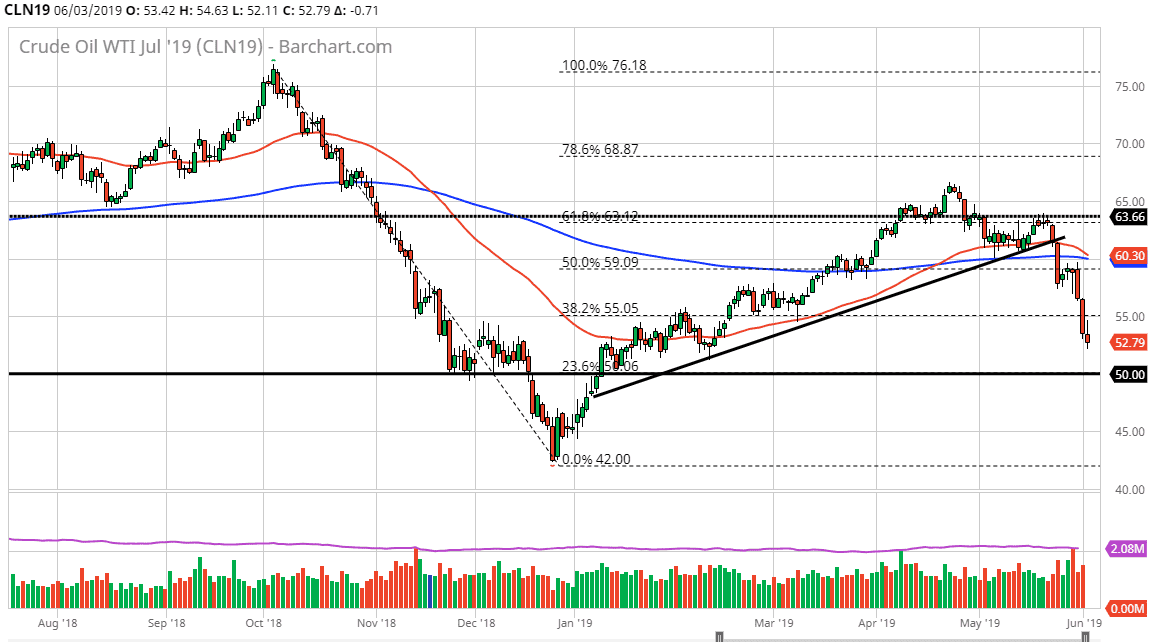

WTI Crude Oil

The WTI Crude Oil market initially tried to drive higher during the trading session on Monday but gave back the gains just below the $55 level to show signs of weakness again. By doing so, it shows just how Barry’s this market has become. The buyers cannot hang onto the gains, and therefore it makes sense that we will continue to see this market drift lower longer term. By doing so, it opens the door to the $50 level, where I would anticipate seeing much more significant support, perhaps enough to cause a significant bounce. Even though the outlook for crude oil is very bearish, the reality is that we are most certainly oversold at this point in time.

However, if we were to break down below the $50 level it’s likely that we could go down to the $47.50 level and then the $45 level. As far as buying is concerned, I don’t have much interest in doing so, and I believe that rallies are to be sold going forward.

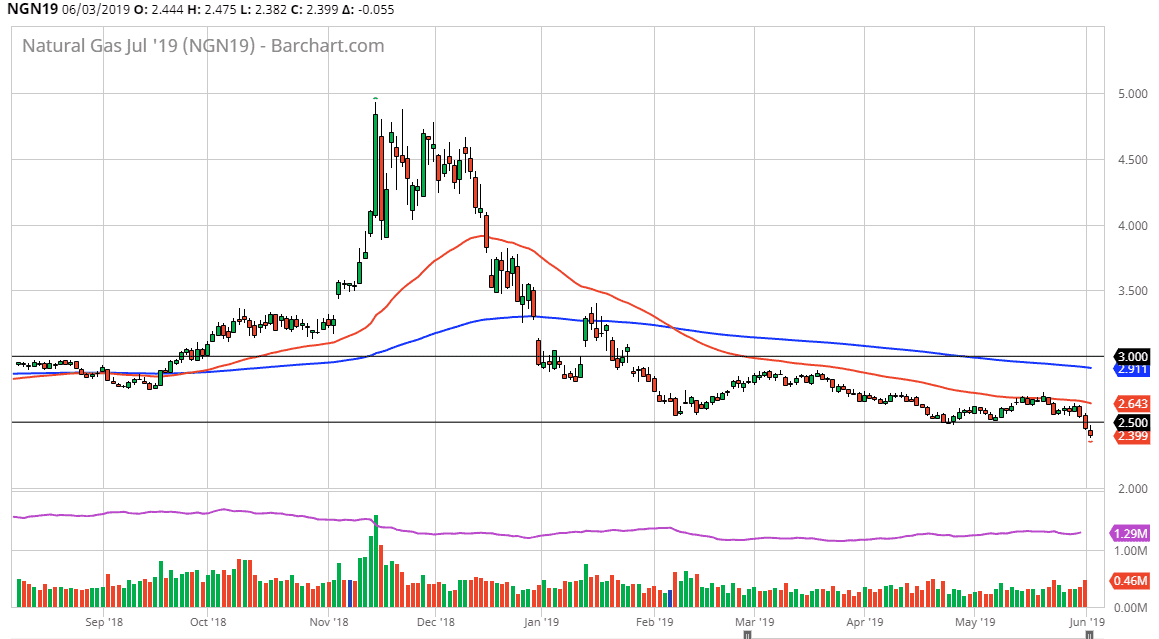

Natural Gas

The natural gas markets fell after initially trying to rally during the trading session on Monday, and then broke down below the $2.50 level again. By doing so, it looks very likely that we are going to continue to go much lower, perhaps reaching down to the $2.25 level. I have no interest in buying this market, and therefore it’s very likely that we will continue to see rallies sold off as we have seen so much in the way of negativity.

Keep in mind that this market is highly sensitive to global demand and with the global outlook looking a bit soft when it comes to growth, it makes sense that we are months away from seeing demand pick up.