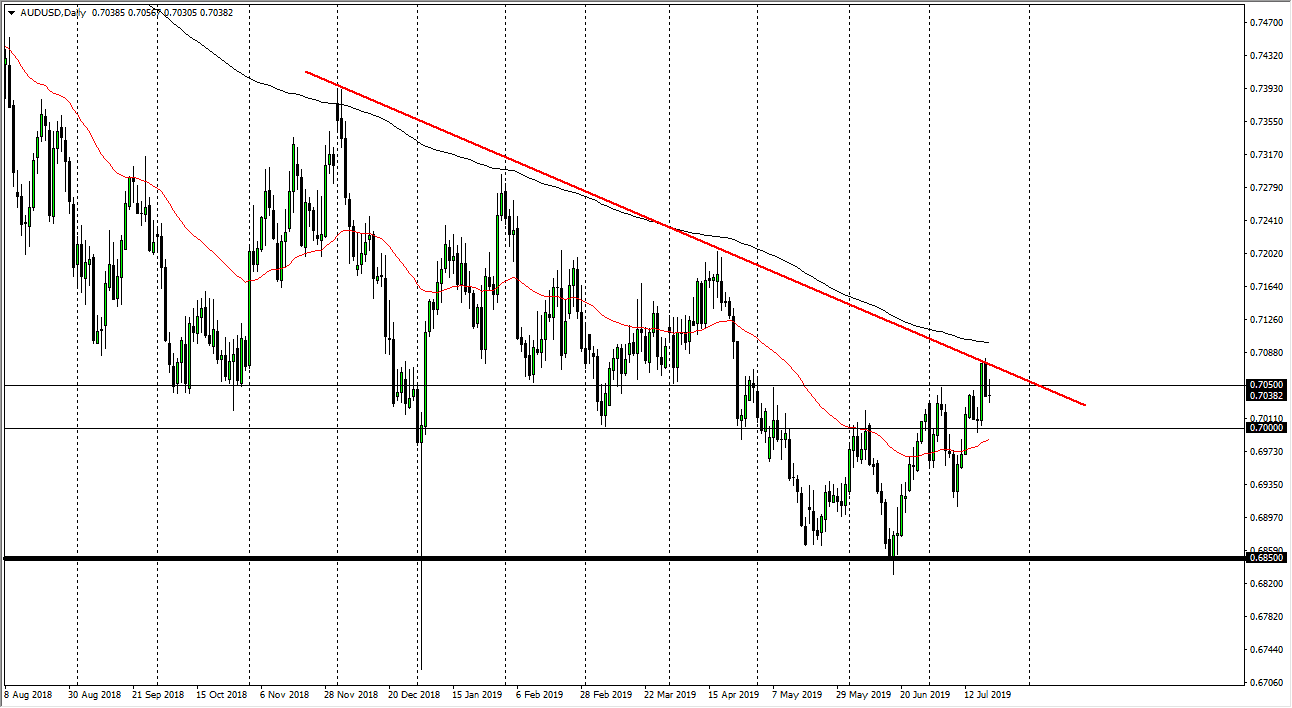

The Australian dollar went back and forth during trading on Monday, breaking above the 0.7050 level before pulling back yet again. We ended up forming a less than attractive candle stick from the buyers standpoint, but it’s not a huge surprise considering we are approaching significant resistance levels.

Keep in mind that the Australian dollar is highly sensitive to the gold market, but also sensitive to the US/China trade relations, as the Aussie is tied to the Chinese mainland. After all, Australia provides a lot of the raw materials for the Chinese construction industries as well as the manufacturing sector. Because of this, what we are essentially waiting on is to see whether or not the US and China trade spat will cool off, and that could give us plenty of reason to think that the Aussie could take off to the upside. However, remember that it works in both ways so this is certainly going to be a very interesting currency pair to play.

Gold

As you are more than likely aware of, the Gold markets have been absolutely on fire. Gold markets rallying the way they have is due to the Federal Reserve being likely to cut interest rates, as well as the ECB and many other major central banks around the world. They are either going to cut rates or liquefy the markets, both of which should be poor for currencies. If there’s going to be some type of “currency war”, then it means that “hard money” should continue to be attractive. The ultimate “hard money” is gold.

Technical analysis

The Australian dollar has tried to rally during the day but gave back the gains at the significant 0.7050 level. By turning around and selling off at that level, we have formed a bit of an inverted hammer, which could lead to lower pricing. The 0.70 level underneath should be supportive, just as the 50 day EMA which is painted in red should be. I would not be surprised at all to see buying pressure enter in that area, but if we were to turn back around to break above the top of the inverted hammer, then we will test the downtrend line that defines the trend right now.

Ultimately, a break above that downtrend line would be extraordinarily bullish, because it would slice through the resistance of the day on Monday, but also break above this downtrend line. The 200 day EMA above which is pictured in black is also an area that needs to be cleared for the trend change. If we get that, this market is one that is not only a buying opportunity when that happens, but one that you should hang onto for the long term. The question now is whether or not we are going to make that move. As soon as we do that, the Aussie could become one of the better investments of the year, if not the next few years. Keep in mind that the 0.6850 level below looks very much like the bottom we had seen a few years back.