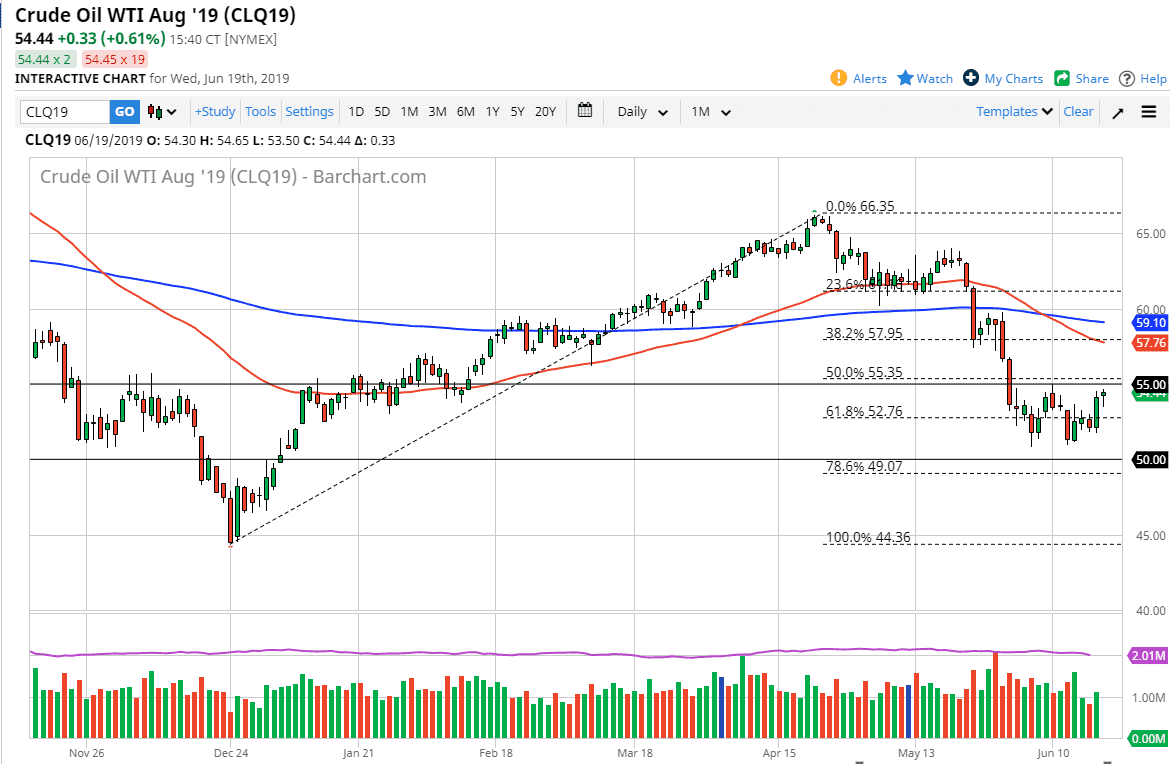

WTI Crude Oil

The WTI Crude Oil market broke down a bit during the trading session initially on Wednesday but turned around of form a bit of a hammer. That hammer sits just below a significant resistance barrier in the form of $55. That is the top of a larger consolidation area that extends from the $50 level on the bottom, to the mentioned $55 level. If we can break above there, the market should then go looking towards the $59 level based upon the “W pattern” that has formed. At this point, as soon as we can break above the $55 level, I’d be a buyer of this market as it looks like we have bottomed at roughly the 61.8% Fibonacci retracement level. If we are going to have a saw for the US dollar, and of course more stimulus coming out of the Federal Reserve and the ECB, as well as China, then it makes sense that crude oil will continue to get a bit of a boost.

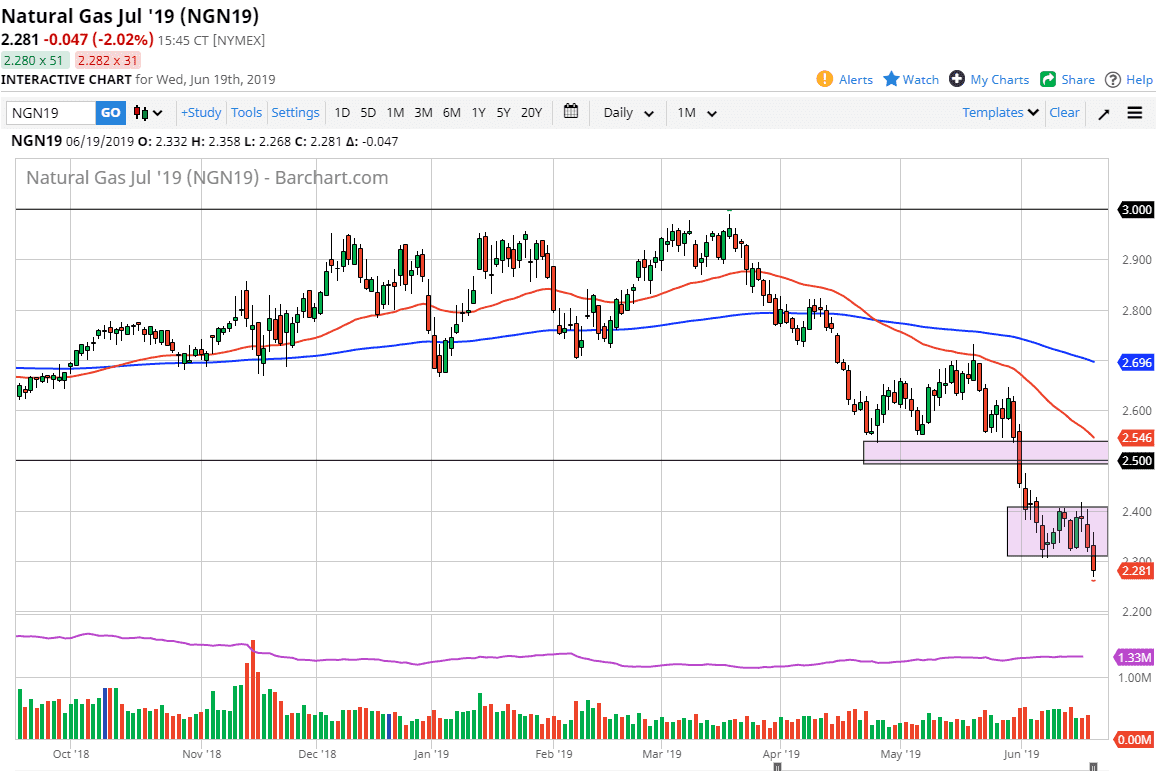

Natural Gas

Natural gas markets broke down below the $2.30 level, after initially trying to rally during the trading session. By breaking below the $2.30 level, it looks as if we are probably likely to test the $2.25 level. At this point, we have entered another leg lower, in a market that simply cannot hold itself up. Overall, this is a market that has been bearish for quite some time, and although I think that it is a little overextended, the reality is that it’s difficult to find a situation where you can be bullish, so at this point it’s only a matter of time before we reach towards much lower levels. In fact, I have no interest in the buying of this market, at least not until we get to the fall season.