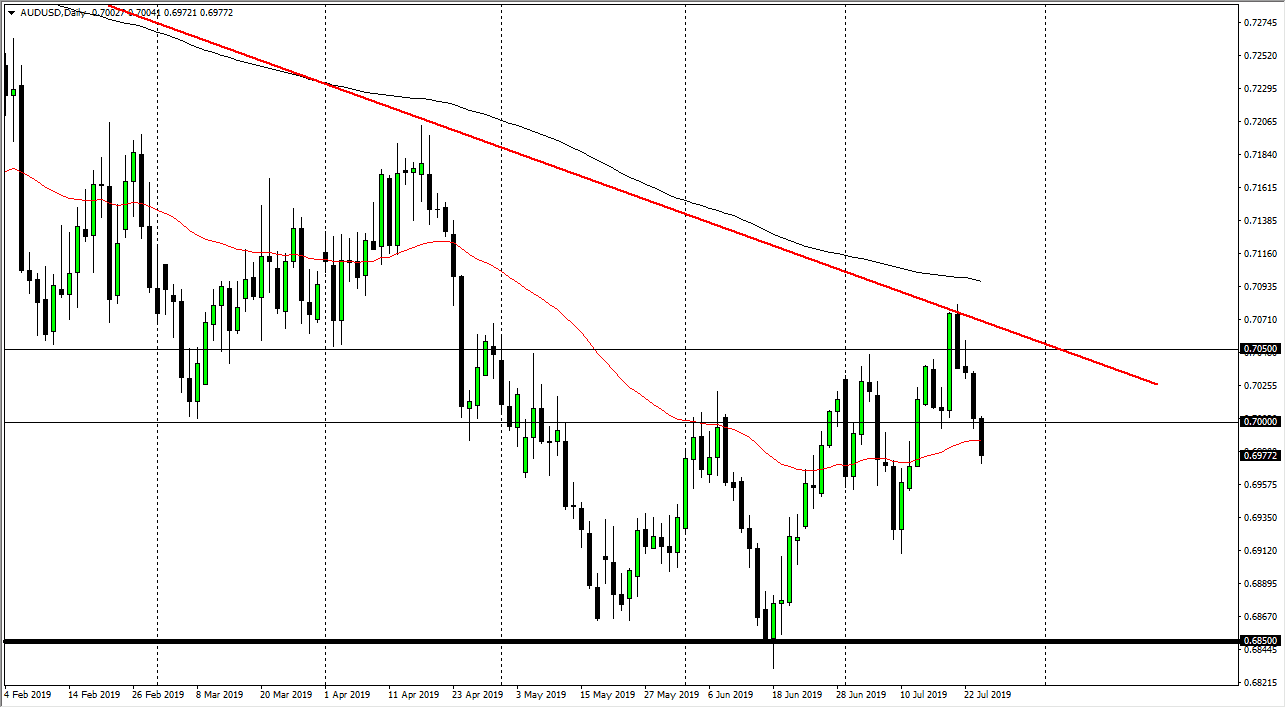

The Australian dollar has broken down again during the trading session on Friday, slicing through the 50 day EMA. That is obviously a negative turn of events, but the market breaking below the 0.70 level as well is also a reason to think that the probably have a little bit more negativity going forward. That being said, if started to see the market roll over again but I do think given enough time we will probably find buyers.

The Australian dollar of course is sensitive to the US/China trade relations, as Australia’s a major supplier of raw materials to the Chinese mainland, both for construction and manufacturing. If there is continued trouble between the Americans and the Chinese, then it makes quite a bit of sense that the market is going to punish the Aussie. However, there is also the possibility that gold will lift the Australian dollar as well. This is a market that continues to show signs of weakness, but ultimately this is the market that also finds the Federal Reserve looking likely to cut interest rates. That being the case, I think that the US dollar is going to continue to struggle overall.

If that’s going to be the case, then the Aussie could be a natural place for buyers to come back. However, we have not seen that but the last couple of days and we have in fact pulled back from that major downtrend line. That major downtrend line is a major problem for buyers, and it’s not until we break above there that we can get a longer-term move to the upside. Looking at this chart, we could very well go lower as I don’t see any change in attitude of the last couple of days. I think at this point it’s likely that the Aussie is going to continue to struggle, although maybe not break down completely. I think we will bounce around but keep an eye on that trend line, if we can finally break above it then the market could go much higher. At that point it could be a major trend change, and that of course could send the market much higher over the longer-term. I do believe that happens eventually, but when that happens, we just don’t know. Patience will be needed for longer-term traders but short-term traders will probably continue to fade small rallies that show signs of exhaustion.