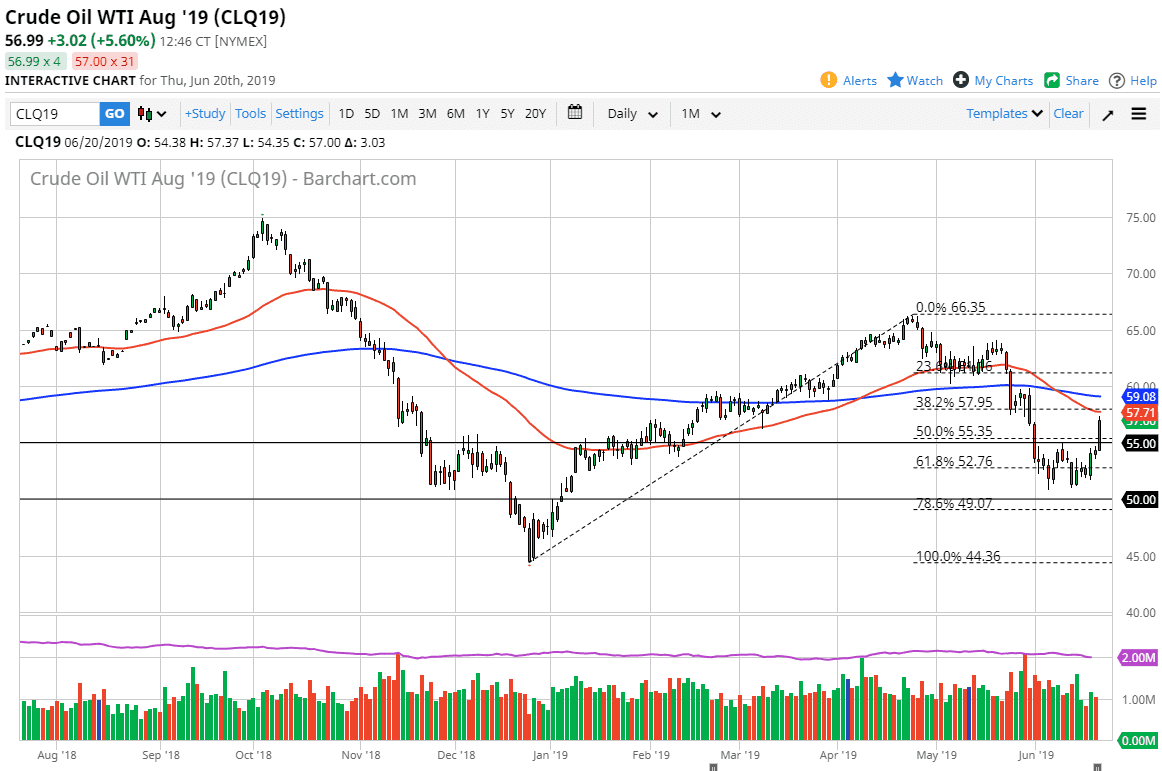

WTI Crude Oil

The WTI Crude Oil market exploded to the upside, breaking above the vital $55 level that I had talked about yesterday. We had got about three days ahead of ourselves from what I see, so it’s very likely that the 50 day EMA could cause this market to pullback a bit. Ultimately though, I think this pullback will probably offer a nice buying opportunity as you can see a “W pattern” that has been broken above, and measures for a move to the $59 level. Coincidentally, that 200 day EMA is right at the $59 level as well, so that doesn’t hurt either. I think the market could remain a bit elevated because we are concerned about the situation between the Americans and the Iranians possibly making crude oil a bit unstable. No interest in shorting this market anytime soon, as the $55 level should offer a bit of a floor.

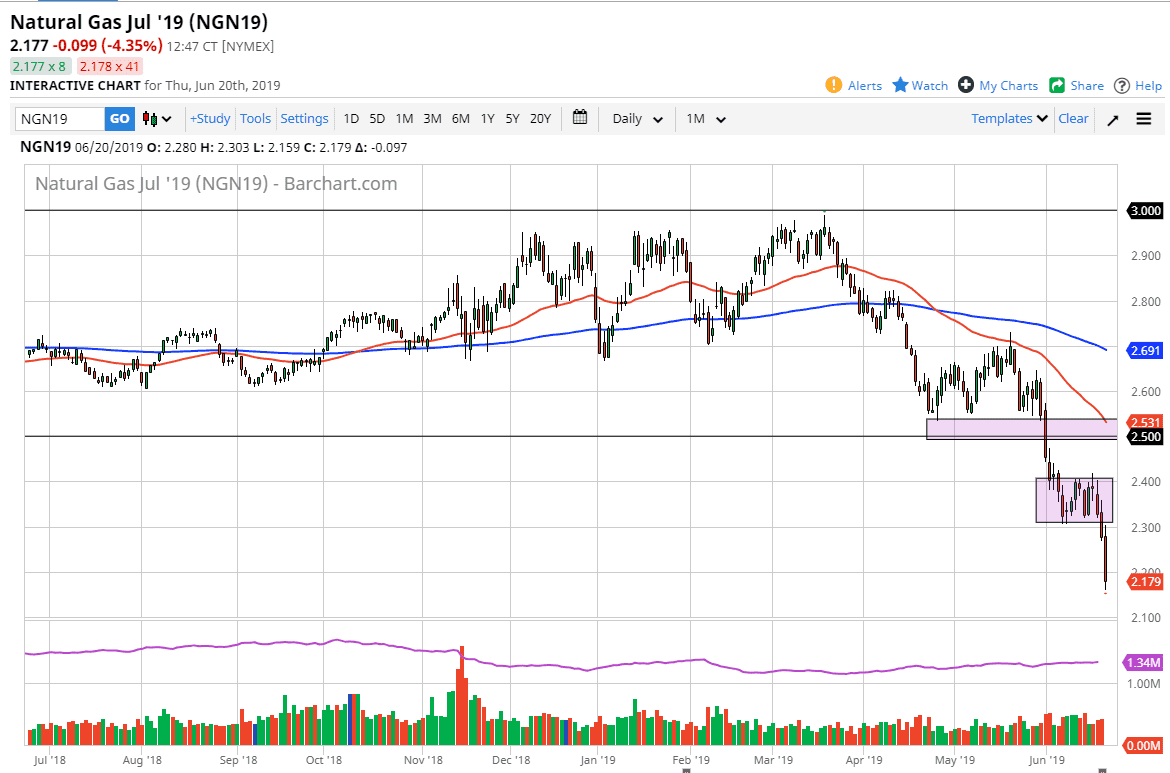

Natural Gas

Natural gas markets absolutely collapsed during the trading session on Thursday, breaking below the vital $2.30 level and drifting down towards the $2.26 level after that. This market is so oversold that I don’t really know what to do with it other than to wait for rallies to show signs of exhaustion that I can sell into. This is a market that doesn’t typically do well this time of year anyway, but the fact that there are a lot of concerns about global growth signifies or perhaps demand might drop beyond the usual heating or cooling situation.

Looking forward I think the only thing you can do is sell rallies that head towards the $2.30 level and the $2.40 level. Exhaustive candles are what I would look for on short-term charts such as shooting stars. To the downside I believe that we are heading towards the $2.00 level eventually.