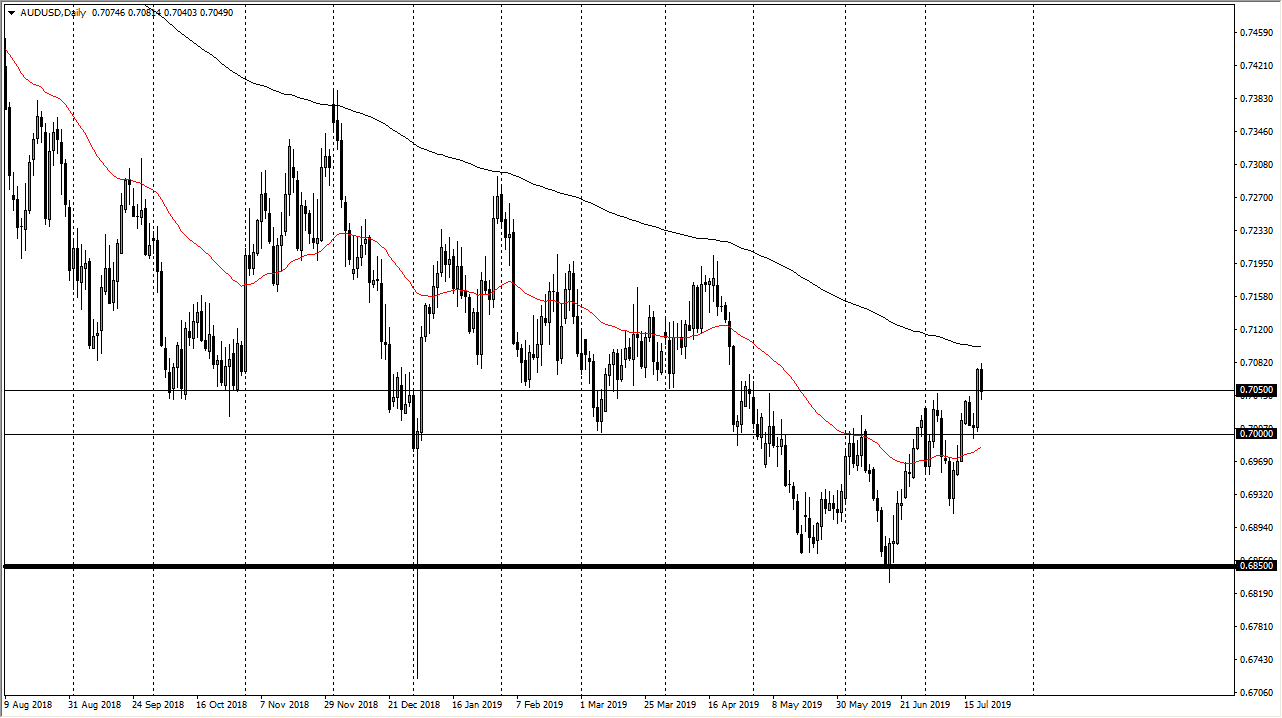

The Australian dollar has fallen a bit during the trading session on Friday, reaching down towards the 0.7050 level. This is a market that has been very resistive as of late, running from the 0.70 level to the 0.7050 level. That is an area of significant resistance being broken, so any time that happens you obviously need to pay quite a bit of attention.

Pullbacks make sense as well, as we had burst through so much selling pressure. Now that we have pulled back to the 0.7050 level, it’s likely that we will find buyers, and we are in fact doing exactly that at the end of the day. I believe that it’s only a matter of time before the market takes off to the upside, as the Aussie has made a significant move. The 200 day EMA is just above, which of course could offer a bit of resistance. However, if we break above the 200 day EMA, that will be the last long-term signal to keep this market down.

Looking at the chart, it’s clear to see that we have made a series of “higher lows”, so having said that it’s likely that the buyers are starting to become a bit more aggressive based upon price action. The Australian dollar is of course sensitive to the gold market, and as a result of the bullish pressure that we have seen in the gold market, the Australian dollar has come back into favor. Beyond that, the Federal Reserve is on the other side of this trade looking to cut interest rates, so that of course should drive down the value of the US dollar as well. This is a bit of a feedback loop, meaning that the US dollar falling continues to push the gold market higher, while the gold market continues to push the Australian dollar higher.

All that being said, it’s likely that the market will continue to find plenty of interest due to the fact that the Australian dollar has been beaten down rather drastically, and then of course the Reserve Bank of Australia is on pause when it comes to easing its monetary policy. Ultimately, this is a market that is trying to turn the corner, and I do think that we may have just formed a longer-term bottoming pattern on the chart suggesting a major trend change.