The US dollar has been going back and forth against the Mexican peso, and this of course is fairly common as the market features two economies that have a lot of cross-border transactions. That being said though, Donald Trump has thrown a monkey wrench into this situation, as he suggested that the Americans will be putting a 5% tariff on Mexican goods until the illegal boarding crossings are curbed. That being the case, with the United States being much more of a stronger economic power, it makes sense that the Mexican peso would get hammered in that scenario.

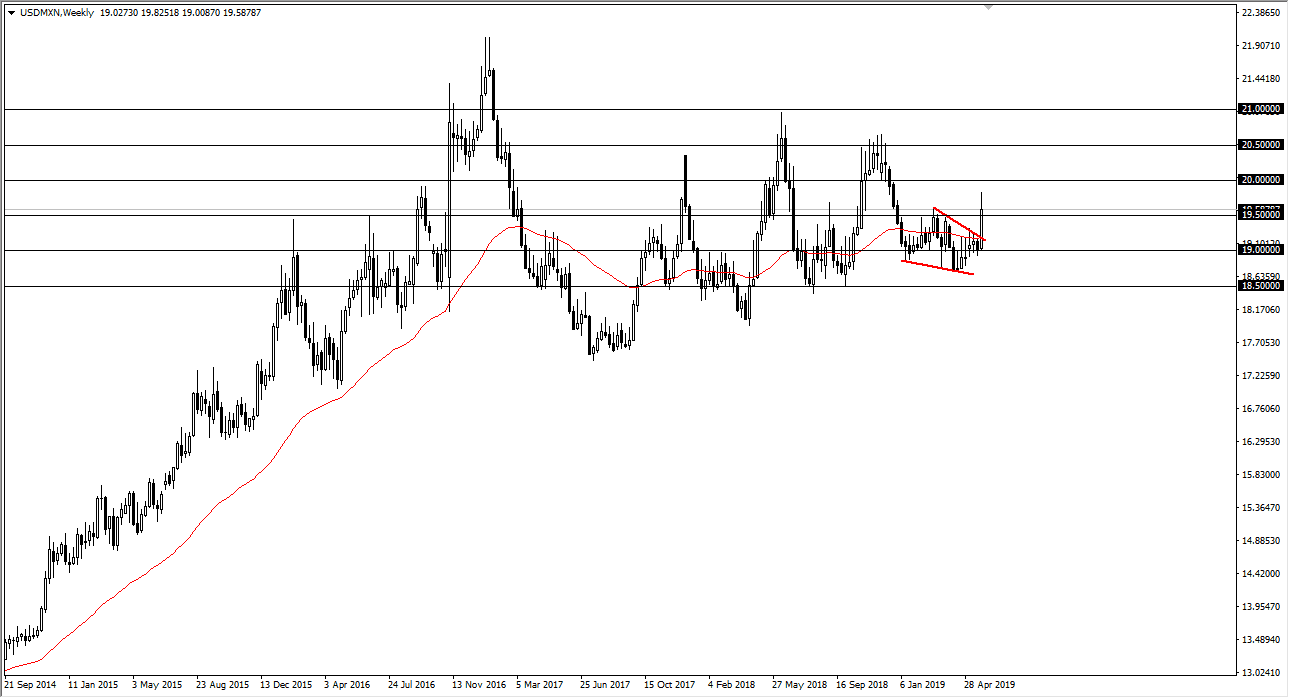

You can see that I had a falling wedge forming on the charts for the last couple of months, and now that we have broken above it, the target would have been the top of that wedge. We essentially hit that in one day on May 31, so now the question is where we go next?

I suspect that we will probably try to go back towards the 20.50 pesos level, which is an area that began significant resistance all the way to the 21 pesos level above. If that happens, we will have simply continued to consolidate in the larger area that I have marked by a series of black lines. That makes sense, because nobody knows what to do next. The US dollar strengthening against the Mexican peso makes a lot of sense in the global context as well, because there are a lot of concerns when it comes to the global marketplace. I believe the month of June is going to be difficult for risk appetite, and therefore currency such as the Mexican peso will probably suffer as a result. While I do believe that Donald Trump walked back these comments, I don’t think it’s going to be enough to stem the “risk off” trade that almost certainly will be coming.