The Australian dollar initially tried to rally during the trading session on Monday as traders came back to work, in a bit of an attempt to show “risk on.” Ultimately, the Australian dollar is highly sensitive to the USD/China trade, and of course that seems to be in flux at the moment. Ultimately, the conversation between the United States and China will be highly influential as to where the Australian dollar goes.

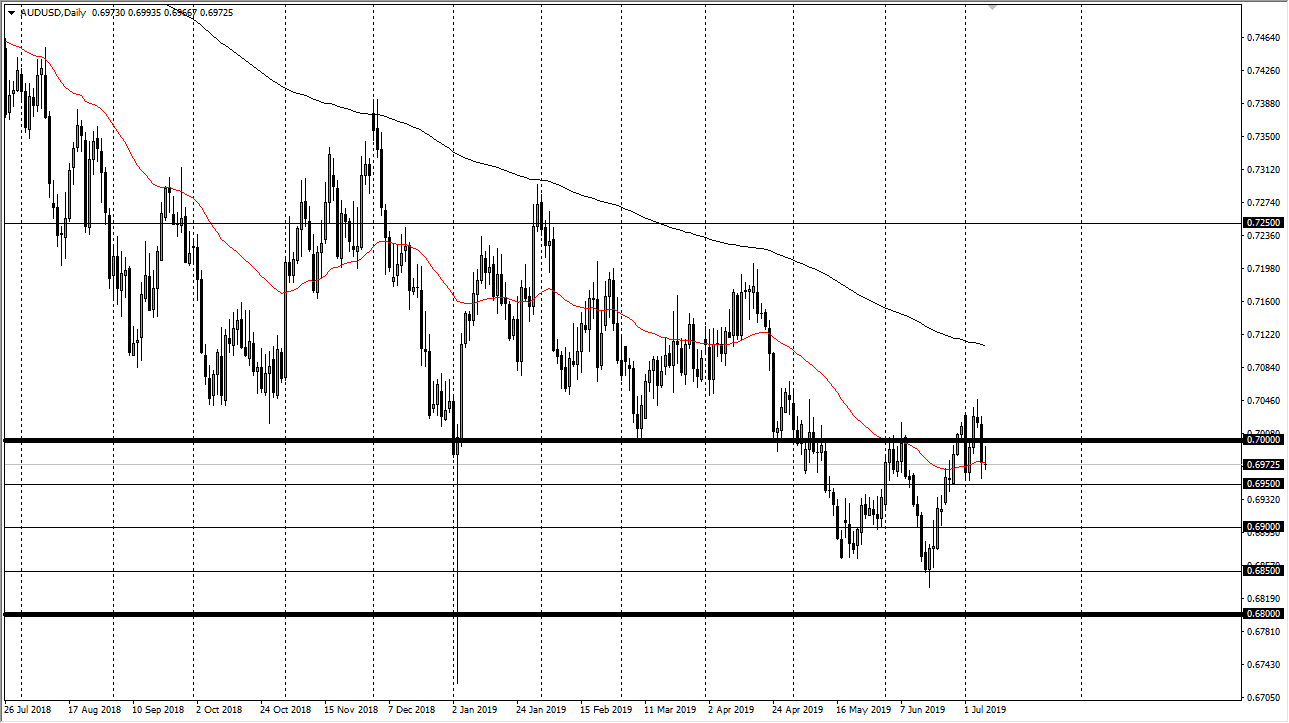

On the other side, you have to pay attention to the Federal Reserve and what its intentions are. Obviously, most of the world is assuming that the Federal Reserve is going to cut interest rates in July, so that does give this pair a little bit of levity. We are currently testing the 50 day EMA, which is slicing right through the middle of the candle stick. That being said though, the candle stick for the day is a bit exhausted so we may have to drop down to the 0.6950 level to find buyers. If we break down below there, then we start to change the tone of the market, as it appears like it is trying to form a bit of a “W pattern.” A break down below that level would more than likely send this market down towards the 0.69 level or possibly even lower.

I still believe that regardless we should have buyers underneath, so therefore signs of support underneath should continue to be a buying opportunity, but overall we are in a major area of support, down to the 0.68 level. That being the case, I’m looking for value to take advantage of. Ultimately though, if we were to break above the Thursday shooting star, that would be a reason to go long as well. Notice how I say there’s no reason to short this market, because I think we are much closer to the bottom than the top. At this point, it’s only going to take some good words coming out of either Beijing or Washington involving the trade negotiations to cause a bottom, and if they get some type of deal going, this market should go much higher.

The candlestick showing signs of exhaustion for the day shows that there are sellers out there, so if we go above this candlestick for the day, that will trap them and perhaps boost the upside in this pair to go much higher and reach towards the 0.7250 level longer-term.