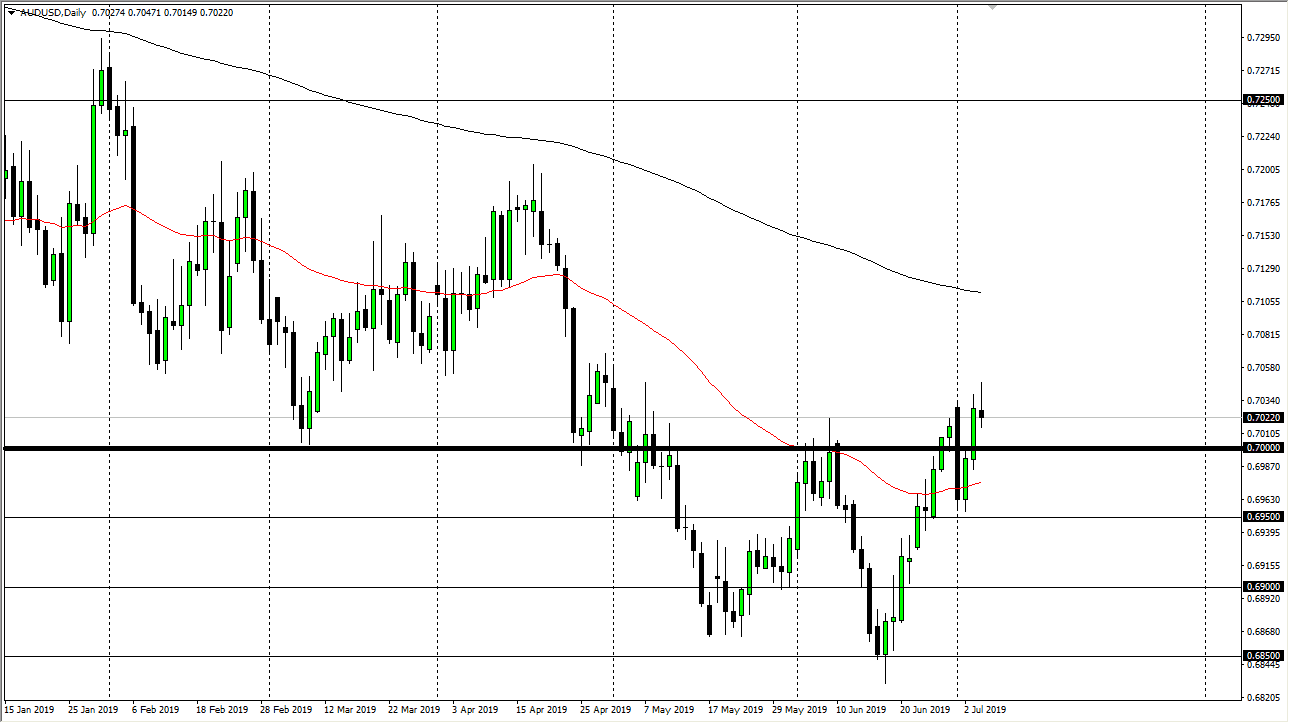

The Australian dollar initially tried to rally during the quiet Thursday session as the Independence Day volume would have allowed the market to move around a bit more than necessary. That being the case, we started to see resistance hold, and ended up forming a bit of a shooting star. That of course is a negative sign, but we have recently made a “higher low”, and it suggests that we are trying to break out to the upside given enough time.

The candlestick that formed during the trading session suggests that we need to pullback but I think that pullback will end up being a nice opportunity as things are starting to line up for the Australian dollar in general. Keep in mind that the US/China trade situation calming down does help the Aussie as it is so highly levered to the Chinese economy. Beyond that, we have the Federal Reserve looking to cut interest rates, so that of course should drive down the value of the dollar in general.

When you look at ultra-longer-term charts, the area just below the 0.70 level has been supportive more than once. I think we are in the process of forming a bottoming pattern, perhaps even the “W pattern”, as a little bit of observation can make out. All things being equal though, another thing that you should pay attention to is that the 50 day EMA has rallied slightly and started to turn higher as well. Longer-term traders will pay attention to this but we still have the 200 day EMA which is pictured in black above.

On a breakout above the 0.7050 area, the market could very well go looking towards the 200 day EMA, possibly even the 0.72 level. To the downside, I do think that the 50 day EMA should offer a bit of support so I’ll be watching the reaction after the jobs number in order to pick up value. This will be especially true if we can form some type of hammer on an hourly chart or something along the lines of that. I have no interest in shorting this pair, at least not until we break down below the 0.6950 level on a daily close. The US dollar is on its back foot as of late, and that should translate over here as well, especially if we can avoid headlines coming out of the US/China trade tensions.