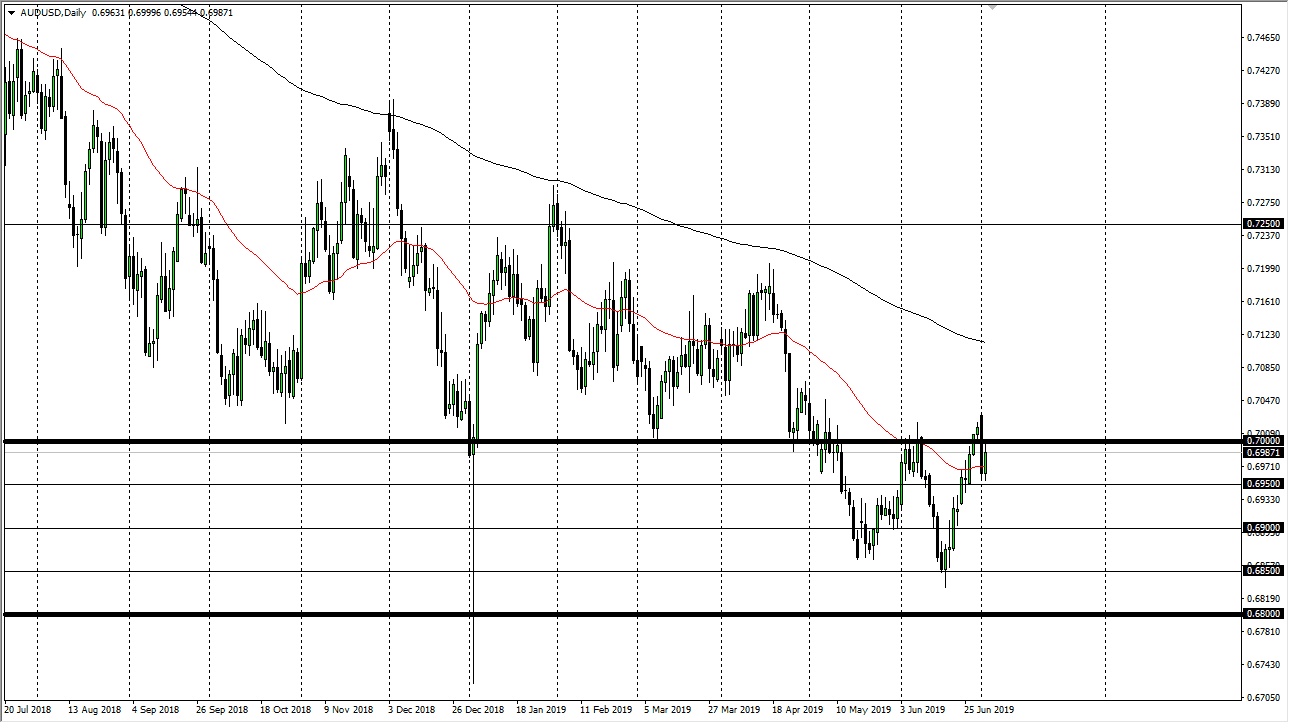

The Australian dollar has rallied quite nicely during the trading session on Tuesday, using the 0.6950 region as support. This was after the RBA chose not to cut interest rates, perhaps something that people were anticipating. That being said, there are a lot of things going on right now that could continue to drive this market back and forth so paying attention to these various factors will be crucial.

The 50 day EMA is sitting in the middle of the candle stick and starting to turn higher. However, one of the things that we have seen during the day is that the 0.70 level offering significant resistance. Because we could not break above there it tells me that the bearish candlestick from the day before still could apply, and as a result it’s likely that the market is probably going to go back towards the 0.6950 level, perhaps even below there. If we were to break down below that level it’s likely that the market could go another 50 pips at a time, as we have seen the lot of interests in these areas.

Keep in mind that the Australian dollar is highly sensitive to the US/China situation, which although we have seen a lack of escalation, we haven’t exactly seen any real progress. I suspect at this point most of the news pundits are probably singing the praises of how things are better, while the lot of bank analysts aren’t necessarily convinced. At this point you have to think about who controls more money.

If we were to break above the 0.7060 level, then obviously that’s a bullish sign and it should open the door towards the 0.7250 level. All things being equal though, I think we will probably try to go towards the bottom again, and a bounce from time to time in these areas makes sense. I think we are trying to form some type a bottom right now, but these affairs always take quite some time, and it could be several weeks if not months before things get turned around completely. After all, the Americans and the Chinese are nowhere near getting things together right now, even if things have calmed down over the last couple of days. As we head into the July 4 holiday season in America and of course the jobs number on Friday, it is very likely that the next couple of days will be shaky at best, and iliquid at first.