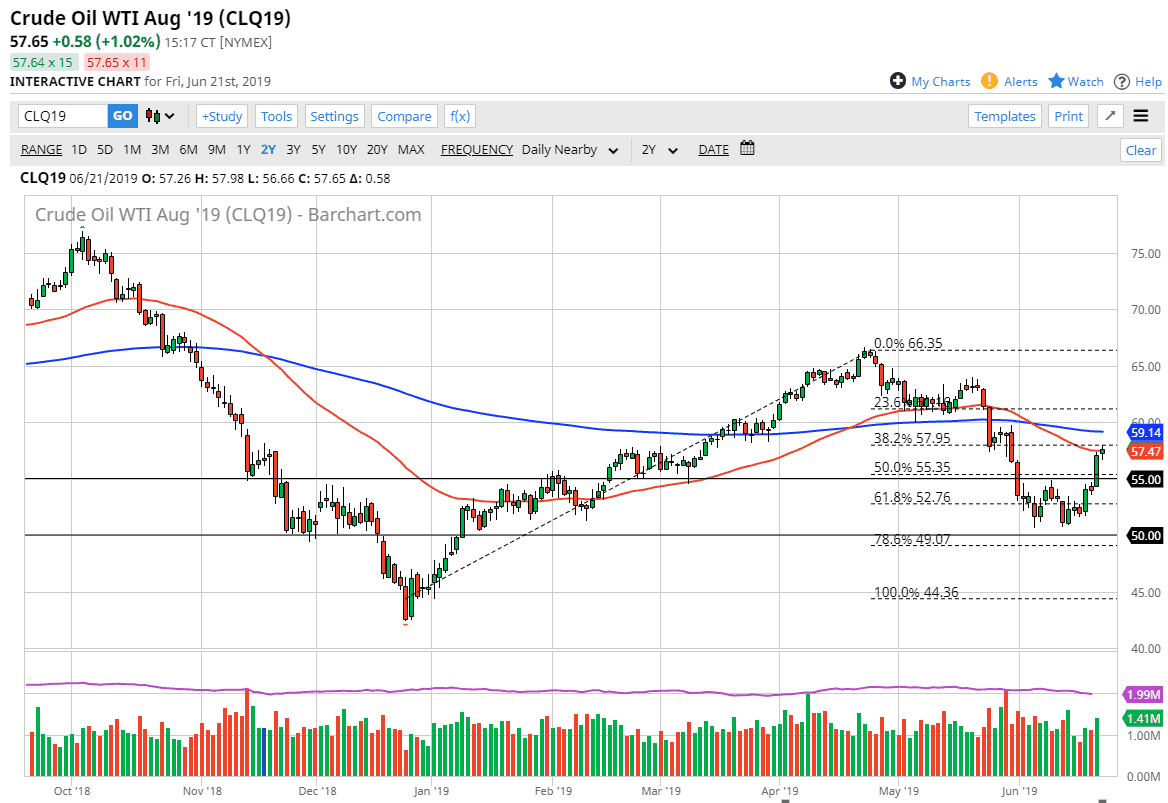

WTI Crude Oil

The WTI Crude Oil market went back and forth during trading on Friday, as we are hovering around the 50 day EMA. This makes a lot of sense, because we gained roughly 6% the day before, so obviously exhaustion would settle in. Beyond that, we also have a cluster of resistance just above so I think that a short-term pullback is likely. Pulling back from here, I think should offer plenty of value especially near the $55 level which should now be massive support as it was significant resistance. The measured “W pattern” underneath calls for a move to the $59 level, but we don’t have to do it right away. Look for value on pullbacks and take advantage of them as crude oil has certainly turned around.

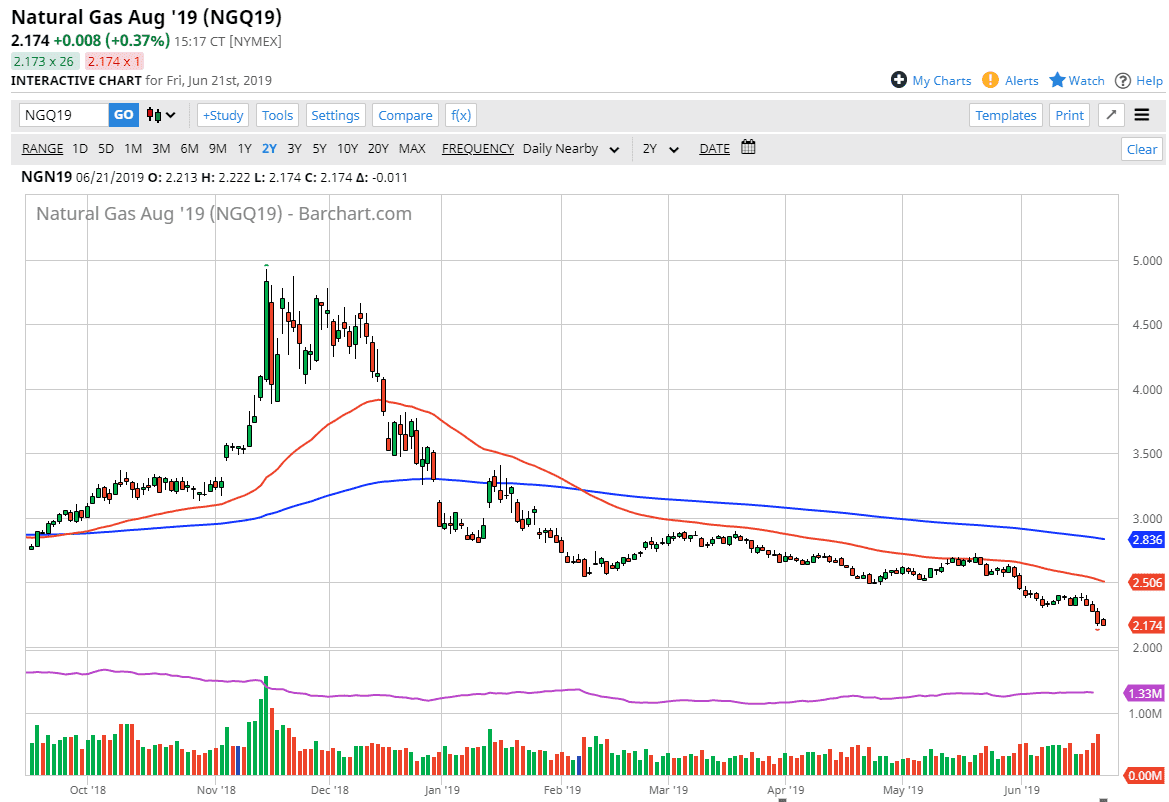

Natural Gas

Natural gas markets cannot catch a break at this point. This is the wrong time of year for natural gas to be bullish so I continue to sell regardless. I look for short-term rallies to take advantage of and although Friday was a little bit negative, the reality was that the stability of the range tells me that we are probably looking for an opportunity to start shorting above at the $2.25 level, the $2.40 level, and of course the $2.50 level where the 50 day EMA is. In fact, I think that natural gas is to be sold going forward until about November when we start to focus on colder temperatures in the Northern Hemisphere.

The $2.00 level below is a major support level from a psychological and historical aspect, so at this point I think it’s only a matter time before we would bounce from that level. That being said, it will also attract traders to short towards that level.