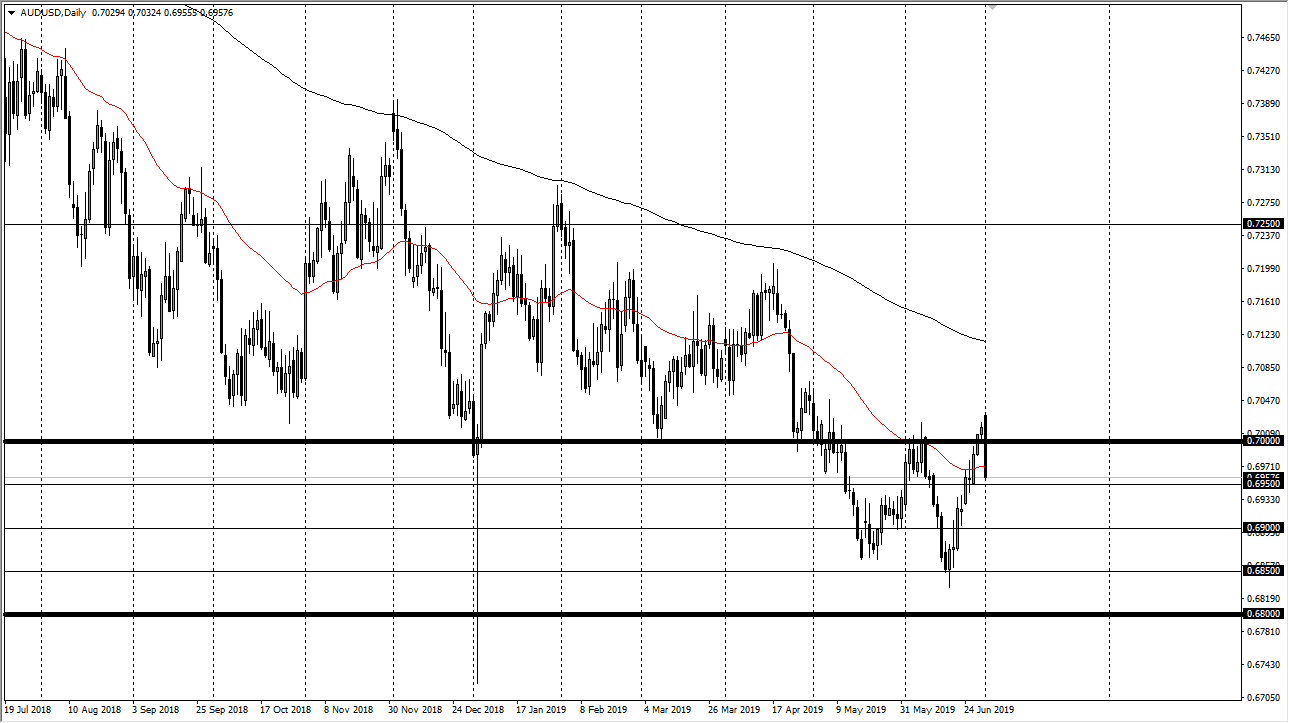

The Australian dollar gapped higher to kick off the trading session on Monday but has since collapsed significantly to form an extraordinarily bearish candle. This is not a good look, and it sets up a potential trading opportunity to the downside again. This shows just how confused this market is, as the Aussie has made a “lower low” followed by a “higher high.” We have since formed a bearish engulfing candlestick, which is a very negative sign. In other words, the market has no idea what to do with itself.

The Australian dollar is highly sensitive to the China situation and considering that the Americans and the Chinese have at least settled down slightly, it is a bit suspicious that the market turned right back around to fall as hard as it has. In fact, we are starting to see the US dollar strengthen around the world. I think it’s because people are starting to look into the details of what was actually settled, and that isn’t much. With that in mind it’s likely that the Aussie will be on the back foot as it is so highly levered to the Chinese economy.

Adding more fuel to the downward fire is that the RBA is expected to cut interest rates rather soon, and as a result that will weigh upon the Aussie overall. Between a stagnation of US/China trade relations and of course interest rate cuts, there isn’t much reason to think that the Australian dollar can take off to the upside. Granted, when I look at this chart I can make an argument for some type of bottoming pattern trying to form right now, especially as we can see a “W pattern” here, but the reality is that the candle stick from the Monday session changes a lot. Every once in a while you get a very impulsive candle stick that is engulfing and we have just formed this. That tells us that attitudes are changing again, so when I look at this chart I recognize that the 50 pip rule comes back into play. This market has been moving every 50 pips or so, and at this point a break below the 0.6950 level could open the door for another 50 pips, perhaps even 100 after that.

All things being equal though, if we were to turn around and wipe out the candle stick for Monday, that would be an extraordinarily bullish sign and would in fact confirm a bit of a “W pattern.” That being said, I don’t expect that to happen and I expect more bearish pressure to come.