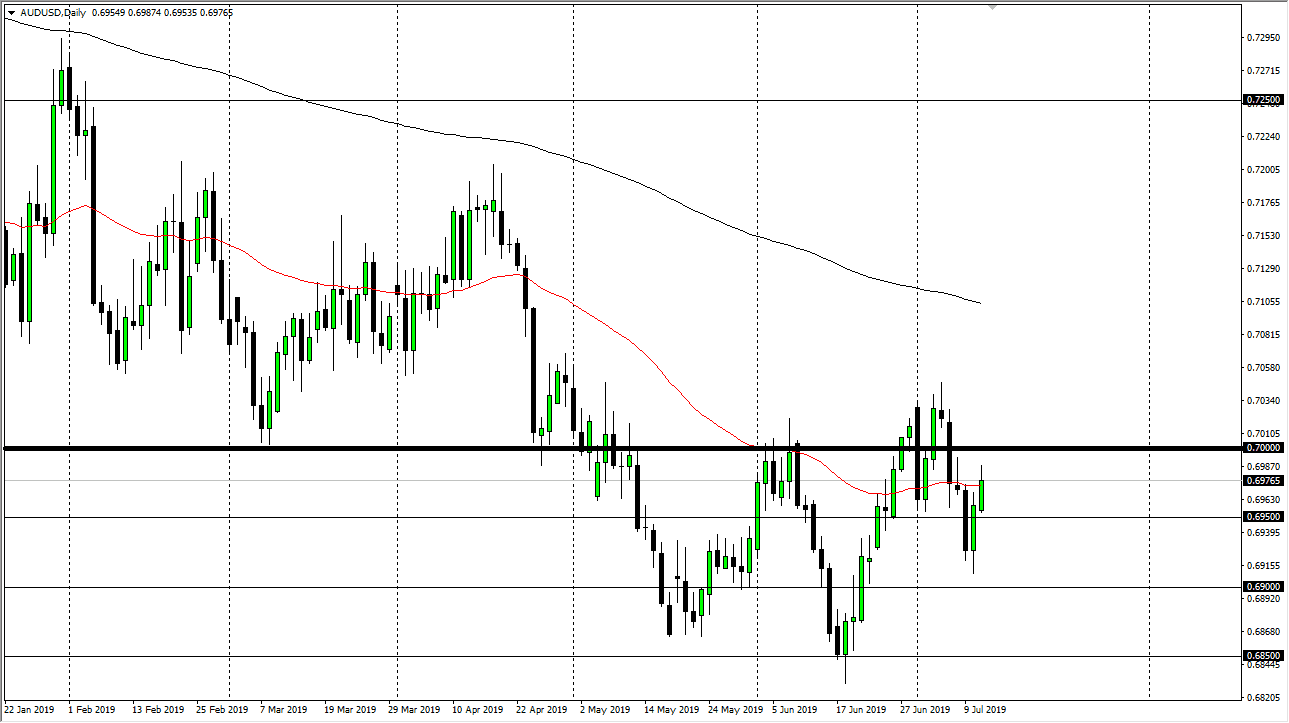

The Australian dollar rallied during the trading session on Wednesday to test the psychologically and structurally important 0.70 handle. This is an area that will attract a lot of attention because not only hasn’t been significant resistance previously, but it’s also a large, round, psychologically important figure. If we can break above that level, and perhaps even more importantly the shooting star that sits at basically 0.7050, then the Australian dollar can continue to climb. I think it happens given enough time but it’s very unlikely that the market can do it right away. After all, there are a lot of different things going on that could throw the Australian dollar around.

To the downside, we have to worry about the US/China trade situation, as it just simply isn’t getting much better. Yes, things have calmed down but at the end of the day we are still in a long way away from getting clarity and more importantly some type of solution to the US/China trade issues. Ultimately, this is a market that I think continues to see a lot of volatility due to things like that. However, we also have the possibility of going to the upside, due to the fact that the Federal Reserve is looking to cut interest rates. We already know that they are cutting in July, at this point the question is whether or not they will keep cutting interest rates after that?

Looking at this chart, the 50 day EMA is slicing through the candle stick, and it is offering a little bit of resistance as well, but I think it’s only a matter time before we leave that in the background. The 200 day EMA above pictured in black currently hovers around the 0.71 level, but I do think that will be a minor blip on the radar as the market is trying to form some type of supportive area underneath. The 0.68 level is the absolute “floor” in the market and extends to the 0.70 level overall. I think we are trying to form a large rounded bottom, which of course is a nice turnaround signal but is also very slow in. Overall, if we can clear that the 0.7050 level, the market is ready to go much higher. At this point the 0.7250 level above will be a target, but it will take a long time to get there.