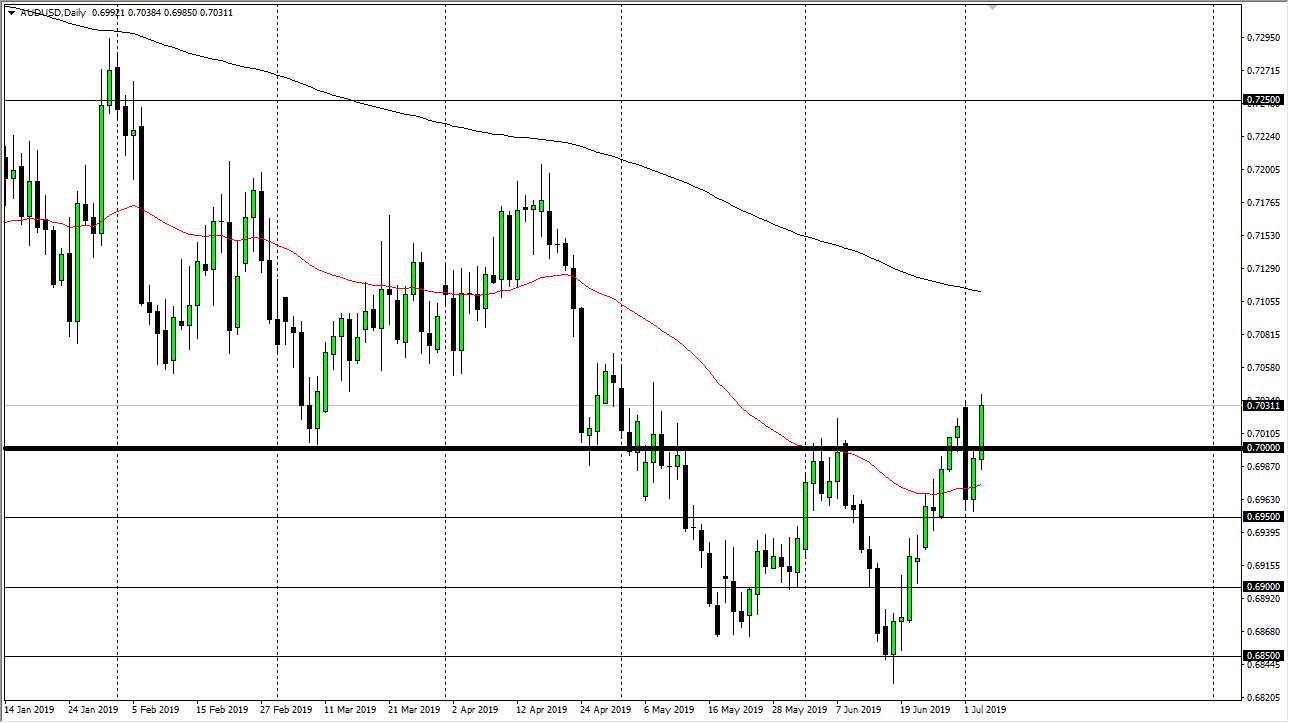

The Australian dollar has rallied significantly during the trading session on Wednesday, breaking to the upside rather straight forward, breaking above the top of the top of the candle stick from the Monday session that was so negative. That engulfing bearish candlestick is of course a very negative sign, but as we have seen so much in the way of a reversal, it does suggest that perhaps the Australian dollar is ready to go much higher.

Keep in mind that the Australian dollar is sensitive to the US/China trading situation, and as a result we could have a sudden reversal at any moment. The question now is whether or not we get some type of negative headline out there that could throw a wrench into this situation. In the short term though, it looks as if we are probably going to be paying attention to the Federal Reserve cutting interest rates, so it makes sense that the US dollar may fall from here. The question now is whether or not that has enough juice to push this market to the upside.

The 50 day EMA underneath is starting to curl higher, so perhaps it can offer some type of support. Beyond that, we have the jobs number coming out on Friday, and that could very well cause a lot of volatility. However, in the next 24 hours we will probably see very thin trading which could move this market around quite drastically. After that, we will get a reaction to the jobs figure and if the jobs number is poor, that could have this pair rally based upon what would almost certainly be yet another reason for the Federal Reserve to cut interest rates.

At this juncture, the 200 day EMA is worth paying attention to which is currently hovering around the 0.71 handle. Beyond that, the market then is free to go to the 0.7250 level longer-term. That is an area that should be significant resistance, and I don’t think we get there right away. That would be more of a grind but a move higher from here certainly puts a lot of credence into the idea of a “W pattern” be informed on this chart which looked to be threatened after the Monday candle stick. After a couple of days though, it looks as if we have reaffirmed that shape, and as a result we have a measured move to the 0.72 implied based upon that pattern.