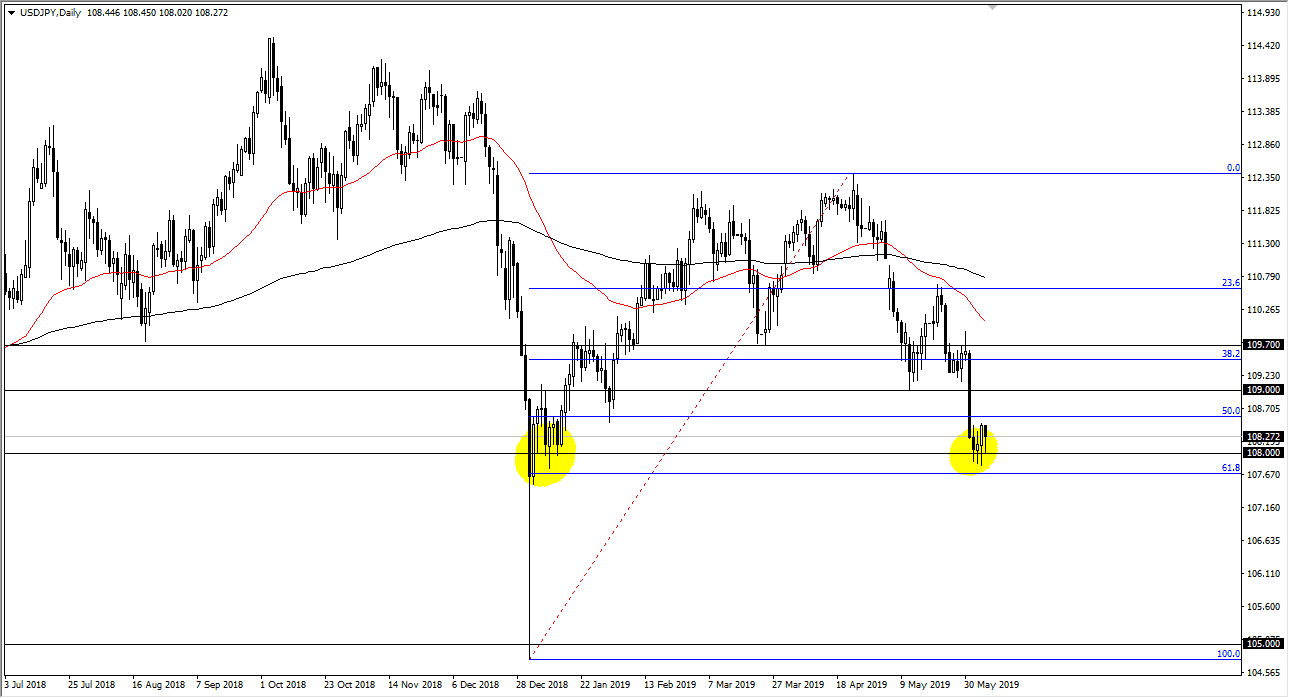

USD/JPY

The US dollar fell initially against the Japanese yen during trading on Thursday but did recover a bit to form a hammer. This of course is a good sign, and it shows that there is a lot of resiliency underneath. In fact, this could be the market trying to tell you what it will do given enough time. We are at a major support level, and the fact that we can’t break through it tells us a lot. However, Friday is a significant event as we get the jobs number coming out of the United States. Remember, this pair is extraordinarily sensitive to the jobs number, so expect a lot of volatility around 830 in the morning New York time.

If we can break above the highs from the Wednesday session, it’s very likely that this pair goes looking towards the ¥109 level. However, if we break down below the lows of the Wednesday session and perhaps even the ¥107.70 level, we will have cleared the 61.8% Fibonacci retracement level, opening up the door for a bigger sell off down to the ¥105 level.

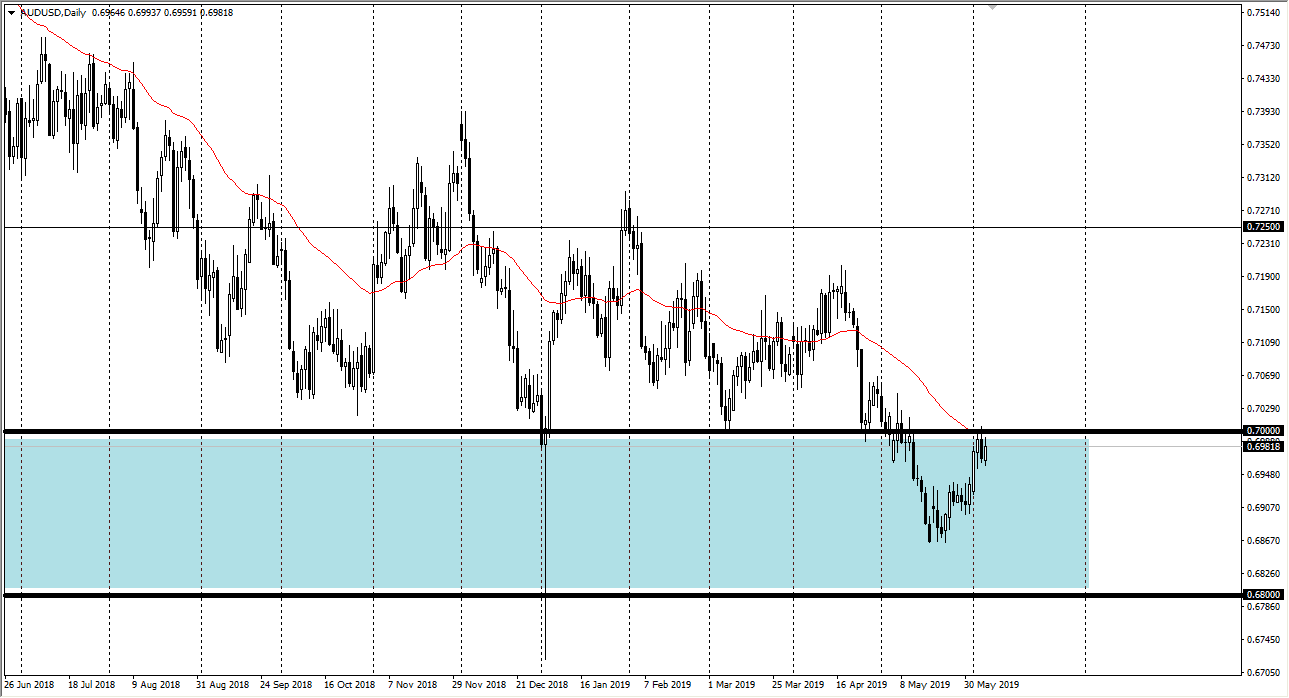

AUD/USD

The Australian dollar tried to break above the 0.70 level but did give back some of the gains late in the day. Because of this, it’s very likely that we continue to consolidate in the blue box I have drawn on the chart. Beyond that, the US/China trade talks are going anywhere, so that of course works against the Aussie. If we were to break above the 0.7050 level then it’s likely that the market probably goes higher, perhaps trying to reach to the 0.72 level. To the downside, I suspect that there is probably some support at the 0.69 level, extending down to the 0.6850 level and even the 0.68 level after that.