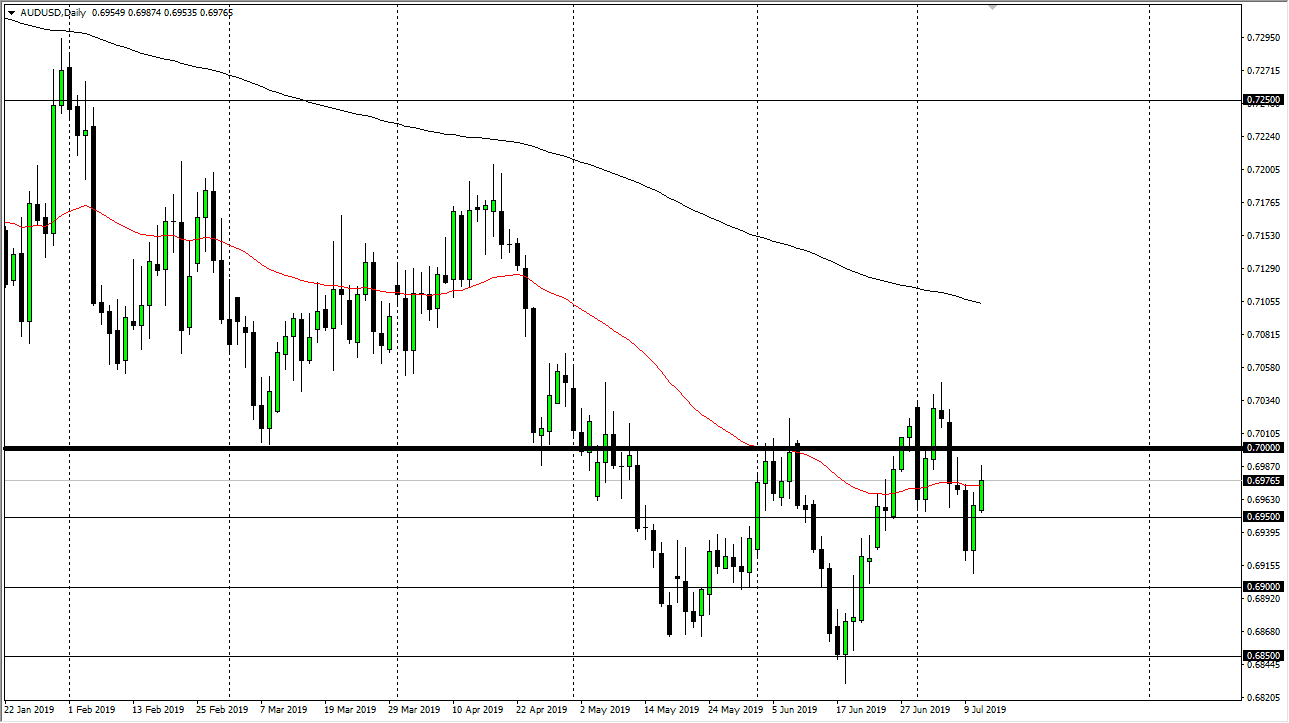

The Australian dollar ripped higher on Friday to break above the 0.70 level rather handily. We are looking at a shooting star just above from the previous week, so if we can break above that this could really get the Australian dollar moving to the upside. I would not be surprised at all to see a little bit of a pullback in the short term though, but that should only offer value of a dip.

The 50 day EMA sits just below, colored in red on the chart. That is an area that tends to a lot of technical traders, so pay attention to any reaction in that area. The 0.6950 level underneath should be supportive, as should the 0.69 level. In other words, I think there are multiple levels of support that we can test underneath. All things being equal, this is a market that is going to be very noisy, but we are in an area that is foreshadowing itself as a bottoming of the market, reaching down to the 0.68 level, so therefore I think that we are going to turn things around to change the trend.

Remember that the Australian dollar is highly sensitive to the US/China trade situation, and headlines coming out of that situation should continue to be monitored. However, it looks that the Federal Reserve cutting interest rates is what people are more focused on at this point. If that’s going to be the case, the US dollar will continue to struggle, and that could be exactly what the Australian dollar needs to form some type of basing pattern in and continue to go higher.

If we can finally break above the 200 day EMA, we could go to the 0.7250 level above. Breaking above that level then freeze the market to go much higher but at this point I think we will have a big fight on our hands and that area. All things being equal, I am a buyer on short-term dips, amassing a larger position once we finally break above the shooting star from last week. This is a longer-term trend just waiting to happen as the longer-term attitude of this market is trying to change. It’s going to be difficult, but I do believe that there are buyers out there looking to step in and pick this currency. The US dollar is about to turn completely against several currencies around the world, not just the Aussie.