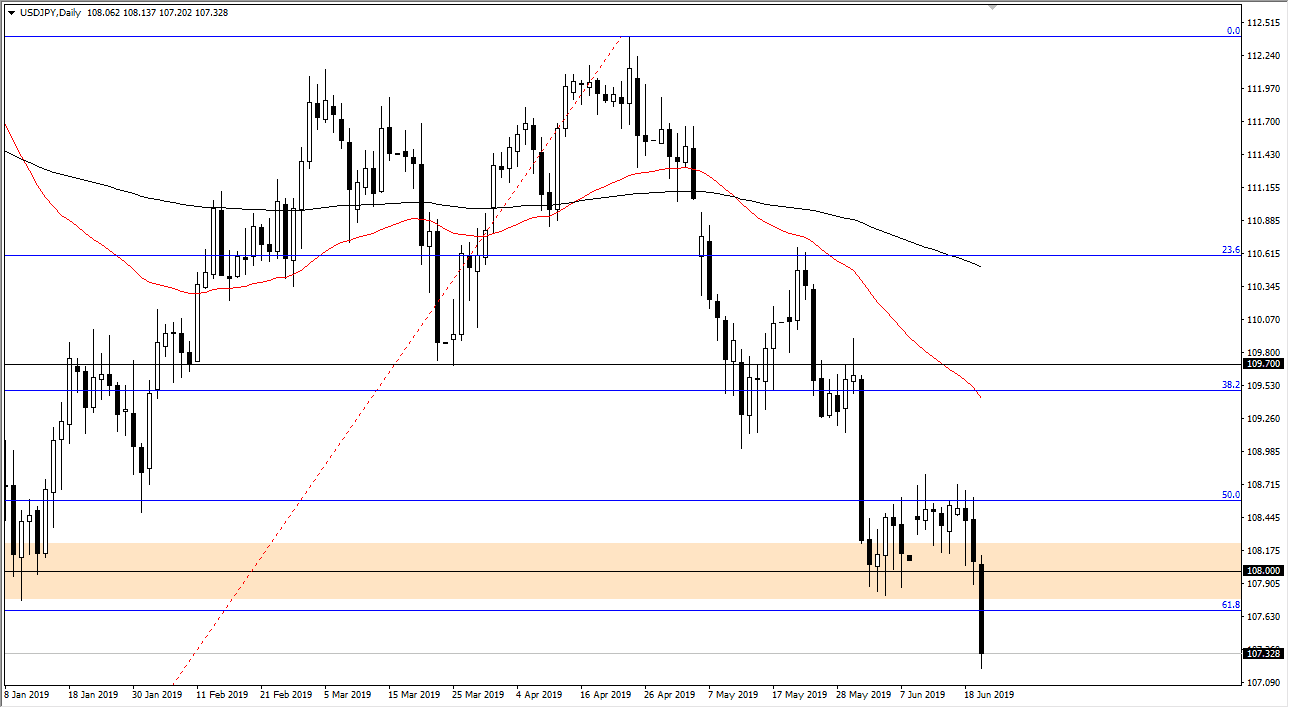

USD/JPY

The US dollar has collapsed against the Japanese yen as the Federal Reserve looks very unlikely to take a hawkish stance anytime soon. In fact, after that very dovish press conference, we have broken below the 61.8% Fibonacci retracement level, which normally means we are going to wipe out the entire move. That has me aiming for the ¥105 level, which could come into play yet again.

Expect a lot of volatility in general, and I think that continues to be the case going forward. Ultimately, short-term rallies at this point should end up being selling opportunities as I believe the ¥108 level should offer significant resistance, because of the breakdown candle that we have formed. To the downside I think that the ¥105 level will be massive support, so I would expect that the market would struggle to get below there.

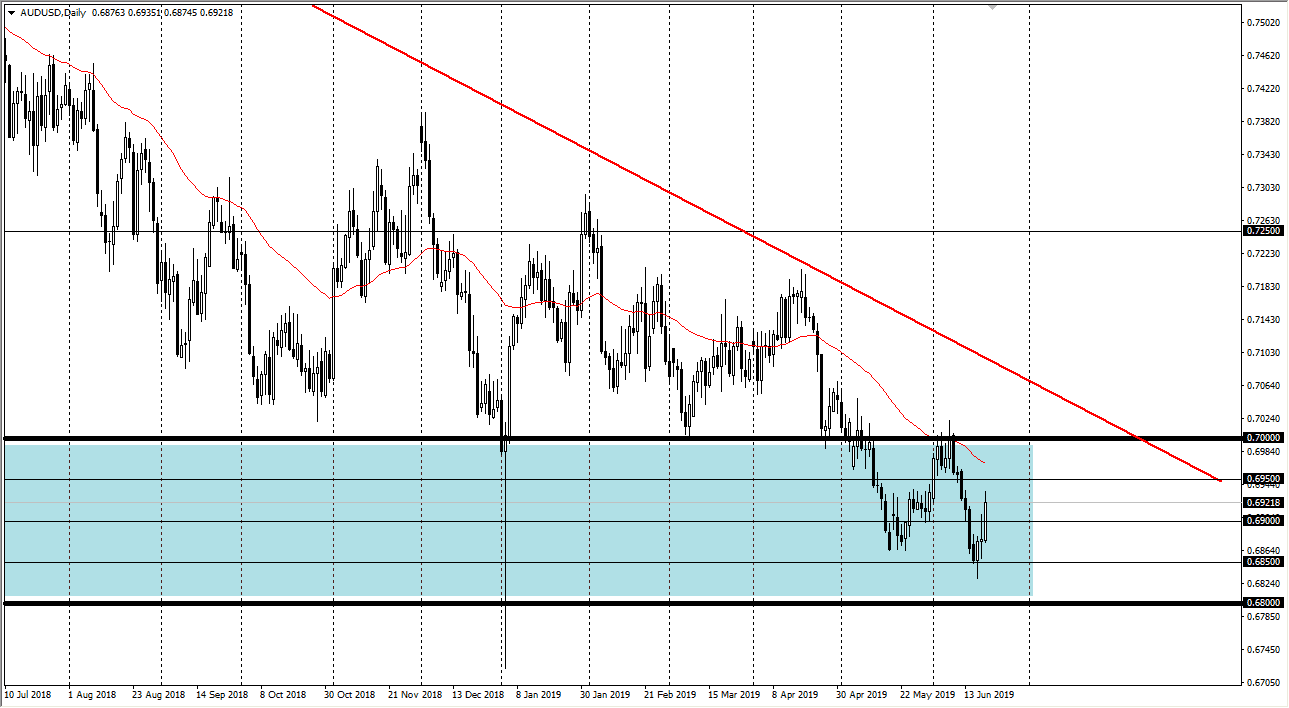

AUD/USD

The Australian dollar has rallied significantly during the trading session on Thursday, as the US dollar has been hammered. The Australian dollar is trying to form a bit of a base, but keep in mind the fact that the US/China trade negotiations are still stalled, and I think at this point were just trying to find whether or not we can build a bit of a base in this blue rectangle again. The 0.70 level above is resistance, and if we can break above the 0.7060 level, then I think the market could go much higher. To the downside, I think the 0.68 level underneath is massive support, so really it makes sense that we continue to go back and forth until we get some type of resolution. However, if we were to break down below the 0.68 level it would be a sign of extreme weakness on the part of the Aussie and risk appetite as the Federal Reserve is already known to be dovish.