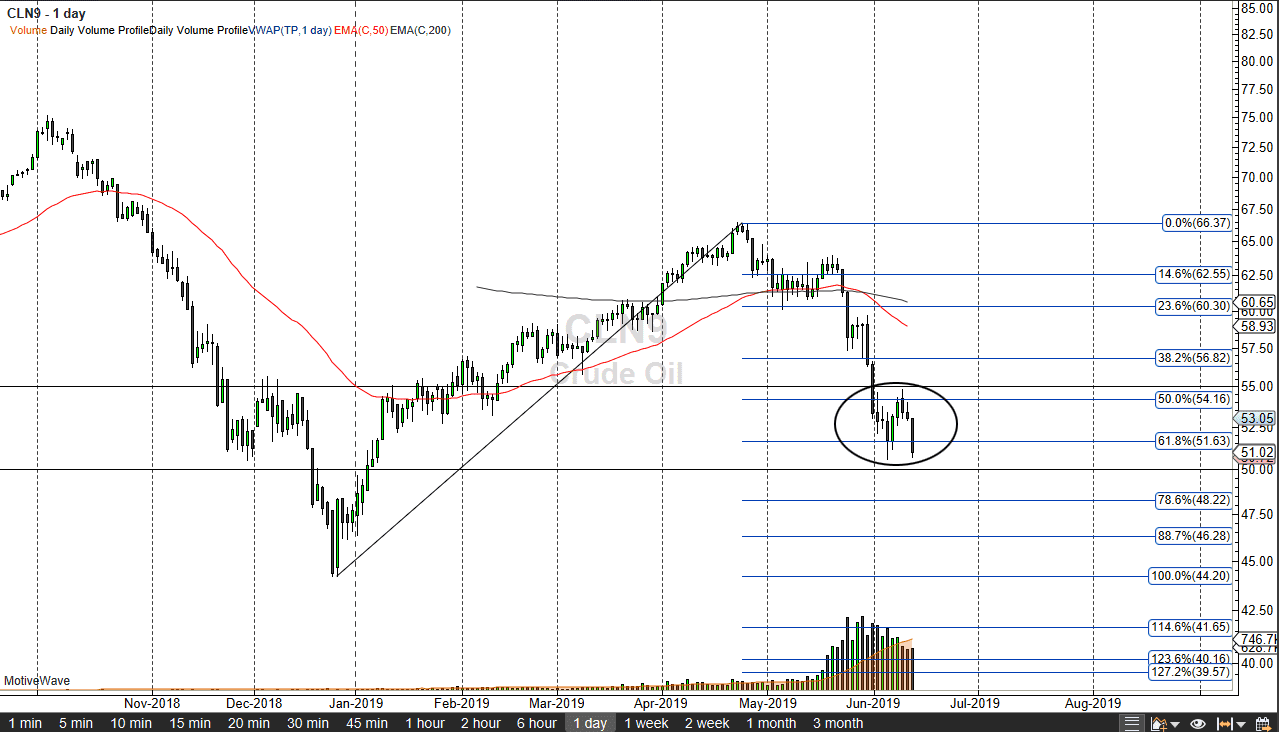

WTI Crude Oil

The WTI Crude Oil market broke down rather significantly during the trading session in what would have been one of the more volatile days we’ve seen recently. We initially when higher, but then broke down at the $53 level during the announcement of a more bearish than anticipated inventory number. Ultimately, we broke down after that and then at the end of the open pit trading session, we had seen a massive amount of selling as well.

Looking at this chart, the most obvious place would be the $50 level to see a lot of support. At this point, it’s very unlikely that the market will simply slice through there, and at this point I think it’s very likely that we will probably simply consolidate between $50 and $55. Looking at this chart, I think we are going to continue to see a lot of volatility. However, if we break down below the $50 level on a daily close, I believe that the market probably drops another $5 over the next several sessions.

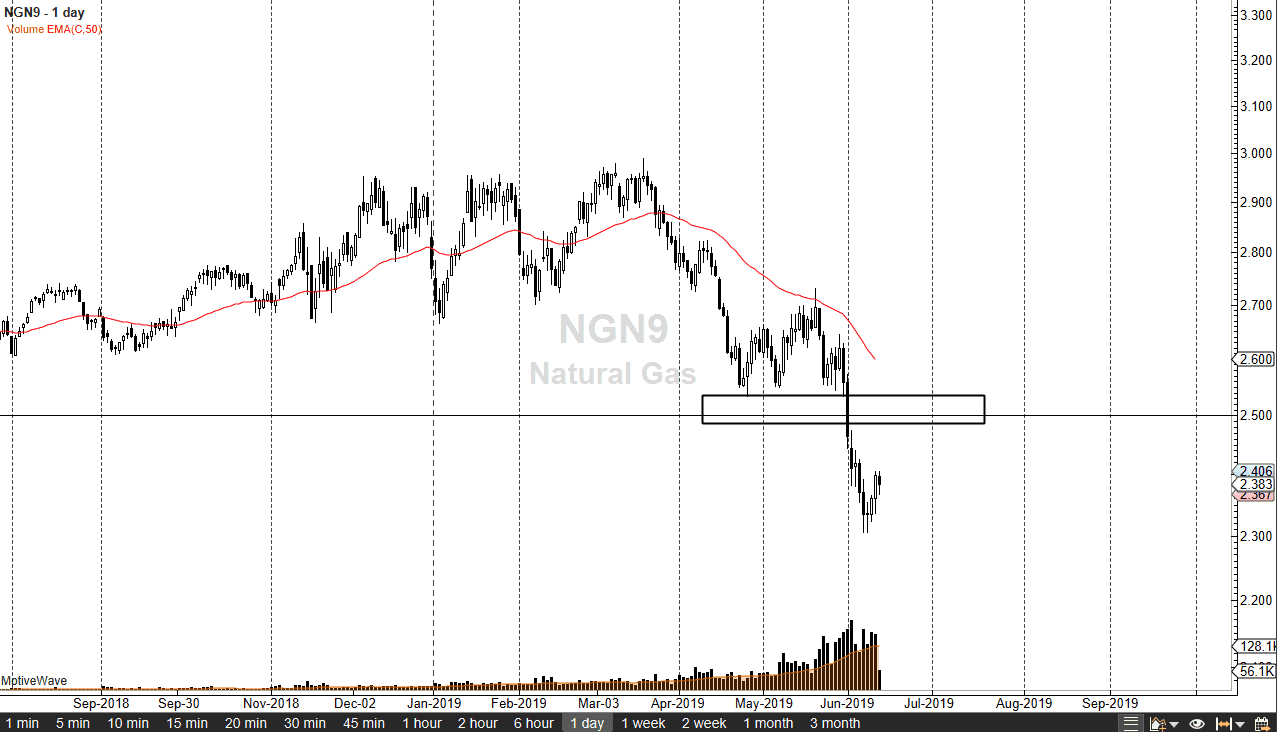

Natural Gas

Natural gas markets continue to look very soft but did recover a bit later in the day. By doing so, it shows a market that is trying to lift itself, but we are so oversold it doesn’t surprise me that we would bounce from here, perhaps reaching towards the $2.50 level. At that point I would not hesitate to start selling. Signs of exhaustion will be jumped on by not only me but plenty of other people. Overall, it’s not time to start buying this market, because the demand won’t be there. However, once we get closer to the Fall we may have an opportunity.