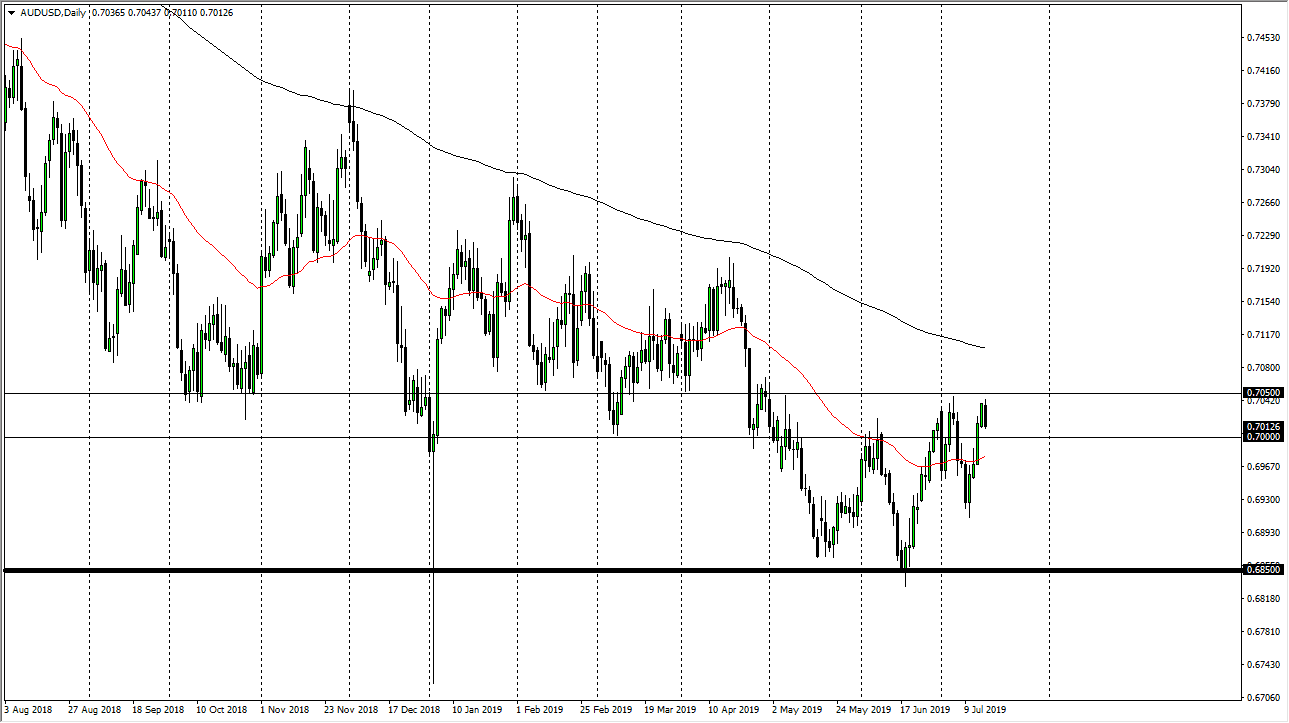

The Australian dollar tried to rally initially during the trading session on Tuesday but did not break above the crucial 0.7050 level. The market has seen a lot of selling pressure in that area, and of course the Tuesday session is negative. Unfortunately, we have not gotten that break out that could lead to a nice long term trade but I have no interest in trying to fight what I believe is an impending breakout. There are a lot of reasons to think that we could break out, not the least of which of course is going to be the United States getting ready to cut interest rates. If that’s the case, then it should continue to put downward pressure on the US dollar.

The Australian dollar, back to buy one of the largest interest rates and that G 10 does fairly well in these types of situations. That being said though, the Australian interest rate is 1%, the lowest it’s ever been from recent memory. That being the case, it does give you an opportunity to earn a little bit of differential on a sizable trade, but for most retail traders you just simply follow whatever is going on with the institutions.

Keep in mind that the Reserve Bank of Australia has recently paused a bit when it comes to interest rate cuts, so that gives us a little bit of bullish pressure in the Australian dollar as well. Beyond that, the Aussie is highly sensitive to the Chinese economy which had posted lower numbers recently, but better than expected. With that being the case, it makes sense that the Aussie also has another reason to rally. If we can get some type of good news coming out of the US/China trade relations, that of course will make this market skyrocket. Obviously, the exact opposite can happen but when looking at a longer-term chart, it’s easy to see the that we are in an area that has offered longer-term support in the past and I think we are trying to revisit that attitude. The market has recently made a “higher low”, so that of course is a bullish sign as well. I do believe in buying dips, but I also recognize that you need to be very cautious with your trade size, as you could see a sudden turn around based upon fear.