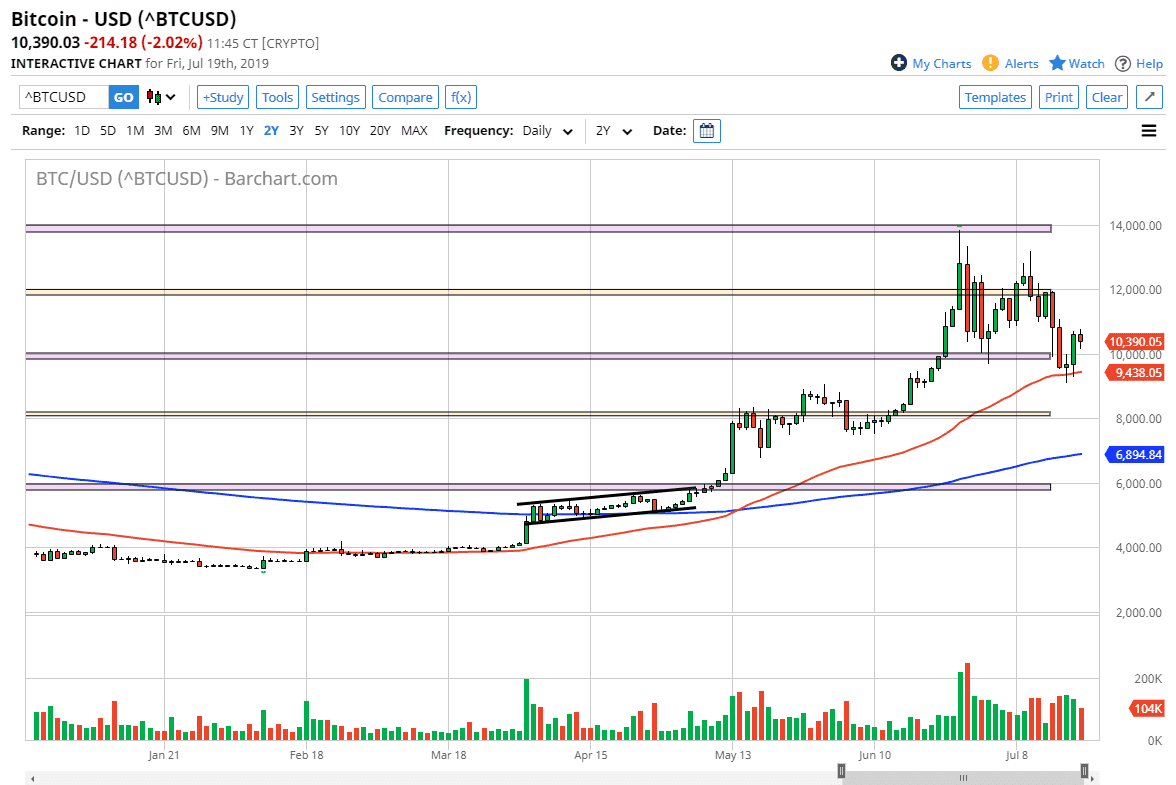

The Bitcoin market pulled back a bit during the trading session on Friday, reaching towards the $10,000 level. This is an area that of course attracts a lot of attention, as it is a large, round, psychologically significant figure. That being the case, it makes sense that we may have pulled back just a bit on Friday due to the fact that we had such an impulsive candle stick for Thursday. The $10,000 level should offer support, just as the 50 day EMA should underneath. We had formed a nice neutral candle stick on Wednesday, and that of course shows signs of hesitation to continue to sell.

The 50 day EMA has offered technical support more than once just as it has offered technical resistance in the past. It’s likely that we will continue to go to the upside, and therefore I think it’s only a matter of time before buyers pick up value. Ultimately, I think that the market holding the 50 day EMA and perhaps even more importantly the $10,000 level signifies that we could go to the $12,000 level after that. That of course is an area that continues to be interesting, as it has offered significant resistance. That being the case, the market is likely to continue to find buyers on these dips and eventually pushed towards the $12,000 level and above. After that, I think that we go looking towards the $14,000 level.

Bitcoin has been in a nice uptrend for quite some time, and as a result I think it makes sense that we continue to build momentum going forward. The US dollar of course has been falling due to the Federal Reserve looking to cut interest rates. That of course is very negative for the greenback, which is the other side of this trade I do believe that a lot of traders will continue to look to Bitcoin and other assets to protect their wealth in a significant “low interest rate environment.” We are entering a new phase of quantitative easing, so it makes sense that the alternative assets such as Bitcoin continue to gain against fiat currencies. There has long been a running argument about Bitcoin versus Gold, at this point both are going to continue to rally going forward. It’s not only against the US dollar that we will see gains, but it is also against other currencies such as the Euro and the British pound.