at is a scenario where we are more than likely going to do a little bit in the way of movement followed by a huge reaction to the Federal Reserve announcement. Ultimately, this is a market that I think will continue to weigh the options between both dovish central banks, as neither look likely to tighten monetary policy anytime soon. The question now is exactly how dovish the Federal Reserve will be? If they become aggressively dovish, that could send this market right back around and form a bottom in it.