The Euro initially pulled back during the trading session on Friday but found enough buyers underneath the turn things around. This shows signs of strength, however there are a ton of resistance areas above. Ultimately this is a market that is going to continue to be choppy and difficult, so I think that there will continue to be reasons to go in both directions. Remember, both of the central banks are looking to cut interest rates so that of course is throwing more confusion into this currency pair.

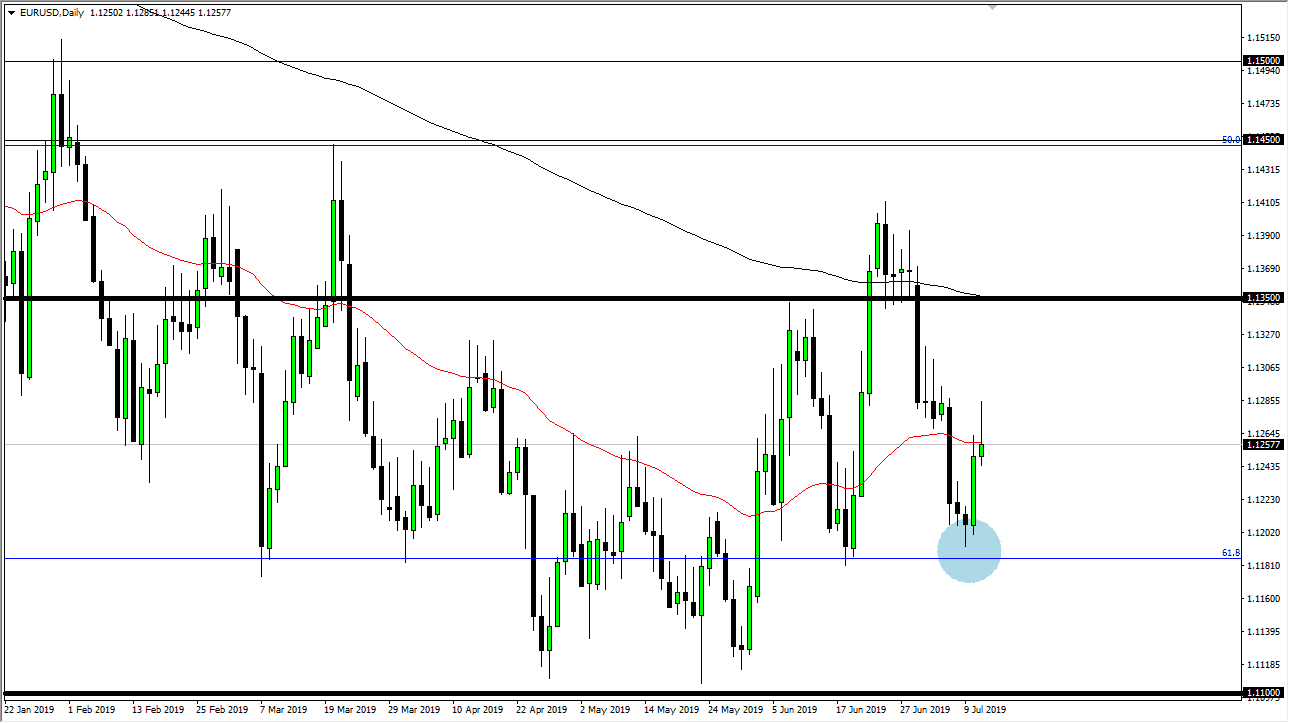

Looking at this chart, there is a significant amount of resistance at the 1.13 level. That is an area that should continue to show signs of exhaustion and resistance, based upon the shooting stars that have formed their previously. That being said, the market looks likely to struggle to go higher. However, there is support underneath so this pair is a complete mess. I wouldn’t waste my time trading it, but it is useful as a barometer for US dollar strength or weakness.

As long as both central banks appear so dovish, it seems very unlikely that we will get any type of clarity anytime soon. That being said, if we can break above the shooting star from the Thursday session and the ones from last week, that would be an extraordinarily bullish sign, busting through a ton of resistance. To the downside, the blue circle at the 1.12 level shows signs of support and a break down below that level would be extraordinarily negative, sending the market down towards the 1.11 handle. Ultimately, this is a market that will chop around to be difficult to navigate for any length of time, so keep your position size small if you do feel like you need to trade this market.

However, if you do pay attention this market, you can look at it as something to do with where the US dollar will go and therefore you can use it to trade your other currency pairs. A straight shot in this market is difficult to deal with so keep in mind that the EUR/USD pair is such a huge part of the US Dollar Index that it cannot be ignored. For example, if you are looking to play the impending Australian dollar breakout, if you see the Euro rallied against the US dollar, that could provide even more upward pressure in the AUD/USD pair. As far as straight trading is concerned in this area, it’s hard to do so as there are so many micro levels that could cause issues.