The Australian dollar fell hard during the trading session on Friday, in reaction to the stronger than anticipated jobs number. That of course is a reaction to the idea of the possibility that the Federal Reserve would not be cutting interest rates, and therefore the US dollar gained against most currencies. However, later on in the day the Federal Reserve stated that they were willing to do what is needed to keep the economy going forward, which of course means that they are still on course to cut rates.

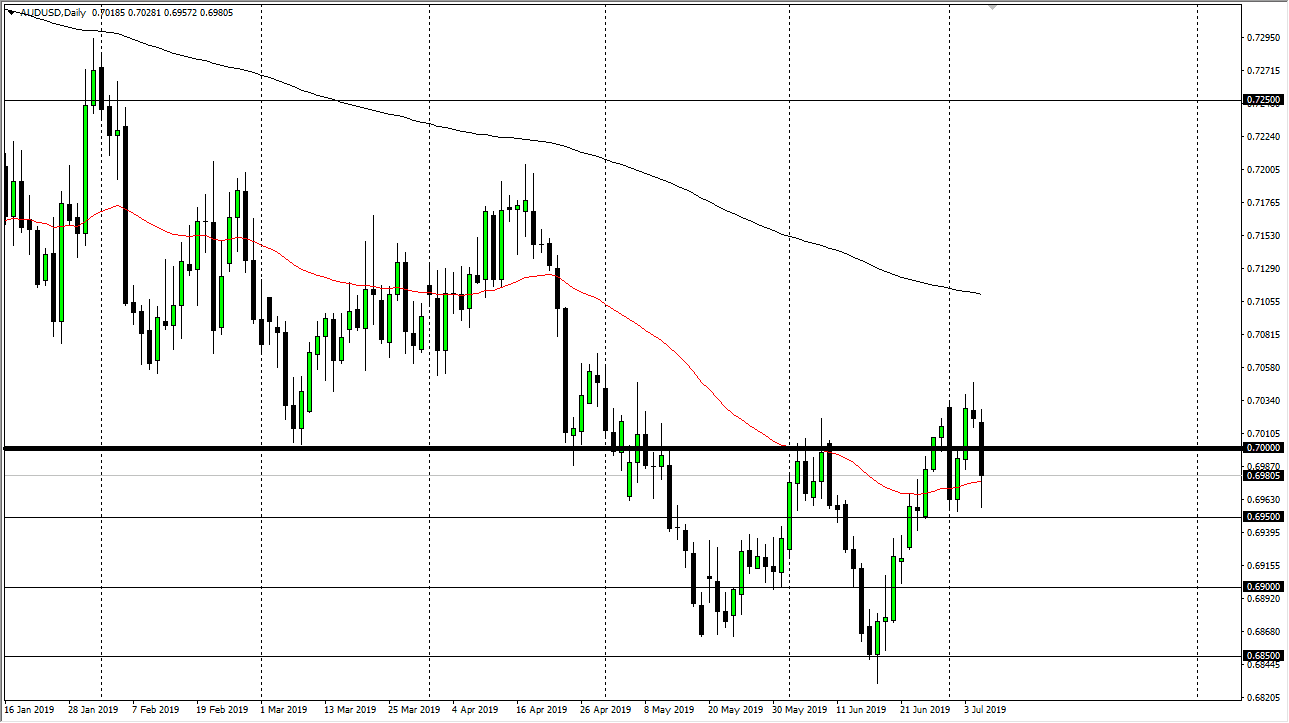

With that in mind, the market broke down below the 50 day EMA, and then bounced back above it towards the end of the day. The 0.6950 level looks very likely to be a bit of a short-term floor at the moment, so therefore it’s likely that the market will continue to find buyers underneath, with the area being a significant buying level. It’s as if we are trying to build up the momentum to finally break out to the upside. If we do break above the shooting star on the Thursday session, then it’s very likely that we continue to break out and go to much higher levels.

If that happens, I suspect that we are then going to go to the 0.72 level above. At this point, we could even go above there and reach towards the 0.7250 level as well. Keep in mind that the US/China trade relations have calmed down a little bit, and that does of course helps the Australian dollar in general as it is so highly levered to the economic engine that is mainland China. They supply a lot of hard materials to the Chinese, so it is typically used as a proxy for that economy.

If the Federal Reserve does of course cut interest rates than the US dollar is overvalued against most currencies. It seems as if that’s exactly what’s about to happen, and the Australian dollar is extraordinarily beaten down at the moment. To the downside, if we were to break the 0.6950 level then we start looking for support every 50 pips or so. This is a general vicinity of support that we have seen more than once, and therefore we could be looking at a longer-term bottom be informed. Either way, I am more bullish than bearish now, but I recognize it’s going to be a very noisy affair to say the least.