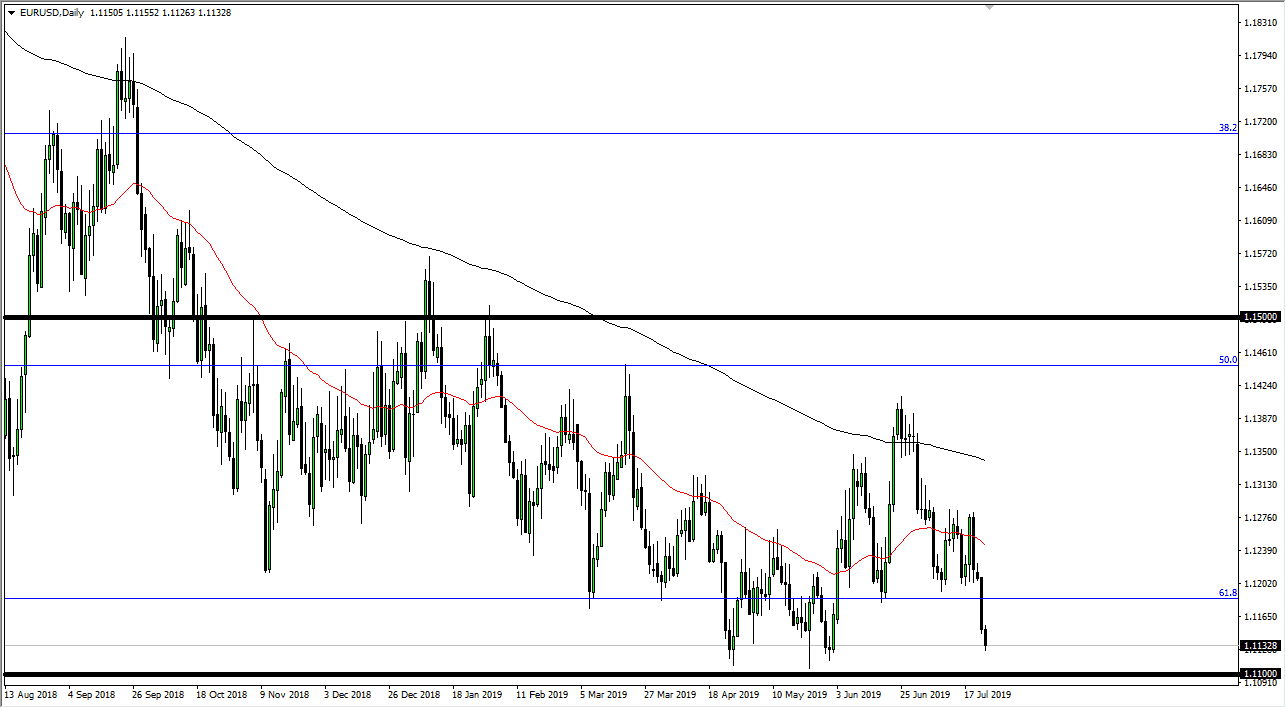

The Euro fell again during the trading session on Wednesday, as we await the European Central Bank interest rate announcement and press conference during the day on Thursday. Ultimately, this is a market that is trying to protect itself from that announcement, so it makes sense that the Euro has softened a bit. However, there is a significant amount of support at the 1.11 level underneath so I don’t know that we break down below there in the short term.

That being said, expect a lot of noise around the announcement, as the volatility is going to continue during not only the announcement but also the press conference. Given enough time though, I do think that the buyers come back unless the ECB does something extraordinarily negative. All things being equal, we have to keep in mind that the Federal Reserve is in fact ready to cut interest rates, so this is going to be a market that is simply traded based upon what it’s focusing on at the moment. Right now, it’s obviously focusing on the dovish dangers coming out of the ECB.

However, almost as soon as that’s done we will start to focus on the Federal Reserve and it’s very likely that this market will turn right back around. I do see the 1.11 level is significant support but I also think that the 1.10 level underneath there will attract a lot of attention as well. In fact, that may very well be a “zone of support” so it wouldn’t be surprising at all to see this market find buyers in that area. To the upside, I see the 1.13 level as a potential resistance barrier. Obviously, the Euro is struggling but I think it’s only a matter time before the US dollar starts to break down and we start to rally due to the fact that the Federal Reserve tends to get what it wants, and if the Federal Reserve is going to cut interest rates, it obviously wants a cheaper US dollar.

That doesn’t mean that it’s going to be easy, but I do think that eventually we will find a buying opportunity. That being said though I would be a trader of this currency pair until after the press conference, and probably a few more hours after that once we start to stabilize a bit. Ultimately, this is a “no go zone” for about 24 hours.