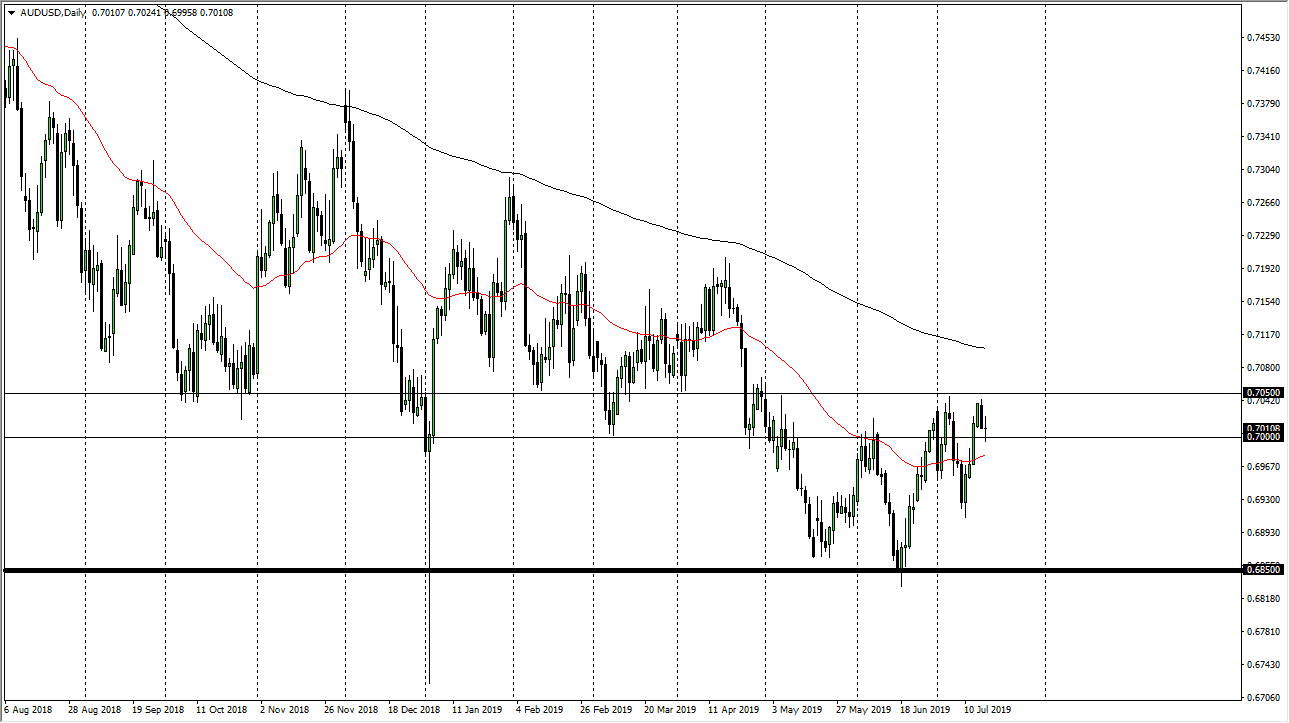

The Australian dollar has gone back and forth during the trading session on Wednesday, reaching down towards the vital 0.70 level before bouncing a bit. That being the case, we have ended up forming a bit of a neutral candle stick, and therefore I think that the market is showing signs of support. I also like the 50 day EMA underneath is starting to turn higher, sitting just below the 0.70 level. Ultimately, this is a market that I think will eventually go looking towards the 0.7050 level that has offered so much resistance. I do think this looks like a bottoming pattern and there are a lot of reasons to suggest that.

Looking at this chart, you can see that we are making “higher lows”, and therefore it looks as if we are trying to build up the necessary momentum to break out. The Australian dollar of course is highly sensitive to the US/China trade talks, which currently seem to be cooling off a bit. Beyond that, we also have the Federal Reserve cutting rates and that of course will continue to put downward pressure on the US dollar. The question isn’t so much as whether or not they are going to cut rates, but by how much and how often?

The 50 day EMA curling higher is a good sign, but we do have the 200 day moving average racing towards that crucial 0.7050 level. If we can clear both of those, then it’s very likely that we are going to be more of a longer-term “buy-and-hold” scenario. I do believe that we are in the process of forming a longer-term bottom, as the 0.68 region has been massively important from a longer-term perspective. We are at historically low levels for the last couple of decades, so it is worth paying attention to those. I do think that the Australian dollar will probably get a bit of a boost from the Gold markets as well, which have been absolutely on fire as of late. At this point, the market is likely to find some type of excuse to break out, so I’m simply looking for a daily close above that 0.7050 level to start putting money to work. Though, we could get the occasional pullback but as long as we don’t make a “lower low”, we are in the technical beginning of an uptrend.