The US dollar against the Swedish krona is an excellent currency pair to trade when it comes to the economic and risk appetite situation around the world. The Swedish krona is considered to be a “riskier currency”, as the greenback is considered to be the safest being the world’s reserve currency.

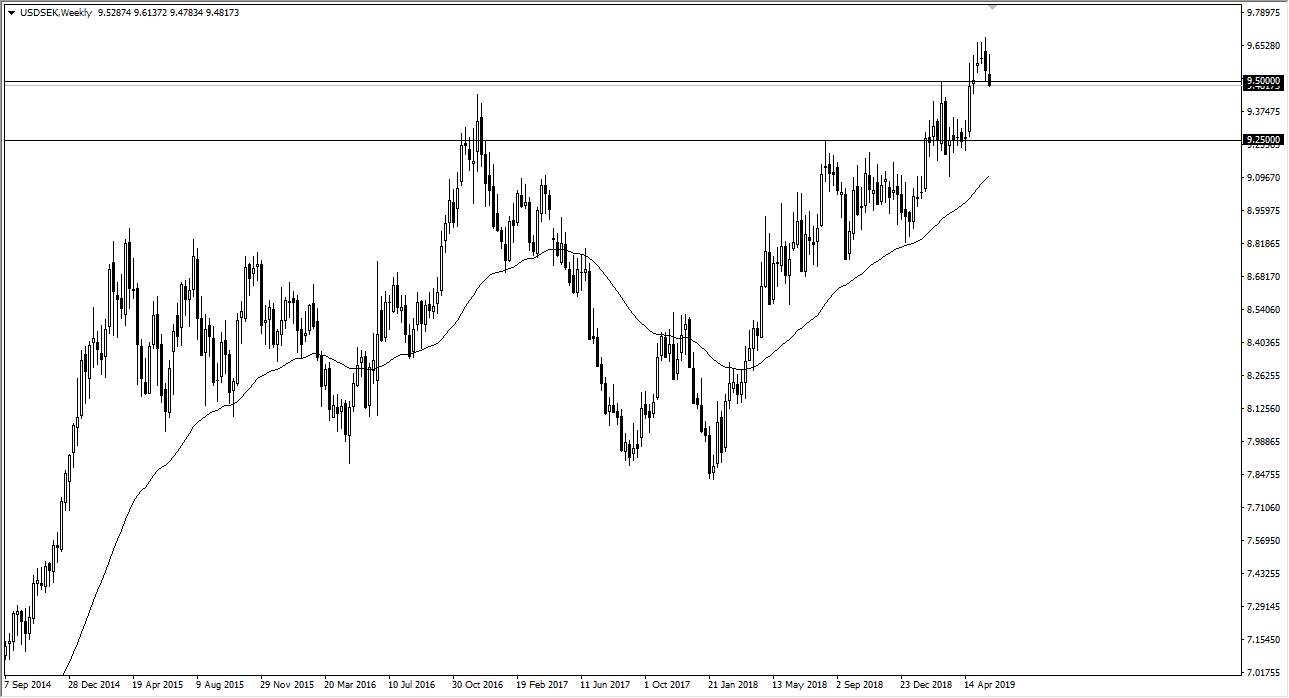

Sweden’s economy is heavily dependent upon technology, which is of course a “risk on” situation. As you can see on the weekly chart, we have been grinding higher for ages, and our most certainly in an uptrend. With that in mind, and the fact that there are a lot of concerns around the world when it comes to global growth and trade wars, it makes sense to think that the market would continue to go higher. That being said, we have rolled over during the last month, so it looks like a pullback is in the cards.

A pullback is probably what we are going to see for the first week or so during the month of June. The question now is where do we start buying again? I anticipate that you will see some type of hammer on the daily chart to give you the opportunity. I believe that the market will probably drop from here, looking for some type of support. With this type of uptrend, we certainly don’t try to sell the market, not when patience will reward you handsomely. I believe that the 9.25 level will probably be massive support, but we could see some type of turnaround a bit higher than they are. All things being equal, it would not surprise me at all to see the USD/SEK pair going towards the 10 handle sometime in the next month or so. I believe this is going to be a very noisy summer, but with a decided negative bias, which of course helps the buyers in this pair.