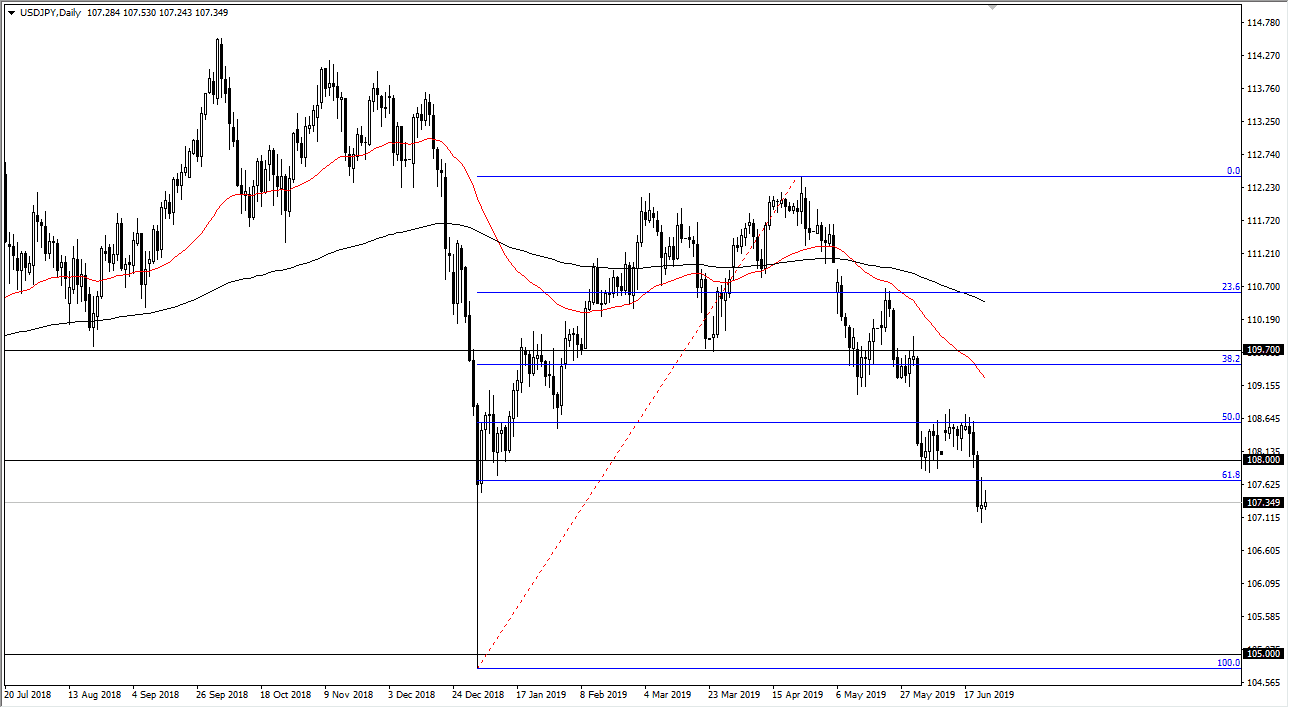

USD/JPY

The US dollar has rallied a bit during the trading session on Monday but given back quite a bit of the gains. This looks a lot like Friday, as the buyers were repudiated as well. At this point, the market has broken below the 61.8% Fibonacci retracement level, which of course is a major area of interest by many traders around the world. With that being the case, it’s very likely that the market probably breaks down, reaching towards the bottom of the entire upward move, a lease that’s typically what happens after breaking down below that level. That means that the market could go down to the ¥105 level, which is an area that has been important more than once. The alternate scenario of course is that we break above the highs of the Friday session, and perhaps go looking towards ¥108.70 above.

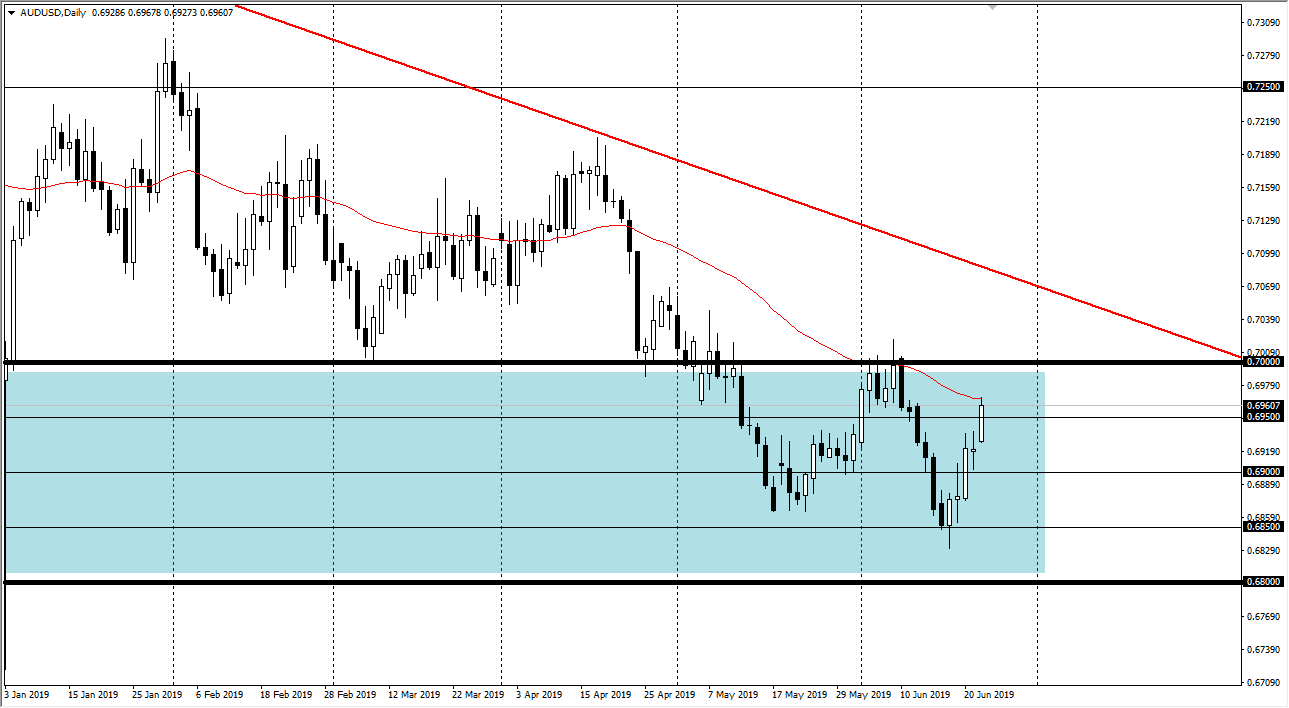

AUD/USD

The Australian dollar has rallied during trading on Monday, reaching the 50 day EMA before pulling back slightly at the end of the session. At this point, the question is whether or not the Australian dollar can continue to go higher with people knowing that the RBA is very likely to cut rates. The 0.70 level above is massive resistance, and therefore it’s going to be difficult to break above there. All things being equal, I think that signs of exhaustion will be jumped upon, as we have recently made a “lower low.” The 0.70 level being broken to the upside is a very strong sign, but I don’t think it happens even though the Federal Reserve has suggested that it could cut rates as well. Remember, this pair is highly sensitive to the US/China trade situation, which of course isn’t anything to get excited about right now. I still think there is plenty of selling pressure just above.