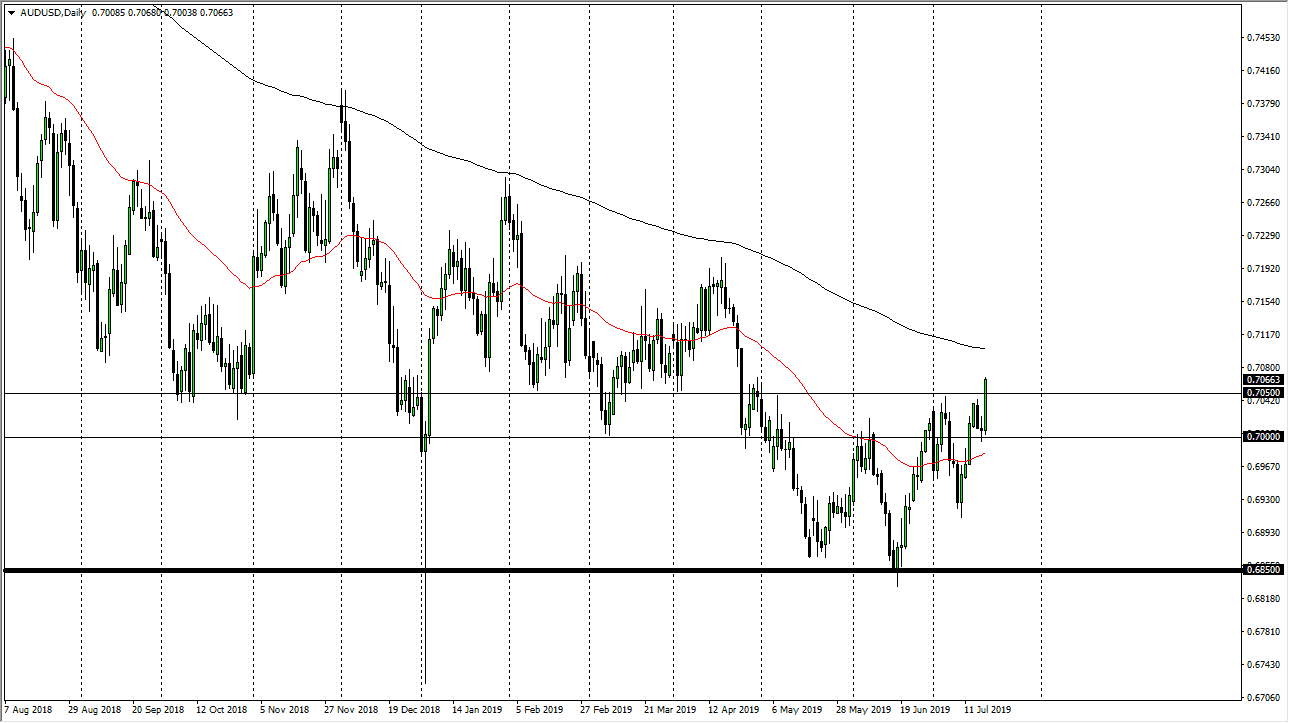

The Australian dollar rallied significantly during the day on Thursday, breaking above the crucial 0.7050 level. Beyond that, we are reacting to significant weakness in the US dollar. This is due to the Federal Reserve looking to cut interest rates, which should drive down the value of the greenback itself. Ultimately, this is a market that show signs of forming a longer-term bottom, and therefore I think it’s only a matter time before we reach to extreme highs. This could be the beginning of the end of the selling pressure, as the Australian dollar is giving signs of a bottom.

Looking at this chart, the 0.6850 level very well could go down as the absolute bottom of the market. That being the case, we could begin looking at a longer-term trend change, so this becomes a “buy-and-hold” marketplace. Because of this, short-term pullbacks should be buying opportunities. I believe at this point in time the Australian dollar is going to recover due to the Federal Reserve cutting rates and of course the idea of central banks around the world easing. This drives up the value of gold, which in turn should drive up the value of the Aussie dollar longer-term.

At this point, the 0.70 level should be supportive, and therefore I think that the floor should be the same level. As long as we do not break down below there, things should continue to show signs of strength. Just above, we have the 200 day EMA, which of course could offer significant resistance. Once we clear that level, longer-term traders will begin to hold the Australian dollar. Furthermore, if we can get some type of positive movement between the Americans and the Chinese, that could be the final nail in the coffin to send this market higher. When you look at this chart, you could use a little bit of imagination to show an inverted head and shoulders. Ultimately though, I think at this point what we are looking at is a market that is trying to rally given enough time. The 0.72 level will be the initial target, followed by the 0.7250 level. The candle stick for the day is also a very bullish, so having said that it’s very likely that we will get some continuation going forward. We could get a short-term pullback on Friday due to the weekend coming, but at this point I think the Australian dollar has made its intentions well-known.