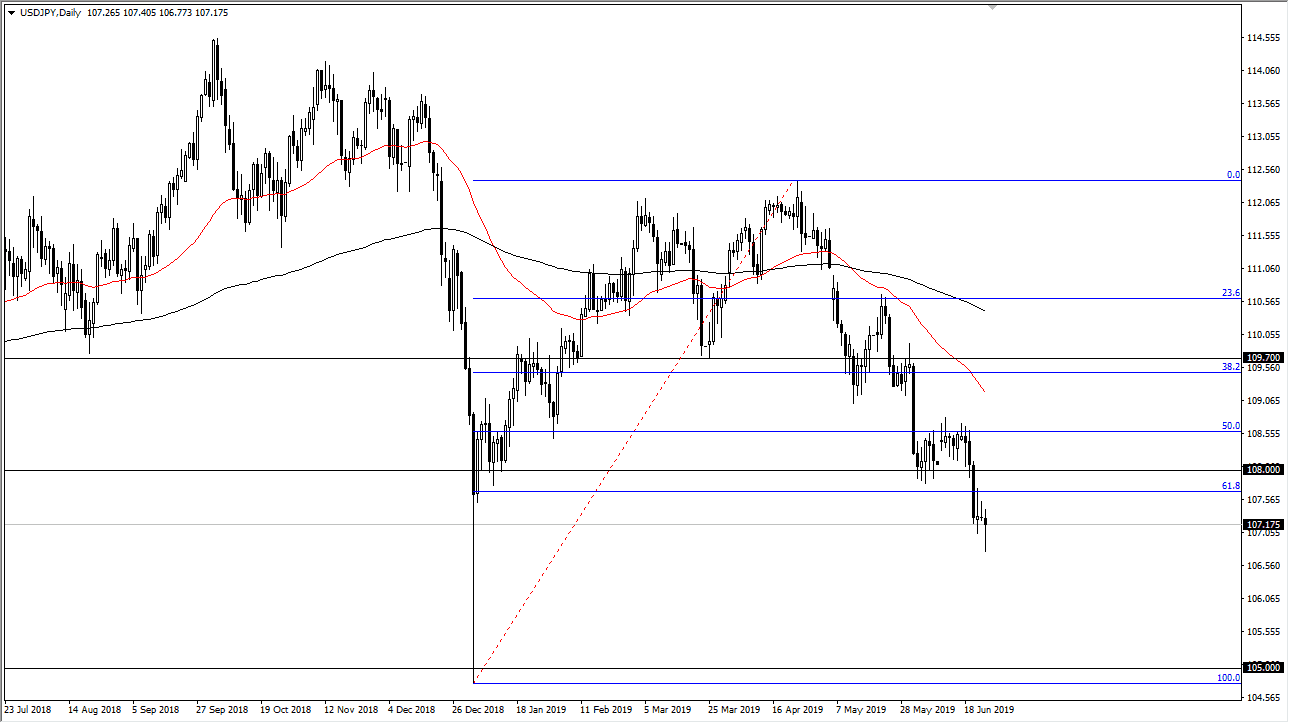

USD/JPY

The US dollar initially fell hard against the Japanese yen but has bounced significantly to turn around of form a bit of a hammer. That hammer is a bullish sign, but at this point we have broken down below the 61.8% Fibonacci retracement level which is a very negative sign. At this point, it’s very likely that we would go down to the 100% Fibonacci retracement level given enough time. That could send this pair as low as ¥105. That doesn’t mean that we go there overnight, but it certainly does suggest that we could get more of a grind to the downside. This of course would accompany both negativity in the markets, which we are starting to see, and of course the Federal Reserve getting loose with its monetary policy, driving the value of the greenback lower.

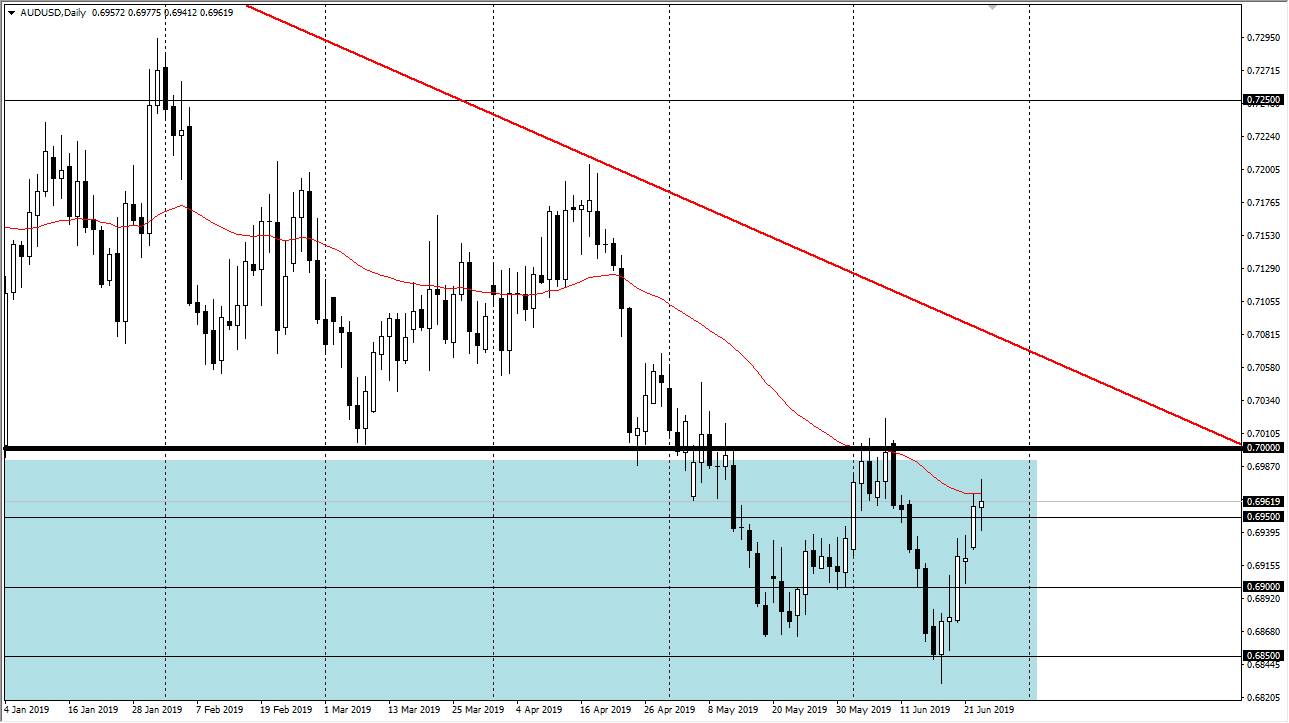

AUD/USD

The Australian dollar has rallied a bit during the trading session after going back and forth but is stalling out at the 50 day EMA, a major technical level. The 0.70 level above is massive resistance as well, and with the G 20 coming over the weekend in Osaka Japan, a lot of traders are going to be afraid heading into the weekend and therefore I suspect that the Aussie will fall as it is so highly levered to the Chinese economy. After all, the Australian dollar has high correlation to that market as Australian supply so many of the hard commodities. At this point I do like selling short-term rallies that show exhaustion as long as we can stay below the 0.7 range. We have made a “lower low” recently, and now if we make a “lower high”, it all makes sense as we grind lower. Yes, the Federal Reserve is on the sidelines when it comes to tightening monetary policy, but China is a bigger issue right now.