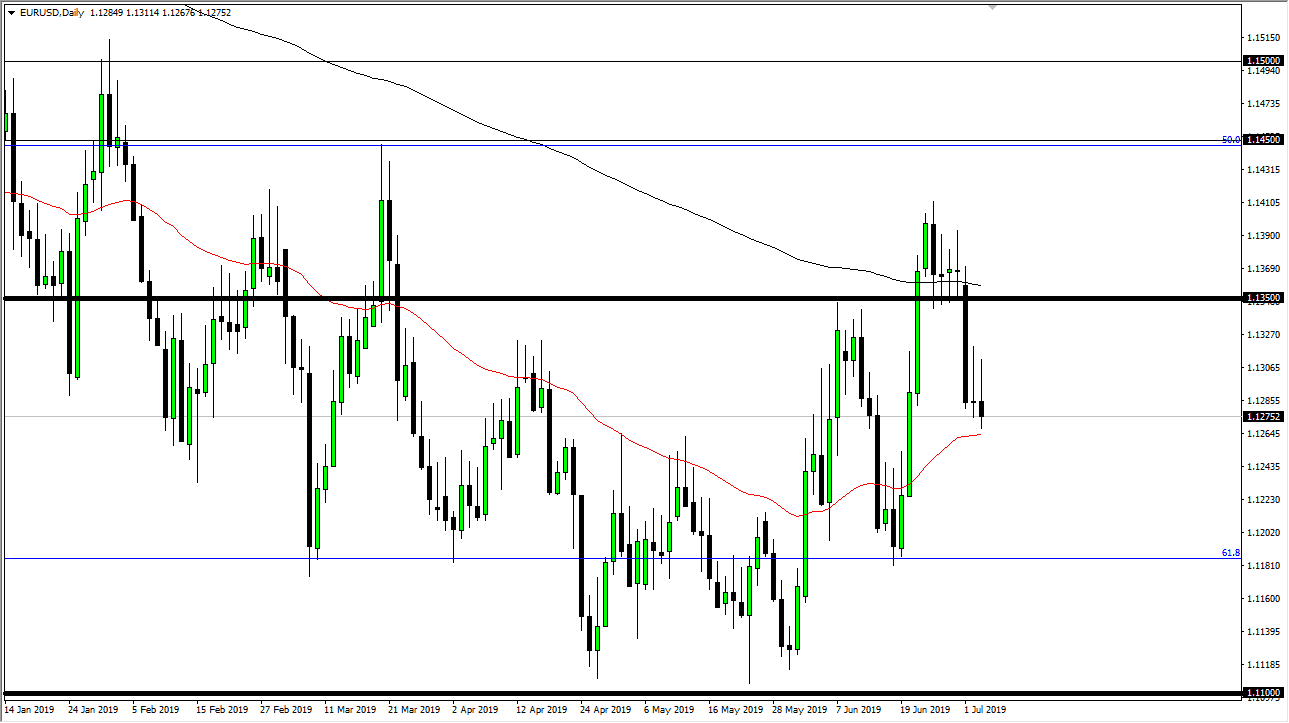

The Euro went back and forth during the trading session on Wednesday, showing signs of stability and uncertainty around the 50 day EMA. That makes quite a bit of sense, because we are heading into the Independence Day holiday in the United States, which will have a massive effect on liquidity. At this point, the 50 day EMA looks very supportive but I think we are looking at a potential move coming on Friday after the jobs number. Between now and then, I would expect very little and I would anticipate that the market probably stays within the range of the last couple of days.

The real question is whether or not the 50 day EMA can hold for a bigger move as support. If it does, that would be a bit of a perfect scenario, because it is a nice measure to move to the upside, making a “higher low” for the third time in a row. That could be the sign of a major bottoming pattern for a longer-term move, as the Federal Reserve looks likely to cut interest rates. A break above the highs of both Tuesday and Wednesday is a very bullish sign as it breaks through a lot of short-term resistance and traps a lot of traders on the wrong side of the trade. After that, the next area of interest will be the 200 day EMA which of course has been very choppy.

While I do not expect this market to break out to the upside that easily, it does look as if it is trying to go higher overall. Yes, I recognize that we have formed a couple of inverted hammers in a row, but the idea of them being broken to the upside lends even more credence to the idea of going long.

The alternate scenario of course is that we break down below the 50 day EMA, which opens up the door down to the 1.12 level. If that happens, then things become a lot more murkier, which is very possible as both central banks are extraordinarily loose. That being said, I think that the Euro has been undervalued now that the Federal Reserve looks likely to cut rates, so I still think it’s more likely to go higher than lower on longer-term charts. You are going to need to be very patient in this pair, but that’s nothing new as it tends to be very choppy and difficult to trade for a bigger moves anyway.