The Euro has seen a bit of a resurgence lately, as we may have had a bit of a bottom when it comes to the EUR/JPY pair, and we also have the EUR/USD pair trying to break to the upside as well, which of course is the overall benchmark for Euro strength.

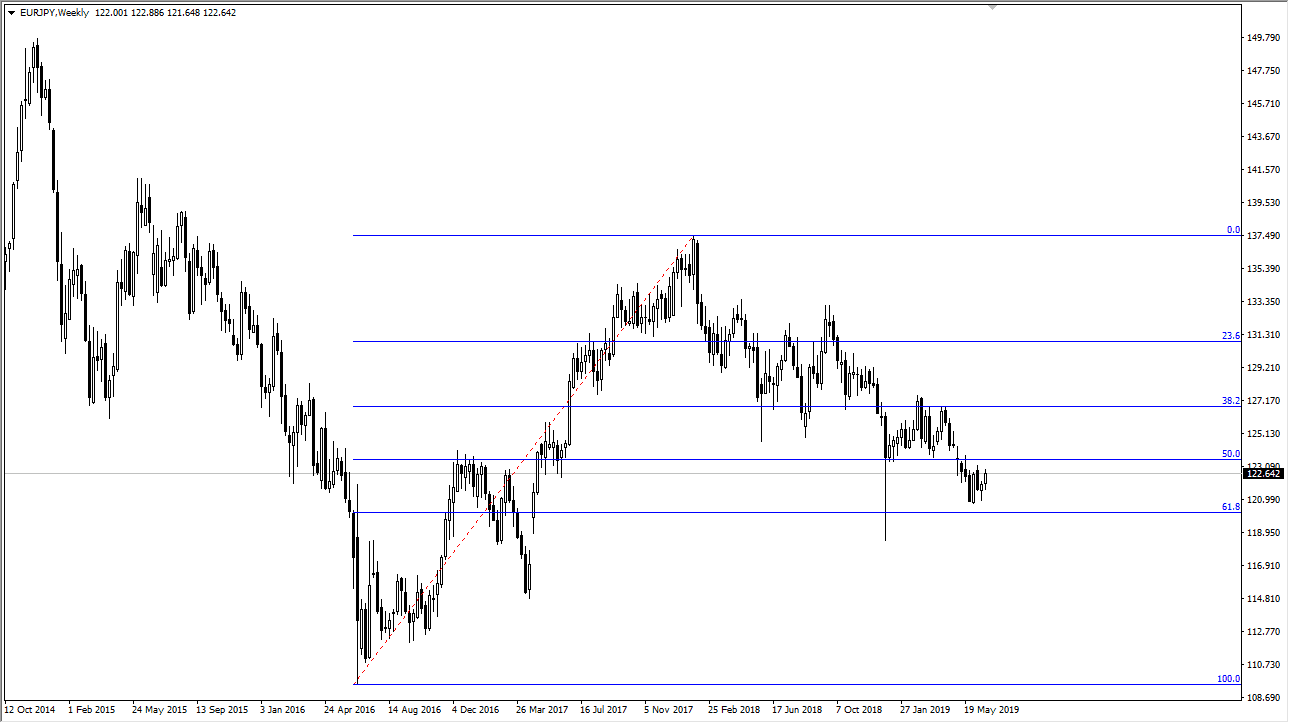

Against that backdrop, it appears that we should see a significant amount of bullish pressure in the Euro in general. Marry that with the idea of the Japanese yen losing a bit of strength toward the end of the month, we could have a bit of a “perfect storm” for the EUR/JPY pair to rally. We have recently reached down towards the 61.8% Fibonacci retracement level in this market and have reacted quite nicely. The last month has seen a bullish candle, a pullback, a hammer, and then eventually another rally. That is a good sign that buyers are starting to pick this market up “on the cheap.”

To the upside, I see the ¥124.50 level as being rather significant resistance. However, if we can break above that level we could go much higher. I also recognize that you should keep an eye on the EUR/USD pair, because I think that level coincides nicely with the 1.15 level in that market. If we can break above the 1.15 level, then this market should follow right along.

Remember though, this is a pair that will be highly susceptible to risk appetite. We need to see an overall “risk on” situation around the world to see this market go higher. One potential could be that the US and China come together with some type of agreement or at least signs of positivity during the G 20 this first weekend of the month, which would send the lot of people looking for risk appetite based markets. That being said, if we were to break down below the ¥120 level, the bottom will fall out of this market.