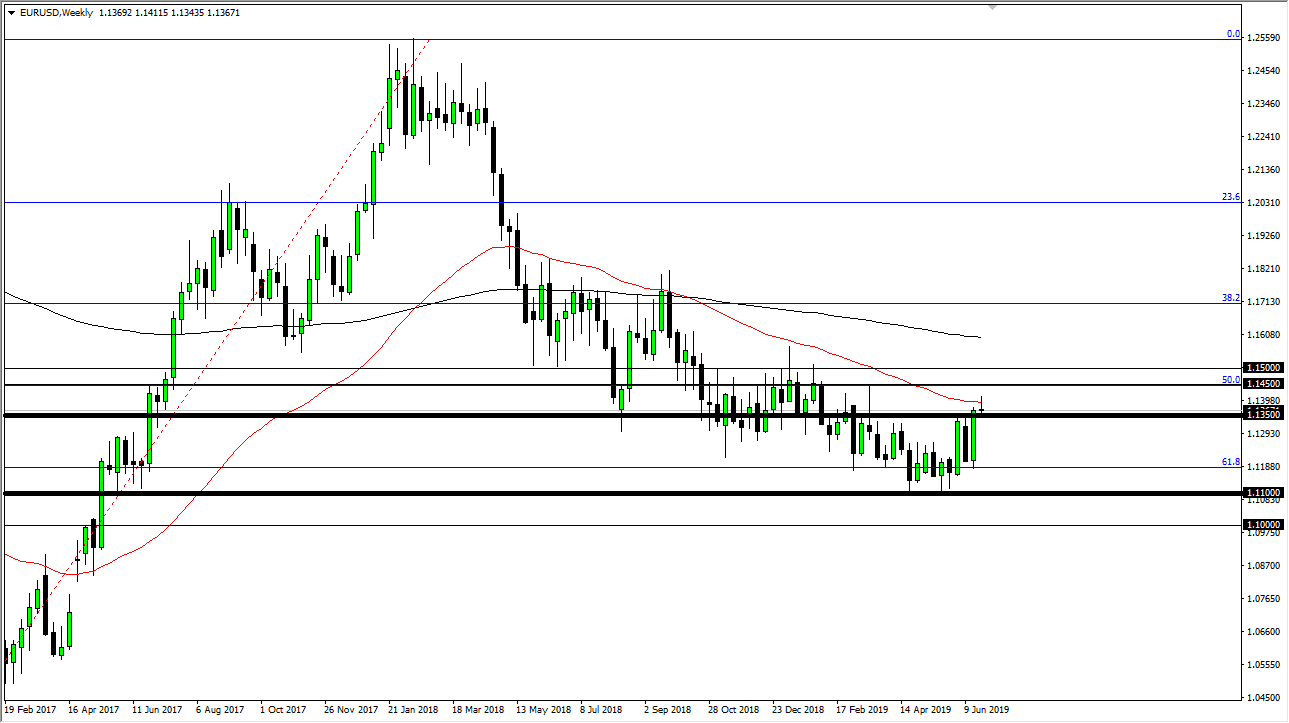

The Euro has rallied quite nicely during the month of June, although it has been a very messy and choppy affair. I don’t think that’s going to change anytime soon, and of course the candlestick that closed out the month on the weekly chart is a shooting star, so that shows a bit of weakness. However, you can see that we have gone back and forth over the last several weeks, as we continue to chop back and forth to the upside.

Looking at this chart, if we can break above the shooting star, that should send this market much higher, perhaps reaching towards the 1.15 level where I expect see a lot of resistance. However, I think we are much more likely to see a short-term pullback, only to find buyers underneath. If we were to break above the 1.15 handle, the market then breaks out to the upside and goes looking towards 1.18 level. I do not expect that during the month of July, but I do expect that later this year.

After all, with the Federal Reserve looking to cut interest rates, it makes quite a bit of sense that the Euro should gain. This is because for quite some time the ECB has been very dovish, but we have not priced in any type of dovish behavior in Washington DC. This is a simple function of trying to catch up as the Federal Reserve is joining the rest of the central banks around the world.

As long as we don’t make a “lower low”, this market appears as if it is trying to form a longer-term bottom, which is always a very messy affair. Be patient, look for support of candles on shorter time frames and take advantage of value.