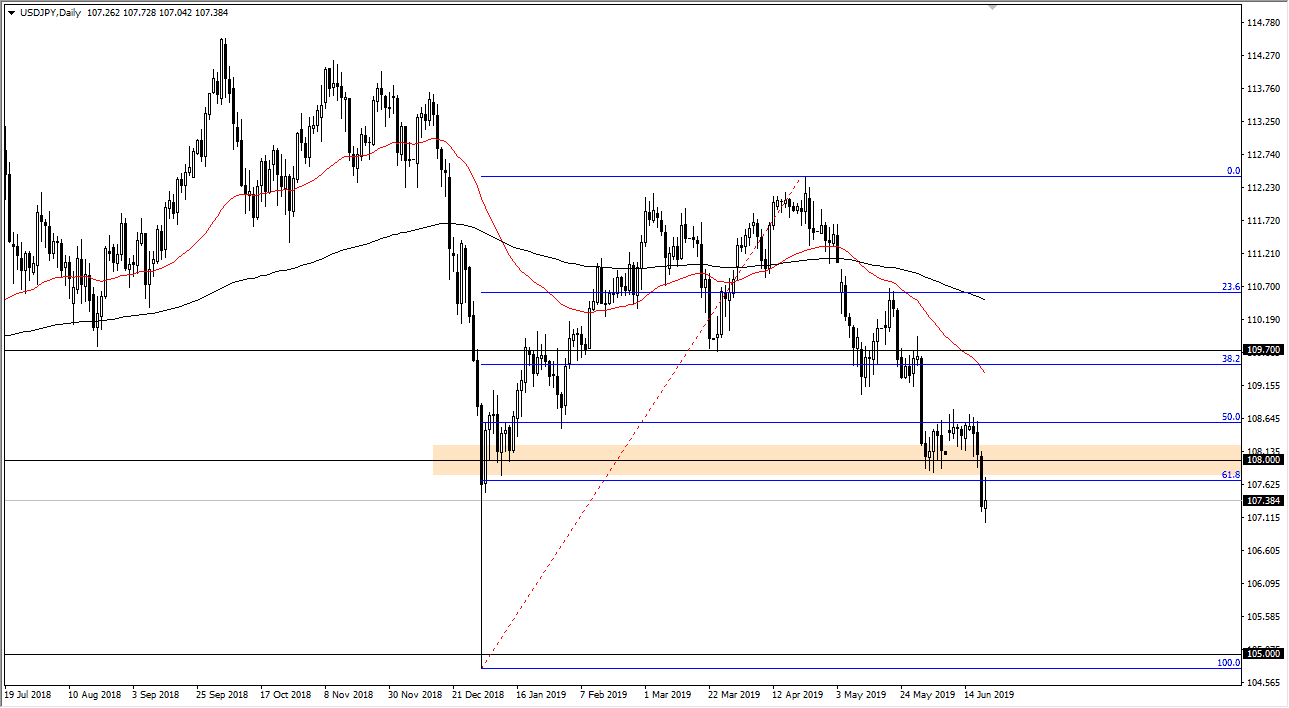

USD/JPY

The US dollar has gone back and forth during the trading session on Friday, showing signs of weakness yet again. At this point it’s obvious that the US dollar is going to be worked against by traders as we have the Federal Reserve looking likely to cut rates later in the year. Beyond that, we have a lot of geopolitical concerns that drives money towards the Japanese yen. With that being the case, it makes sense that we continue to see negativity in this pair and go looking towards wiping out the entirety of the move now that we have closed below the 61.8% Fibonacci retracement level.

The target would be roughly ¥105, and it is going to take some time to get there. However, we have clearly changed trends, and therefore it’s obvious that the Japanese yen will continue to show signs of strength. Not only do we have the Federal Reserve working against the US dollar, but we also have the Japanese yen gaining due to so much out there that has the world concerned.

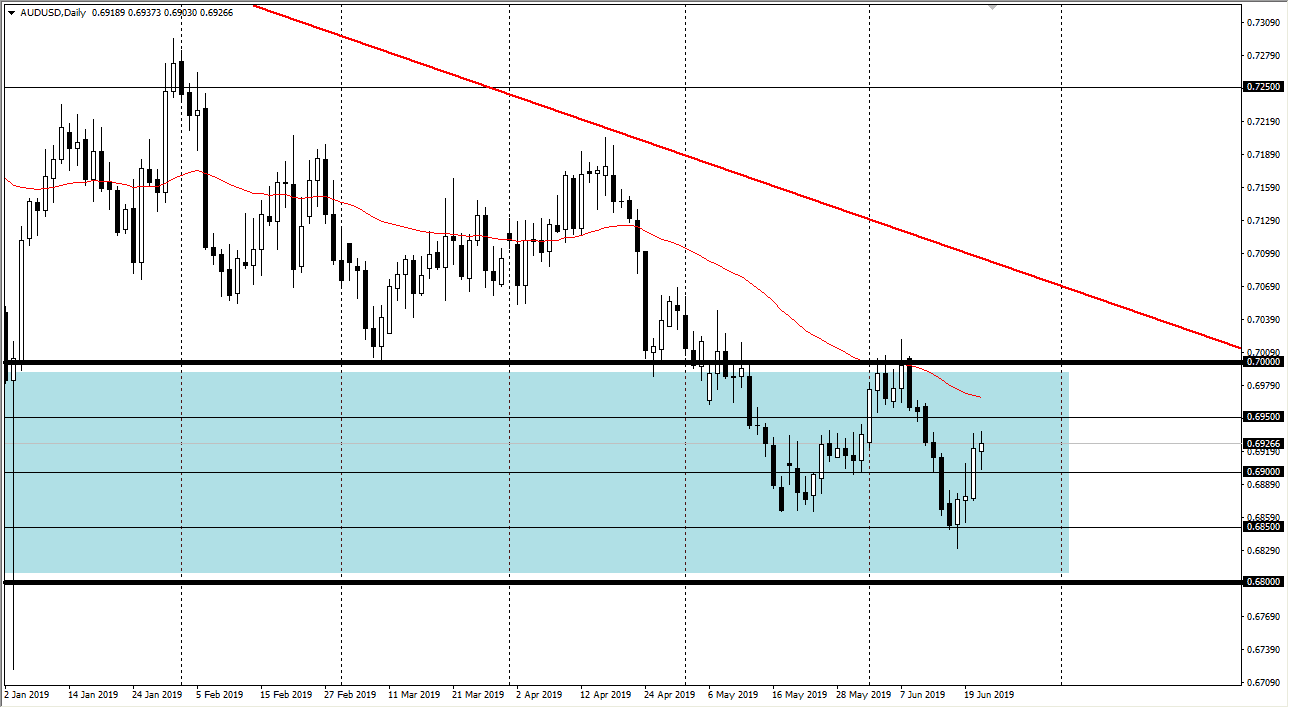

AUD/USD

The Australian dollar initially fell during the trading session but did find signs of strength later in the day as we rallied. However, I think there is significant resistance at every 50 pips increments between here and the 0.70 level and of course there is the G 20 conversations coming out between the Americans and the Chinese, and that can cause a lot of volatility in the Aussie as it is so highly correlated to China. With that in mind, if we get significant progress in the US/China trade situation, it’s very likely that we will see this pair go higher. If we see some type of major break down, this pair will almost certainly go lower. In the meantime I suspect we are stuck in the blue box that I have marked on the chart.