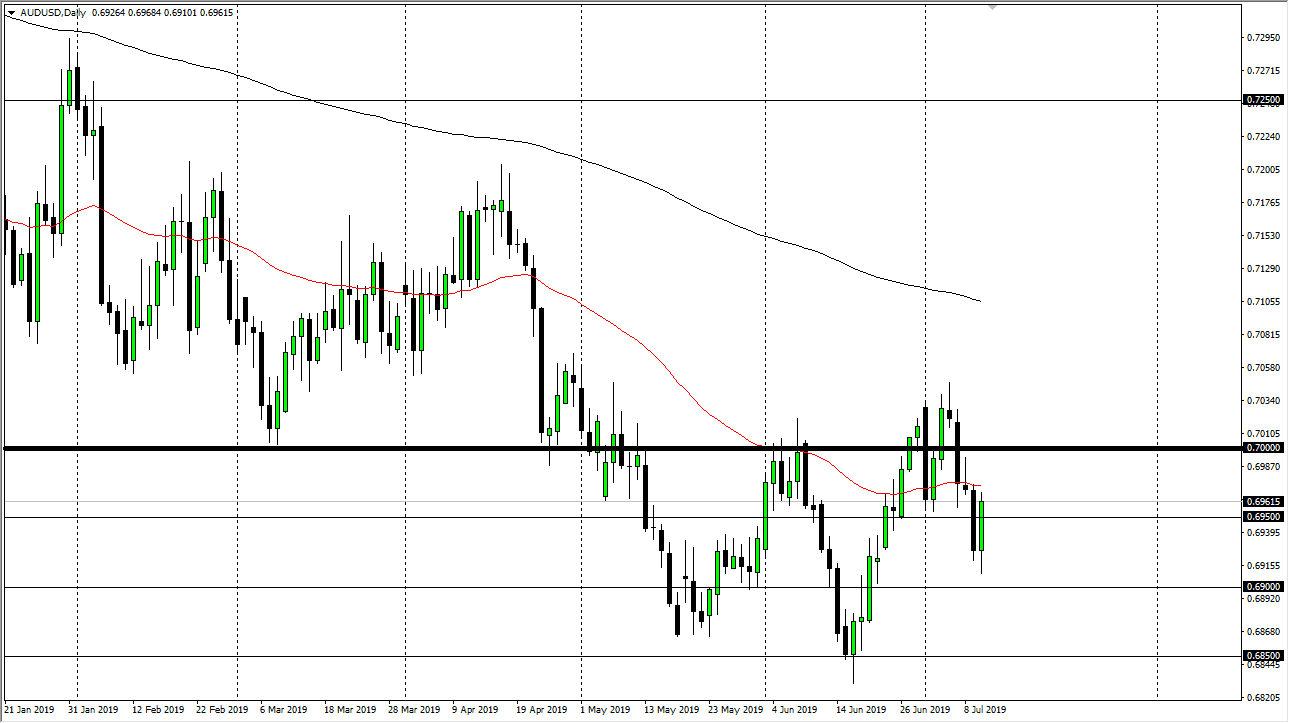

The Australian dollar initially fell during the trading session on Wednesday, reaching towards the 0.69 level underneath. However, we turned around to show signs of life and bounced towards the 50 day EMA. While there could be a multitude of reasons for this move, I suspect that the biggest catalyst would be the release of an opening statement for the Humphrey Hawkins testimony by Jerome Powell. As soon as that happened, the US dollar got sold off as it became obvious that the Federal Reserve is very likely to cut interest rates. This was just more confirmation of what the market had already anticipated, so therefore the US dollar got hammered.

By doing so, it shows that the 0.69 level should offer support as expected. The market tends to move in 50 pips increments, so therefore it’s worth paying attention to the fact that we turned around where we did. We are pressing the 50 day EMA, which of course is a technical signal that if you look to the left, has offered a bit of resistance in the past. Overall though, I do think that we eventually break above there.

The Australian dollar is highly sensitive to the Chinese economy, which by extension is highly sensitive to the US/China trade relations. That being the case, we will get some occasional headlines involving that situation that could move this pair. The Australian dollar will of course gain if there are signs of conciliatory talks between the Americans and the Chinese, as Australia supplies so much in the way of raw materials to China. Obviously, it works in both directions though.

I do believe that the Federal Reserve looking to cut interest rates rather soon is going to continue to put a little bit of pressure on the US dollar, so therefore all we need is some type of bullish sign coming out of China or Australia to send this market much higher. I think we are in the presence of a bottoming pattern, as we have made a “higher low” recently, if we break above the most recent high, then that just confirms the upward trend. I like the idea of buying dips in this pair anyway, so this could have been a nice opportunity. If we break above the 0.7050 level, the market probably goes towards the 0.7250 level longer-term. That’s a key here though: it’s a longer-term set up possibly.