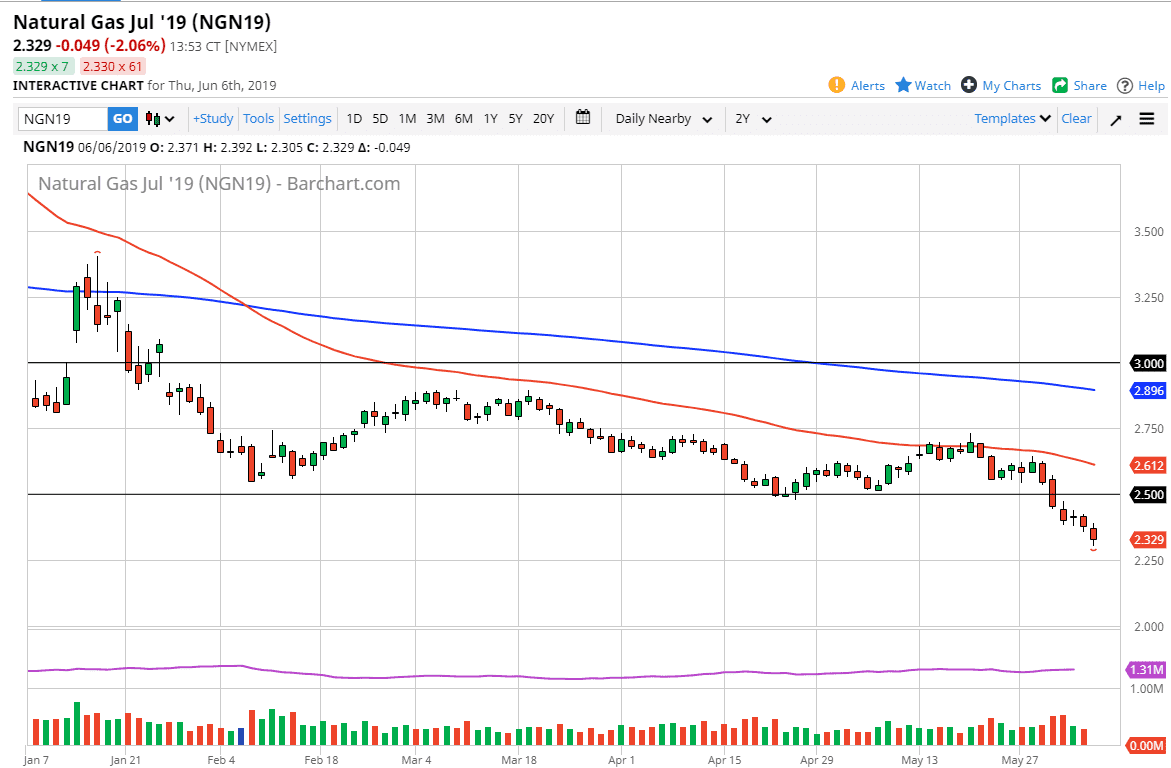

WTI Crude Oil

The WTI Crude Oil market rallied a bit during the trading session on Thursday, showing signs of life at the 61.8% Fibonacci retracement level. That being the case, we have broken above the $52.50 level, and as a result it’s possible that we could even bounce to the $55 level. However, with it being the jobs number Friday, just about anything is possible at this point. The $50 level underneath should offer support though, so short-term pullbacks might be buying opportunities. A breakdown below that level would probably unwind this market rather drastically. In general, I think we are oversold so perhaps we are trying to find a bit of a base now. A strong jobs number could turn this thing around as well, as perhaps it could show that there will be more demand.

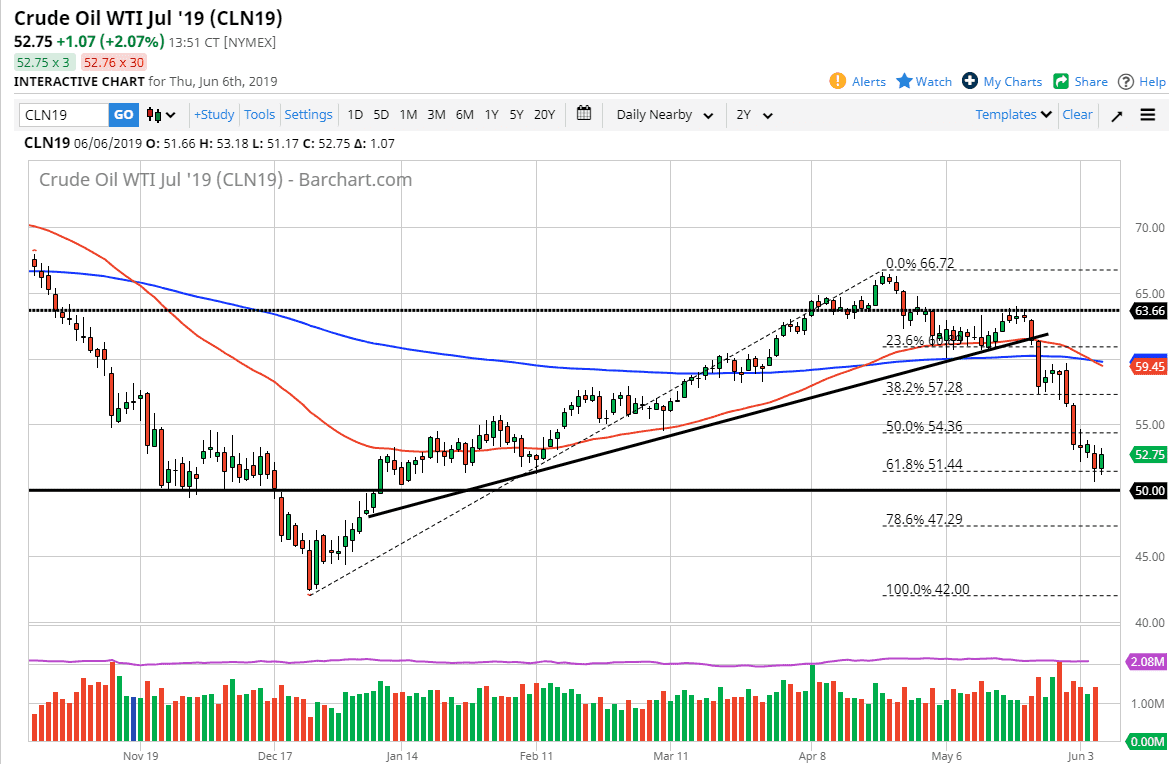

Natural Gas

Natural gas markets fell a bit during the trading session on Thursday, as we have now dropped below the $2.35 level. There is a lot of resistance above, and quite frankly we are starting to get a bit overextended to the downside. If we bounce from here, and I think it is likely that we do sooner or later, I anticipate seeing the $2.50 level as massive resistance. Signs of exhaustion closer to that level will probably be an opportunity to take advantage of a major downtrend line. At this point, I suspect that the $2.25 level underneath will probably be an initial target, but we may drop as low as $2.00 after that. Natural gas will continue to see a lot of negativity due to the fact that there is a serious lack of demand for heating in the northern hemisphere.