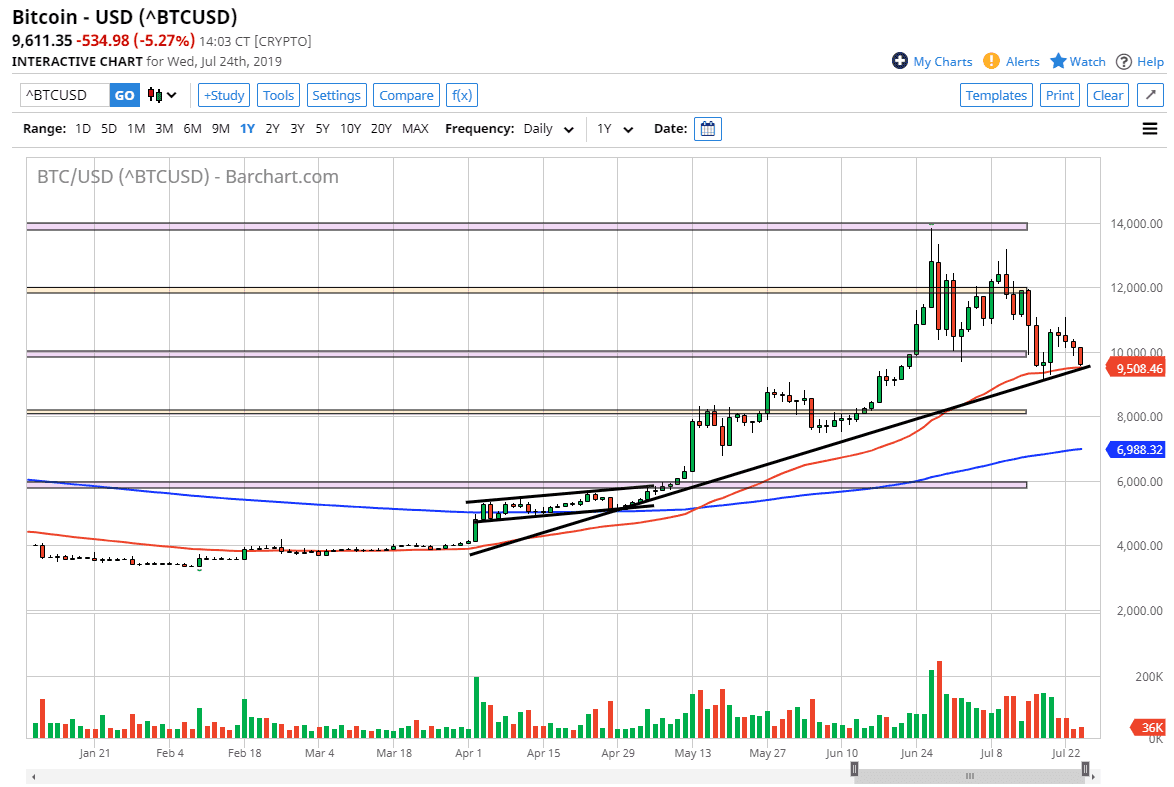

Bitcoin has tried to find support during the trading session on Wednesday, reaching down towards the 50 day EMA, as it is sitting right at the uptrend line as well. This is a very bullish market longer-term, but we are testing major support. I think at this point it’ll be interesting to see whether or not we can break down below the trend line, which would take a lot of wind out of the sails of buyers.

The candlestick is rather negative, but at this point it’s likely that the buyers will try to defend this uptrend line. Bitcoin has been very bullish because of money flying out of China, Venezuela, and many other places around the world. Beyond that, we also recognize that the Federal Reserve is likely to cut interest rates, and that should continue to be a driver of this pair higher, as it should bring down the value of the greenback in general. You will see this in the Forex markets, commodities markets, and of course Bitcoin. In fact, it appears that the Bitcoin market is place where people are looking to put their wealth into to preserve it in a low interest rate environment.

Bitcoin of course has been rallying significantly over the last several months but has recently pulled back. I think at this point it’s rather healthy though, because this market had been so parabolic. That being said, if we do close below the trendline on the daily chart it’s very likely that we go to the $8000 handle. If we were to break down below there, it’s very likely that we go down to the $6000 level. I do think that Bitcoin is in the midst of a renaissance, in the sense that people are trying to lift the price yet again. We had that major bubble a couple of years ago, and now we are starting to reinflate it again. As for myself, I believe that we will eventually form another bubble in Bitcoin but we may not be there quite yet. I do think there is value on the way to the upside, so I’m looking for supportive candles or a bounce from this trendline initially, and then possibly the $8000 level. If we break down below $8000, I would have to rethink my attitude when it comes to Bitcoin. Someday though, I fully anticipate that we will get a bit of a “blow off top” again, and then go crashing.