The US dollar has gone back and forth several days in a row against the Mexican peso, as we have had a lot of different things going back and forth showing both bullish and bearish convergence when it comes to risk appetite and some of the drivers behind the Mexican peso as well.

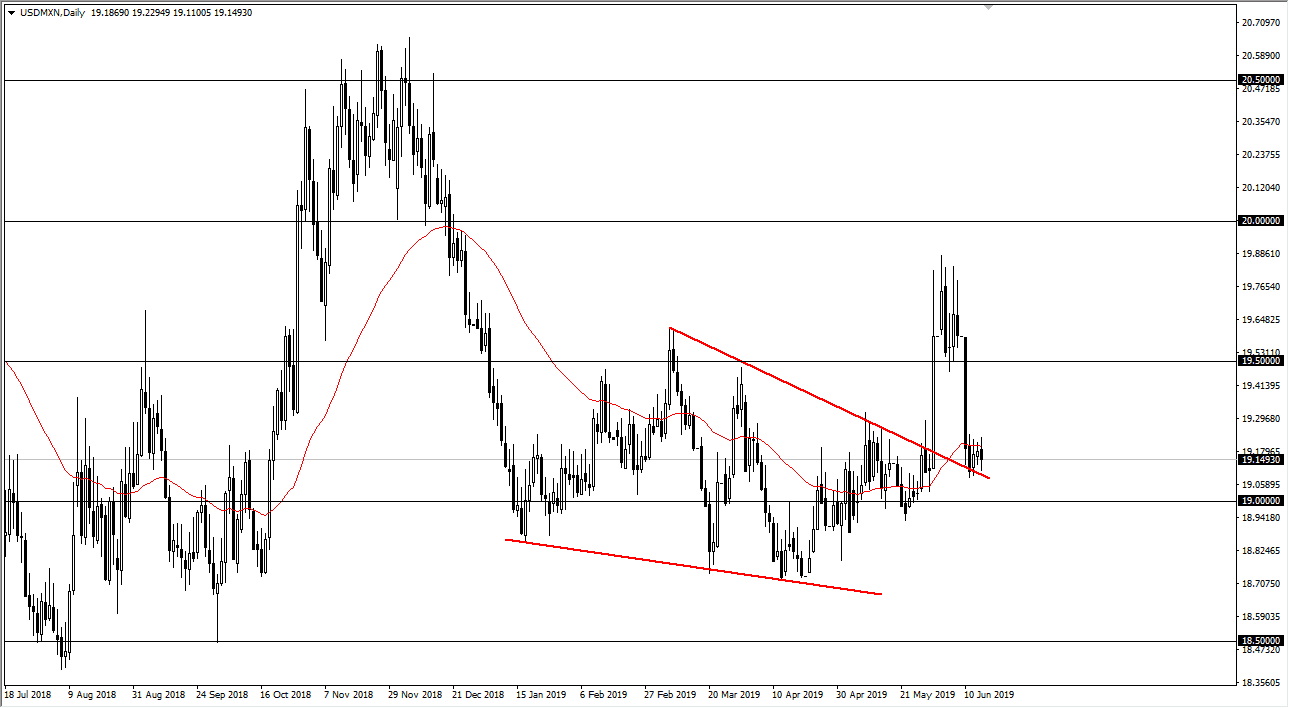

The pair has pulled back to the top of the falling wedge that I had talked about previously, and in fact has also broken through the 50 day EMA. With that being the case, I feel as if the market is essentially trapped between two important levels. As we have gone sideways for three days, I find it interesting because while oil markets have been on fire, the Mexican peso hasn’t followed. Quite often the Mexican peso will be influenced by accrued as there is so many Mexican oil rigs in the Gulf of Mexico.

That being said, I think we are at an area that will offer plenty of support and I think that this area extends down to the 19 level. If we did break down below there, that would be rather negative for the overall trend, perhaps sending the market down to the 18.70 pesos level. The alternate scenario is that we break above the highs of the last four days and then simply blow out a lot of selling pressure. If we do that, then it’s likely that we will go to the 19.50 pesos level. That obviously would be very bullish for the US dollar is very bearish for the Mexican peso, which is probably more of a “risk off” trade than anything else. However there are a multitude of factors going on so it’s probably best to ignore the noise about the tariffs involving the United States and Mexico and focus more on these technical levels that I have mentioned.