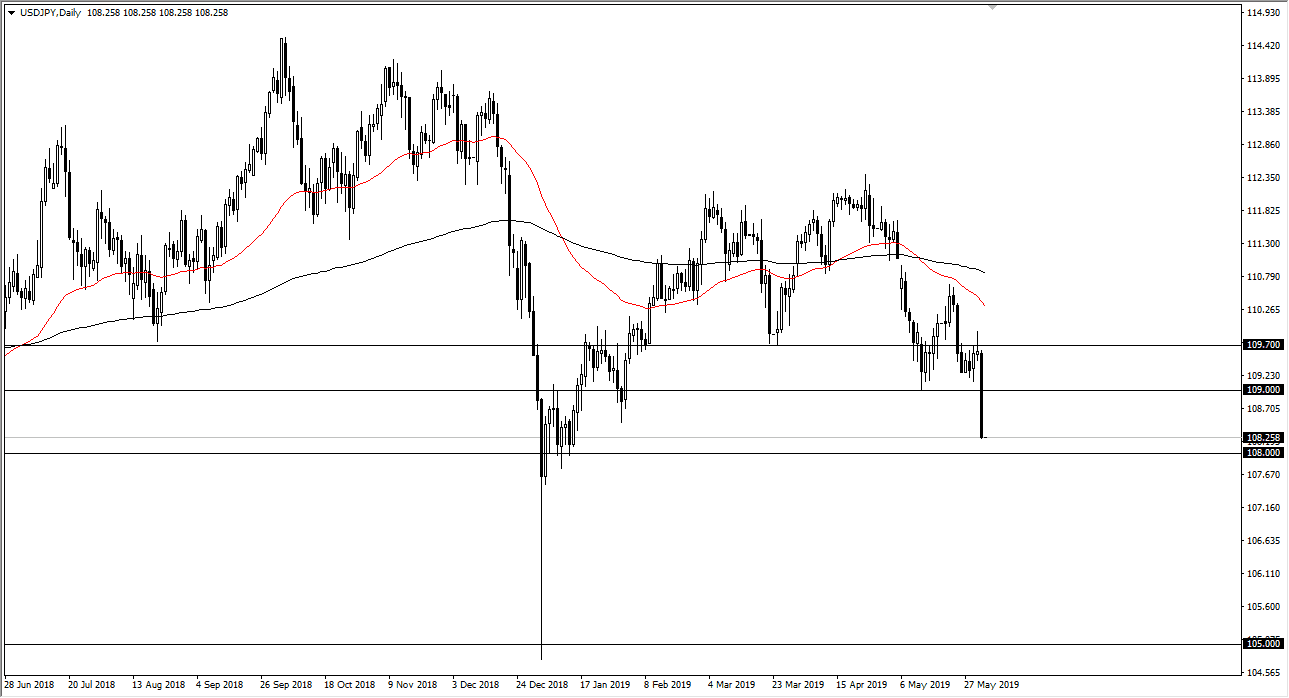

USD/JPY

The US dollar broke down significantly against the Japanese yen during the trading session on Friday, as there has been a major “risk off move.” With that being the case, the Japanese yen was bought, as it is the premier safety currency. The S&P 500 broke down as well, so it was essentially a full on safety trade. The ¥109 level being broken to the downside is a sign that we are going to go lower, perhaps down to the ¥108 level. That level does look like it’s going to be tested, but the fact that we closed at the bottom of the candle stick tells me that there is still follow-through to come. Short-term rallies will be selling opportunities on signs of exhaustion. At this point I have no interest in buying this market and believe that you should be looking for value in the Japanese yen as risk appetite looks horrible.

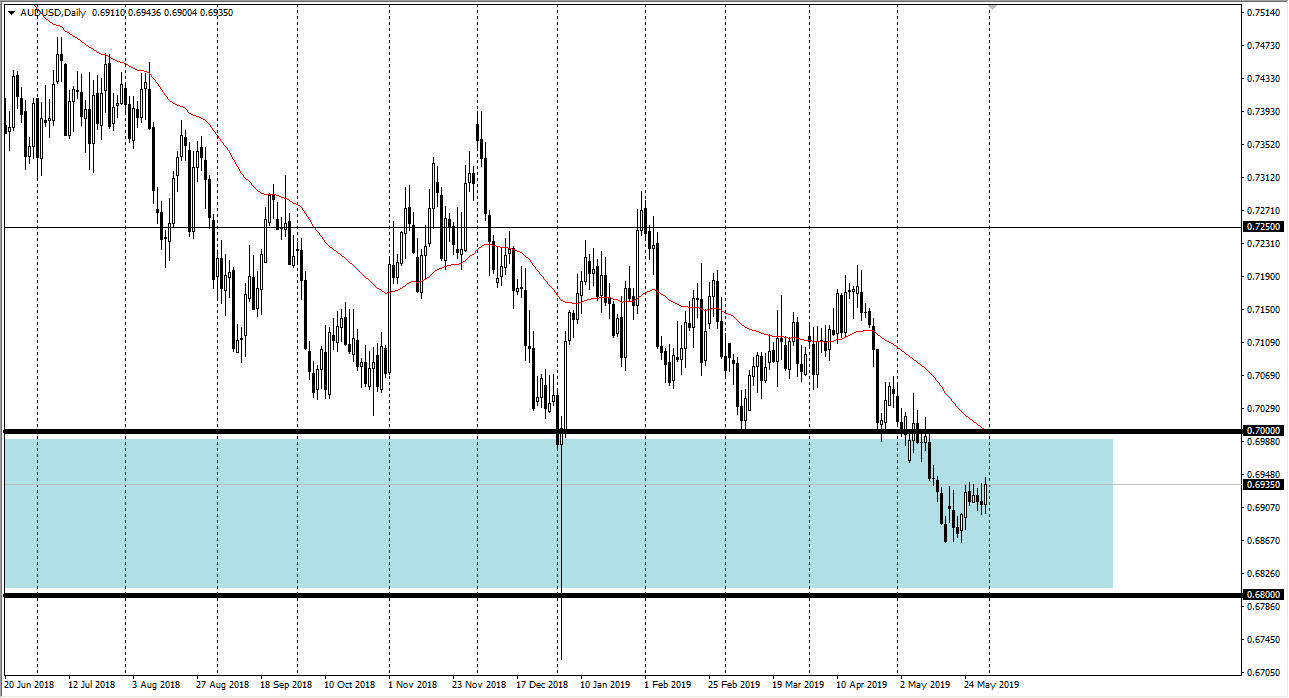

AUD/USD

The Australian dollar rallied a bit during the trading session on Friday, as we continue to bounce around the 0.69 level. Looking at this chart, the 0.68 level underneath is massive support while the 0.70 level above is massive resistance. It does look as if we are trying to find some type of support for longer-term move, but we need some type of help, perhaps in the form of the US/China trade talks. I would not hold my breath for that. In the meantime, I fully anticipate that we go back and forth in this general vicinity but one thing you should be aware of is that the last two weeks have formed hammers. That tells me that there is a serious attempt for people to pick up the Aussie dollar based upon value. You are going to need to be very patient when it comes to that type of trade.