The Australian dollar had a very strong close to the month, breaking above the 0.70 level. This is an area that has caused the lot of resistance in the past, so it makes sense that we would struggle to continue going higher ahead of the G 20 meetings. More specifically we are waiting to see what happens between the Americans and the Chinese. Quite frankly, if the Americans and the Chinese can come to some type of conclusion or at least make positive statements, this will be the first place I’ll be looking to put money to work.

Keep in mind that a stronger Aussie dollar makes sense considering that the Chinese economy gets a lot of it’s hard commodities out of Australia. Beyond that, we also have the Federal Reserve looking to cut interest rates later this year. If that’s going to be the case it should drive the price of gold higher which tends to have a bit of a “knock on effect” when it comes to the Aussie dollar as well.

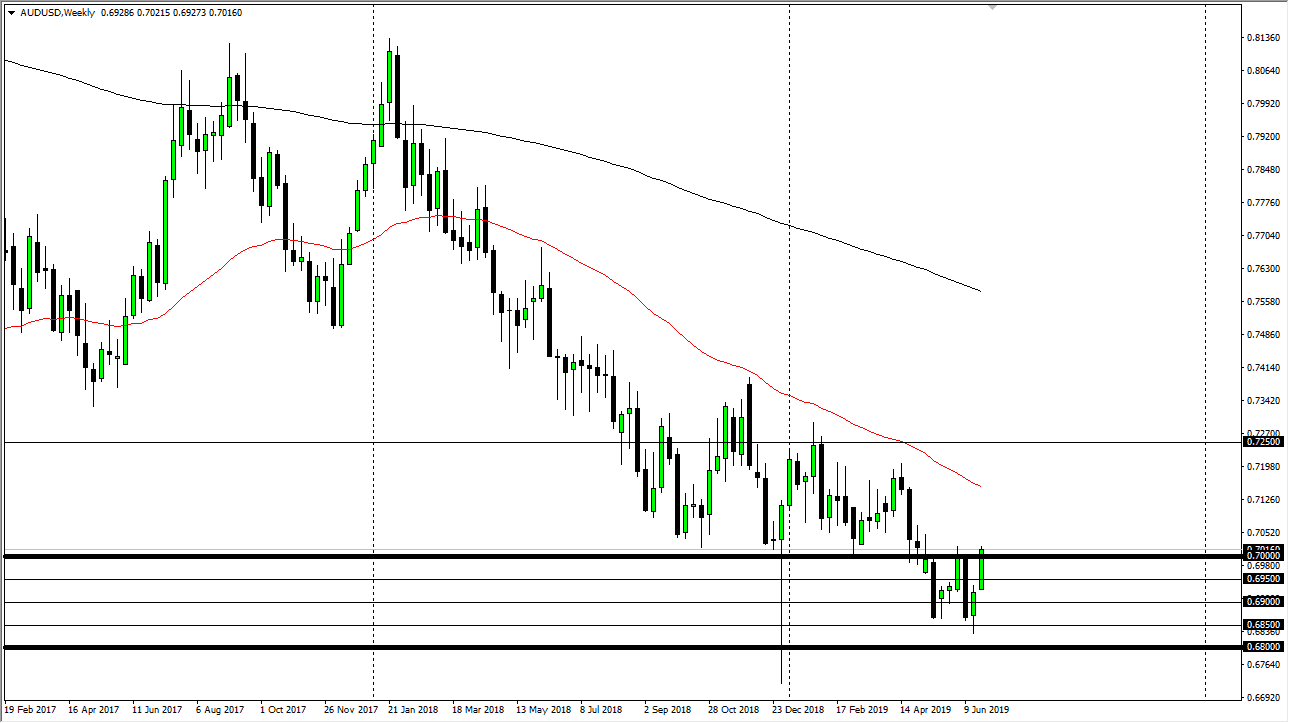

Looking at the technical analysis, we have ended up forming a large “W pattern”, and if we can break above the top of it that’s a very bullish sign. If we do get that break out, it measures for a move towards the 0.7160 area. I think at that point we would probably even continue to go to the 0.7250 level. Looking at the longer-term charts, the area that we just formed the “W pattern” in, was previously massive support band as well. That being said, if the situation between the Americans and the Chinese deteriorate, we could see a massive selloff, perhaps reaching down to the 0.68 handle and below. That being said though, and unless they really blow things up in Osaka, I think we’re going to continue to see buyers come in on short-term dips.