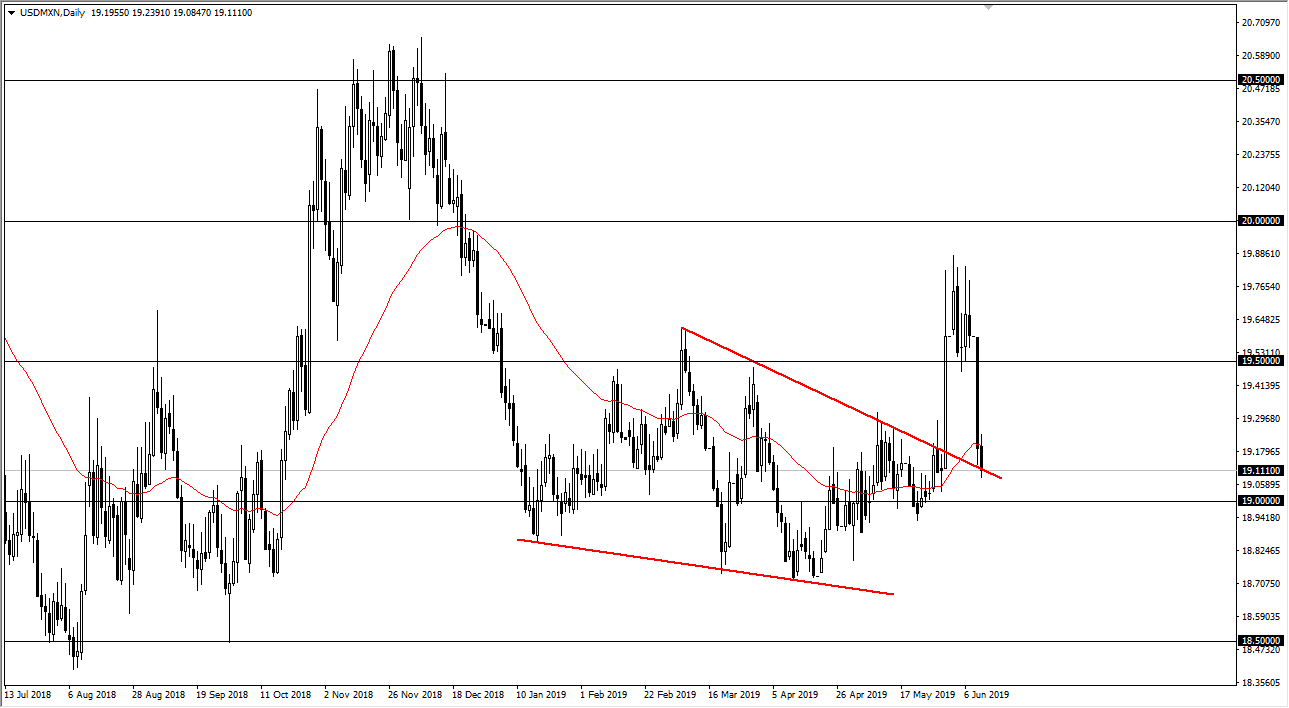

The US dollar initially tried to rally against the Mexican peso, breaking above the 50 day EMA at the open. However, we rolled over again and broke down below the bottom of the previous trading session, which of course was horrific for this pair. This makes sense, because quite frankly the Mexican peso got a bit beaten down because of the potential trade tariffs. That being said, we have made a “round trip” to the top of the falling wedge that formed, hitting the target and then rolling over to the beginning of the breakout again.

That being the case, we have an interesting set up when it comes to trading the Mexican peso, because we are just above the crucial 19 pesos level, and of course that previous downtrend line. Ultimately, this is a market that should see plenty of support in this area, so I think we will probably bounce given enough time, and it certainly looks as if we are starting to see a bit of a “risk off” attitude late in the trading session on Tuesday. If that’s going to be the case, then it makes a lot of sense that we would see the US dollar strengthen, as treasury markets are starting to turn around again.

If we do bounce from here, it’s very likely that we could go looking towards the 19.50 pesos level, an area that has attracted a lot of attention in both directions. The alternate scenario is that we break down significantly and close on the daily candle stick below the 19 pesos level, which could open up a move down to 18.70 pesos. That being said though, things are starting to come together for more of a “risk off move”, so that will probably coincide with another bounce.